Morgan Stanley IM: International Equities Offer Potential Opportunities over U.S. Equities in 2023

The strong outperformance of European equity markets from mid-October last year continued into January, as fears of an energy crisis in Europe have abated. The surprisingly quick re-opening of China from zero-COVID measures, along with a more pro-growth policy shift, will combine with lower energy prices to deliver much-needed growth stimulation for Asia-Pacific.

27.02.2023 | 06:51 Uhr

Here you can find the complete article

We expect corporate earnings to be the key driver of equity markets throughout 2023, a major pivot from last year's macro driven environment dominated by multiple compression from rising inflation and aggressive rate hikes from central banks.

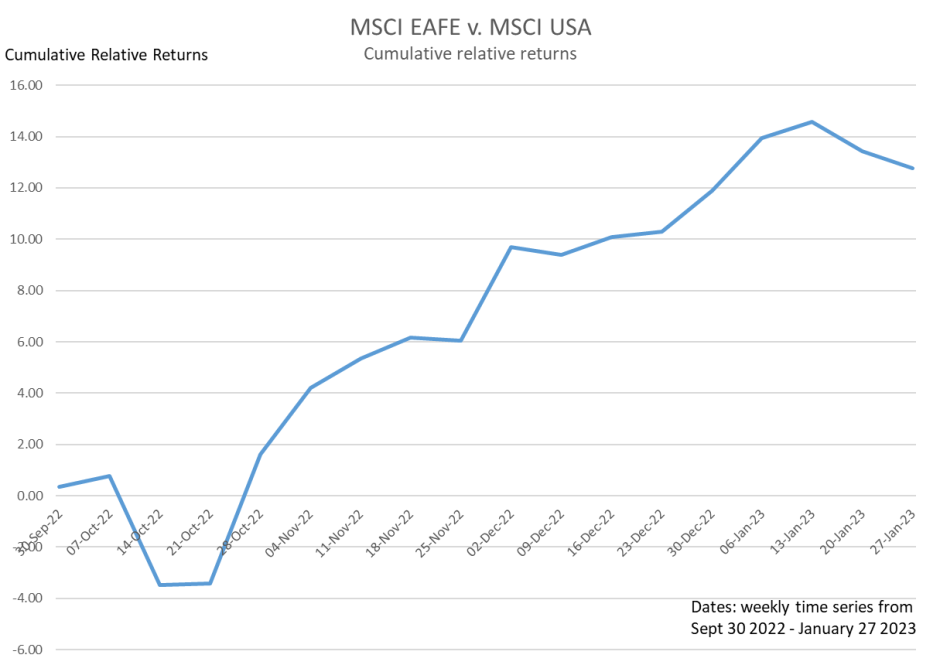

International Equity Markets Outperforming U.S. from Mid-October 2022

Source: Bloomberg, as of January 31, 2023. Past performance is not a reliable indicator of future results.

Entering 2023, investors have been considering the impact of the earnings contraction and where the impact on share prices will be felt greatest. With recession widely expected in many large economies by investors, there is widespread fear over corporate profitability.

A key focus for equity investors will be identifying pockets of resilience, which include companies that can continue to deliver on earnings expectations against a backdrop of slowing economies and continued rising interest rates. It is important to remember that periods of investor angst are often seen as buying opportunities and we believe that share prices will look beyond 2023 earnings.

Impact of high interest rates

The impact of central bank tightening is expected to significantly squeeze the economy this year. Even as we expect unemployment and corporate earnings to deteriorate, we are optimistic that this could be a year of bad economy/good market. Our team's focus is on mid- to long-term investing, and understanding the enduring power of a company's business model.

We maintain a positive outlook for international equities in 2023, particularly compared to the U.S. For some time, the U.S. equity market has appeared imbalanced, due to the dominance of a handful of large technology companies. A bubble mentality, fuelled by ultra-loose monetary policies globally, was finally burst by central banks' interest rate policy moves last year.

We believe we are at a point in the economic cycle where the impact of high interest rates, after so many years of zero to negligible rates, will undoubtedly increase the probability of left-field risks arising in the economy. Such distortions are simply not as meaningful in international equities. We have moved beyond the era of free money, and risk within equity markets will start to be priced more efficiently.

Risk Considerations: The value of investments may increase or decrease in response to economic, and financial events (whether real, expected or perceived) in the U.S. and global markets. The value of equity securities is sensitive to stock market volatility. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Diversification does not eliminate risk of loss.

Active management attempts to outperform a passive benchmark through proactive security selection and assumes considerable risk should managers incorrectly anticipate changing conditions. There is no guarantee that any investment strategy will work under all market conditions, and each investor should evaluate their ability to invest for the long-term, especially during periods of downturn in the market.

Diesen Beitrag teilen: