Columbia Theadneedle: Are we heading for a bear market in equities?

Equities are having a tough time. As of Friday’s close, the S&P 500 index is officially in correction territory, being down over 10% since the peak in July.

31.10.2023 | 07:12 Uhr

But at least it’s up year-to-date. The FTSE 100 is down year-to-date, and the smaller cap FTSE 250 has lost 10% over that period. Not a good performance.

The theme that is causing the problem is monetary policy, with interest rates having risen further than the market had hoped and central banks telling us that they will stay higher for an extended period. So worried are the equity markets that good news in the form of stronger economic data has become bad news, as it raises fears of higher rates.

The shift in monetary policy, from being super easy to tight, is obviously bad news for risk assets in general. But I would argue that there are good reasons to remain confident that equities are not heading into bear market territory. Indeed, we should see evidence this week, that interest rates are not headed higher and we could well see evidence that they are set for big falls in 2024. Moreover, despite the evidence of slowing overall growth shown by the closely watched purchasing managers’ indices, we also see signs that corporate earnings growth is beginning to turn up, at least in the US.

Let’s start with the interest rate hurdle. Regular readers will be familiar with my argument that the tide has turned in the war against inflation. The US Federal Reserve’s preferred measure of wage inflation may well have been published by the time you see this. I expect it to show a further significant decline. The wage price spiral is operating nicely in reverse with lower inflation leading to lower wage rises. Later this week we get the critical data on jobs in the US. Yes, it’s likely that jobs will rise but labour supply is also on the up, led by immigration. Even if we don’t get an increase in unemployment in this week’s figures, the trend over the next few months is up and this will change the mood music within the Fed. And it’s not just the US, early indications are that core inflation is falling in Europe too.

So if interest rates are set to fall, what about the economic slowdown evident in the purchasing managers indices? The important point here is that services dominate overall economic activity, especially employment, but the earnings of quoted companies are much more sensitive to manufacturing.

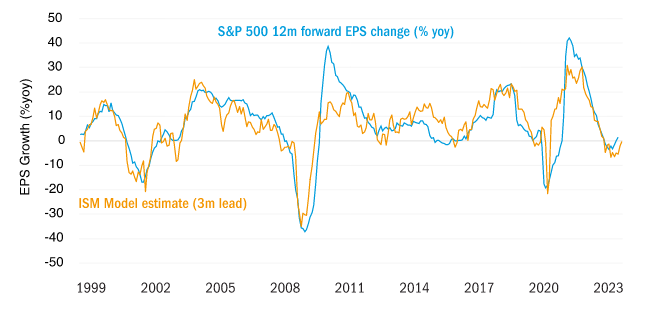

US earnings outlook set to improve

S&P 500 EPS (% YoY)

Past performance is not an indication of future performance.

Source: Columbia Threadneedle Investments, Datastream and Bloomberg as at 20 October 2023. EPS = earnings per share. Estimates and forecasts are provided for illustrative purposes only. They are not a guarantee of future performance and should not be relied uponfor any investment decision. Estimates are based on assumptions and subject to change without notice.

This chart shows our model which tracks the consensus expectations for S&P 500 earnings. It has a good fit, a 3-month lead, and is suggesting that the weakness in earnings may be over. It is driven by the US ISM indices, the original series that led to the purchasing managers indices. But the manufacturing component is the dominant one, twice as important as services. So the overall economy is set to slow, courtesy of a slowdown in services but corporate earnings should recover as the manufacturing sector picks up. In the current context this is the perfect combination: lower inflation pressure but better corporate earnings.

This is big week for economic data and central bank meetings. We could see the Japanese announce the end of their yield curve control, we should see a decline in US wage inflation and signs of further slowdown in their labour market, even as jobs continue to grow. With more earnings reports from companies there will be much for markets to digest. My guess is that the net result will be positive. We shall see.

Diesen Beitrag teilen: