Janus Henderson Investors: Chinese PMI softening before virus hit

Chinese recovery hopes were boosted by a rise in the Markit manufacturing PMI to a 35-month high in November.

04.02.2020 | 08:45 Uhr

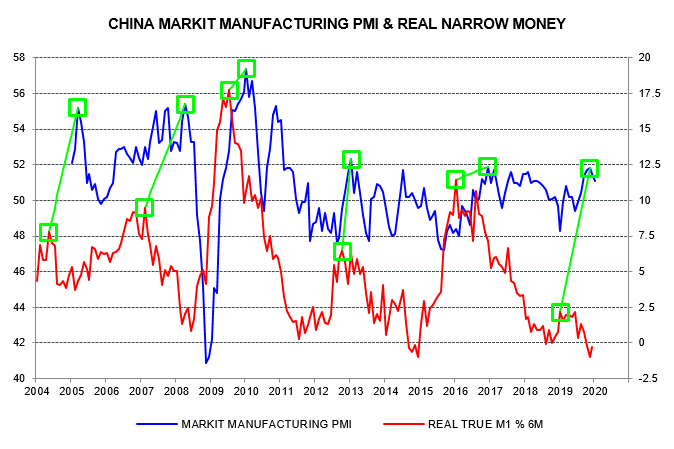

A post here in December linked the PMI pick-up to stronger real narrow money growth in early 2019. With money trends deteriorating from Q2, the suggestion was that the PMI would show renewed weakness in early 2020.

The November reading appears to have marked a peak, with the PMI falling for a second month in January. The latest survey was conducted before the disruptive effects of the nCoV epidemic were apparent: the closing date was 22 January and the commentary does not make a link with the weaker results.

The relationship with real narrow money momentum suggests that the PMI was on course to continue to slide into mid-2020 – see chart. The nCoV epidemic represents a joint demand and supply shock, hopefully temporary, comparable with the 2001 terrorist attacks in the US. Based on that episode, the PMI is likely to plunge in February but rebound equally sharply once disruption starts to ease.

A key question is whether the crisis acts as a catalyst for more forceful policy stimulus and a consequent pick-up in money growth to a recovery-consistent level. The 10 bp cut in the PBoC’s reverse repo rate announced today is double the prior reduction in November.

The view here has been that monetary weakness primarily reflects a broken transmission mechanism rather than official reluctance to ease – banks are unwilling to expand credit supply because of funding difficulties, weak capital positions and uncertainty about borrower creditworthiness against an uncertain economic backdrop. The nCoV epidemic is likely to reinforce risk aversion. Successful stimulus may depend on a combination of fiscal action and direct PBoC lending supported by state-owned megabanks.

Diesen Beitrag teilen: