Janus Henderson: Bitcoin - emerging asset or speculative mania?

Bitcoin is and will remain an experimental instrument, as Paul O'Connor, Head of Janus Henderson's UK-based multi-asset team, believes.

21.12.2017 | 08:15 Uhr

The launch of Bitcoin futures on some major US exchanges in recent weeks has been an important step in the development of the cryptocurrency, giving it greater familiarity and wider usage. Still, while 2017 has seen it evolve from being largely associated with black-market and criminal use, towards greater legitimacy, our team's view is that Bitcoin remains a speculative, immature financial instrument based on an experimental technology.

The launch of Bitcoin futures on some major US exchanges in recent weeks has been an important step in the development of the cryptocurrency, giving it greater familiarity and wider usage. Still, while 2017 has seen it evolve from being largely associated with black-market and criminal use, towards greater legitimacy, our team's view is that Bitcoin remains a speculative, immature financial instrument based on an experimental technology.

The practical problems of cryptocurrencies

The broad idea behind cryptocurrencies is that they can provide an efficient alternative to traditional ‘fiat’ currencies, appealing to those who distrust central banks and those who wish to conduct transactions, peer-to-peer, away from the oversight of banks and regulators. Whereas fiat currencies have their foundations in the traditional system of central banks and financial intermediaries, cryptocurrencies are based on networks of cryptography, miners, exchangers, and wallets. In theory, cryptocurrencies could provide low cost, secure, decentralised alternatives to fiat money. In practice, they are nowhere near being ready to stake such claims.

Cryptocurrencies score poorly against the three classic essential characteristics of a currency: medium of exchange, unit of account, and store of value. When assessed as a medium of exchange, the issue is simply that cryptocurrencies cannot be easily used as payment in everyday transactions. Compared with fiat currencies, transaction costs are too high and settlement speed is too slow to be relevant for anything other than black market or criminal transactions. We also observe that the wild price swings of Bitcoin and other cryptocurrencies effectively negate their use as units of account or stores of value.

Additionally, cryptocurrencies are currently plagued by a number of practical problems that would have to be overcome before they could be seriously considered as plausible alternatives to fiat currencies. There have been some significant cases of hacking and theft, most notably at the Mt. Gox Bitcoin exchange in 2014, where billions of dollars of Bitcoins (at today’s prices) were stolen from client accounts. Other incidents have seen hundreds of millions of dollars’ worth of cryptocurrencies being lost forever due to bugs and accidents. More recently the market infrastructure has begun to look strained, with frequent outages and sluggish trading execution at dealing platforms and many cases of investors reporting difficulties in selling Bitcoins. Decentralisation has its problems too – there is no resolution process for disputes, and if you lose your password (private bitcoin key) you’ve lost your Bitcoins: the decentralised nature of Bitcoin means you can’t call someone to restore your access.

Environmental concerns over Bitcoin mining

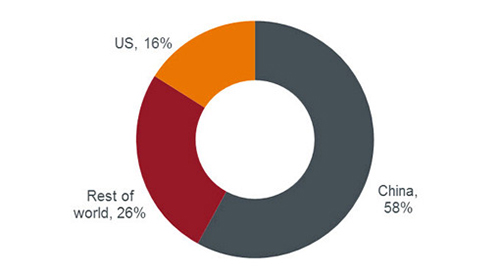

Finally, the processes supporting cryptocurrencies are hugely energy consuming, with vast numbers of computers operating 24 hours a day, running the calculations that generate each unit of the digital currency. Analysts at the cryptocurrency website Digiconomics estimate that the annual energy consumed in mining Bitcoin is similar to what the whole of Denmark uses, or the equivalent to the consumption of over three million US households. Furthermore, data from the University of Cambridge indicates that almost 60% of current Bitcoin mining takes place in China (Chart 1), often based on coal-fired electricity generation. Any rise in the Bitcoin price is likely to increase its impact on the environment, since miners can justify spending more on electricity as they receive more revenue for each unit created.

Chart 1: Where are Bitcoins mined?

(Source: Bloomberg, data from Cambridge University, as at December 2017.)

Regulators: lifting the veil of anonymity

One other important consideration for Bitcoin investors is the growing regulatory risk. Recent press reports suggest that the UK and European Union governments are considering a crackdown on Bitcoin, reflecting concerns about its potential use in money laundering and other illegal activities. Future interventions could conceivably challenge the veil of anonymity that is seen as one of the primary attributes of cryptocurrencies. South Korea is reported to be considering measures to curb speculation on cryptocurrencies, such as by taxing capital gains. Chinese authorities have already introduced measures to control trading in cryptocurrencies, although the modest impact of these so far suggests that further intervention may occur.

Teething problems or design flaws?

At this stage, it is very difficult to tell whether the shortcomings of cryptocurrencies exposed by their rapid development are just teething problems, or rather inherent flaws in their design. For those investors who are prepared to set aside the above concerns and take a constructive view on this emerging asset, a decision has to be made on which cryptocurrency to back. There are plenty of choices: Bitcoin is the big one, accounting for more than half of the asset class, but upwards of 1,350 other so-called cryptocurrencies were available over the internet in December 2017. Bitcoin is primarily seen as an alternative to central bank currency, but many of the others, such as Ethereum, are not and have very different expected functions. The fact that these many different instruments compete on varying technical, security, and transactional characteristics, adds yet another layer of complication to the task of trying to value individual cryptocurrencies. Valuation is tricky enough in traditional fiat currencies, but is made virtually impossible in this multifarious space.

Parabolics and pullbacks

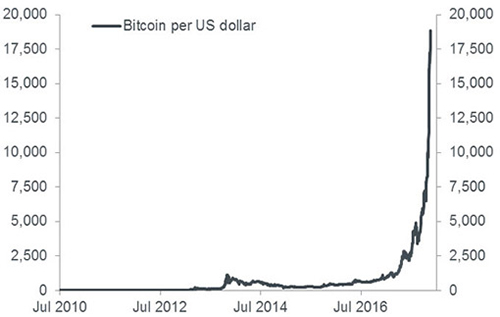

Only time will tell if current investors will ultimately be rewarded for disregarding the developing problems of cryptocurrencies. Perhaps some are chasing a dream that will never materialise. Whatever happens, both anecdotal evidence and the price action suggest that there is a considerable degree of speculation already embedded in cryptocurrencies. This year’s parabolic ascent of Bitcoin (Chart 2) means that anybody who invested US$1,000 in it on the last day of 2016 would now have a holding worth over $19,000 (as at 18 December). History suggests financial assets that climb this rapidly usually experience pullbacks that are equally dramatic when sentiment reverses.

Although now barely discernible in charts plotting the cryptocurrency, early investors in Bitcoin have already experienced a couple of sizeable drawdowns. Anyone who bought Bitcoin at the local peak that occurred in 2011 would have experienced a c90% pullback over the following five months and would have had to wait nearly two years to recover their original stake. A drawdown of over 80% was experienced in 2014, with a three year wait for full recovery.

Chart 2: Bitcoin’s price – a startling parabola

(Source: Janus Henderson Investors, Bloomberg, as at 18 December 2017.)

A speculative mania?

The recent move in Bitcoin is looking to us increasingly like a speculative mania, rather than being evidence of an emerging mainstream asset class. The market is still very much dominated by retail investors and press reports highlight some extravagant use of leverage. While it is very difficult to form a meaningful view of the medium-term potential of any individual cryptocurrency, the combination of parabolic price moves, high retail participation, and leverage mean that when the next Bitcoin dip arrives, it has the potential to become a hair-raising affair. It is therefore our opinion that Bitcoin is still a long way from being an investable asset with a serious role to play in institutional portfolios.

Glossary:

Bitcoin mining = the process of adding transaction records to Bitcoin's public ledger of past transactions or ‘block chain’; the growing lists of records are called ‘blocks’. The block chain serves to confirm transactions to the rest of the network as having taken place.

Cryptocurrency = a digital currency stored on an open and decentralised electronic payment system.

Fiat currency = any money declared by the government to be legal tender. Its value is derived from the relationship between supply and demand, rather than the material the money is made of.

Diesen Beitrag teilen: