Morgan Stanley IM: Climate Change is Here – And So Is the Need to Embrace Sustainability in Real Estate

The MSIM Global Listed Real Assets Team explores why investing sustainably matters in real estate, who is setting the priorities for sustainability, how we integrate ESG into real estate investing and where we see sustainability trends evolving.

24.10.2022 | 07:44 Uhr

Here you can find the complete article

“It is unequivocal that human influence has warmed the atmosphere, ocean and land.” So said the scientists on the United Nations (UN) International Panel on Climate Change (IPCC) in their sixth assessment report released in August 2021.1 Using their strongest phrasing ever to stress that human actions are responsible, this report heightened the sense of urgency to act on climate change.

Not surprisingly, the real estate industry has been under pressure to focus attention on sustainability. After all, building operations and construction account for approximately 40% of global energy-related CO2 emissions.2

Morgan Stanley Investment Management’s (MSIM)3 Global Listed Real Assets (GLRA) team4 believes environmental, social and governance (ESG) factors and a real estate company’s approach to sustainability will significantly influence its future risk and total return prospects. Given this view, we believe it is imperative to focus on analyzing sustainability factors and integrating these risks and opportunities into an assessment of value.

Why Investing Sustainably Matters in Real Estate

Climate change is an important factor to consider for the real estate sector.5 Existing buildings face chronic and acute physical risks, including intensifying hurricanes, floods and wildfires, as well as economic, social and regulatory changes necessary for decarbonization. To limit the global temperature increase to 1.5°C in this century as required by the Paris Agreement, it has been estimated that real estate’s direct carbon emissions will need to be cut in half by 2030, compared to 2020 levels, and reach net- zero by 2050.6

Publicly traded real estate companies hold a significant share of the building stock globally. As such, they are in a unique position to play an important role in achieving global sustainability targets. As public market investors, understanding how companies can influence and achieve net-zero targets is important, as is assessing the financial implications and, importantly, the capital expenditures required to reach such targets.

With 80% of the existing building stock expected to still be in place through 2050, retrofitting the current stock is critical to meeting global net‑ zero targets.7

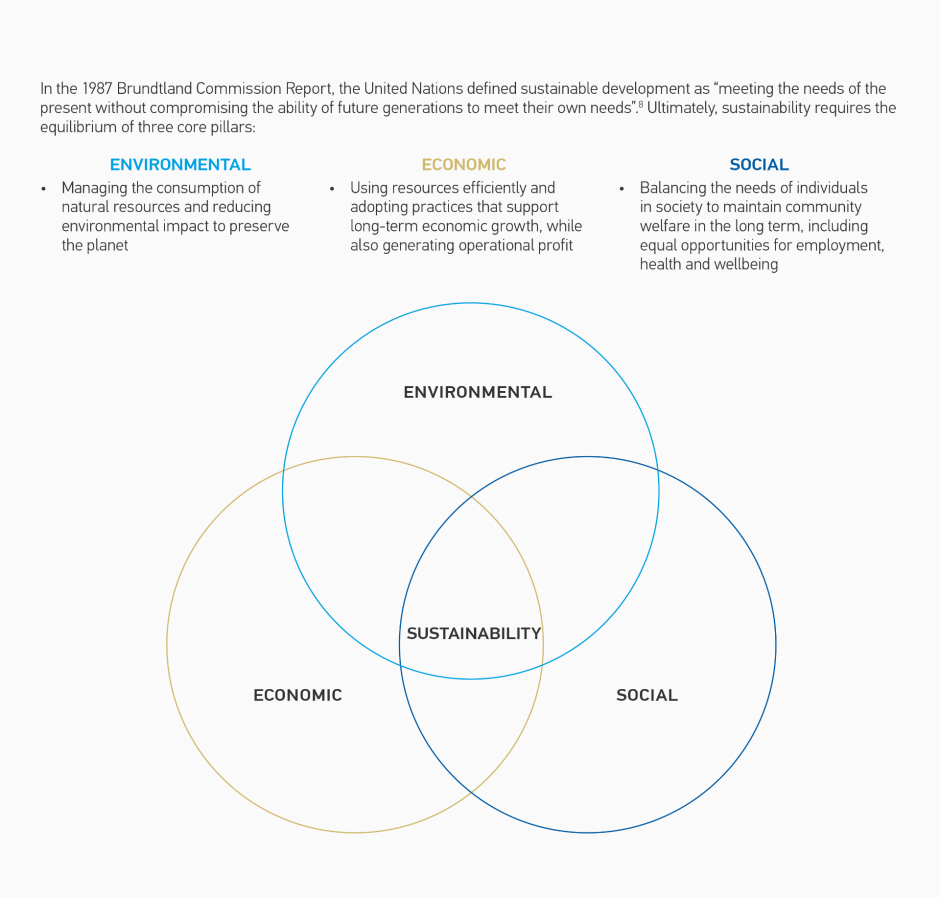

DISPLAY 1:

What Is Sustainability?

Who Is Setting the Priorities for Sustainability?

A confluence of events has led to a rapid increase in the momentum behind sustainability for real estate. This momentum is attributable to three primary constituents: real estate investors, regulators and tenants (see Display 2).

REAL ESTATE INVESTORS

The amount of capital directed towards sustainable investing has experienced exponential growth. For example, the UN-convened Net-Zero Asset Owner Alliance (NZAOA), an international group of 74 institutional investors with $10.6 trillion in assets under management, has committed to transition investment portfolios to net-zero greenhouse gas (GHG) emissions by 2050.9

Energy-efficient buildings represent the second biggest use of green bond proceeds.10 Of the $290 billion total green bond global issuance in 2020, $76 billion—more than one quarter—was tagged for green buildings. Banks are also increasing green building construction and mortgage financing.

DISPLAY 2:

Three-Pronged Focus on Sustainability

Diesen Beitrag teilen: