BNP Paribas: Equities face volatility and disparity, but a positive year overall

Can investors expect more of the same from equities after a bumper 2020? The pandemic and its effects will still pervade every pore of the economy and markets.

27.01.2021 | 09:02 Uhr

However, discerning investors should be able to benefit from appealing opportunities and persistent trends. The answer, in other words, is yes.

Main investment themes for 2021

First off, themes are important in providing context for finding compelling investment opportunities and for building portfolios – they can transcend regions, market capitalisations and – subject to investor sentiment – investment styles.

Looking into 2021, the pandemic will remain front and centre – in terms of the spread of the virus, the rollout and effectiveness of vaccines, and through to the changes in social distancing measures with a direct impact on economic activity. We are all learning to live with the pandemic. Our ability to manage and reduce its incidence will be the real game changer.

Learning to live with the pandemic has accelerated secular change, from how we use communication to how we work, to our leisure time etc. it has also reinforced or reminded us of priorities, from social cohesion through to the environment in which we live.

These changes are unlikely to be reversed. They include the use of cloud computing and artificial intelligence (AI) and the creation of innovative solutions. This is particularly important and topical in healthcare given the pressure to both introduce and expand greater flexibility into our healthcare systems.

The increased focus on sustainability goes from policy, innovation and investor appetite through to public attitude. All are moving forward in step with an appetite for solutions. For investors, there’s a real and exciting opportunity to generate competitive returns, while contributing to meaningful change.

At least in part related to the pandemic, dovish monetary policy can be expected to continue – subject to inflation remaining subdued. Colossal levels of debt are a concern, but dovish policy is important in not starving the economic recovery of oxygen, and in addition underpins asset prices.

We see China as an important theme. How will Chinese policies shape the local and global economy, and hence market prices? We consider China exposure as distinct in strategic asset allocations.

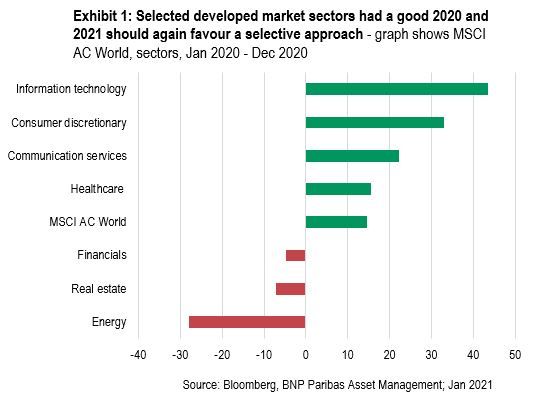

The outlook for equities: be selective

I’m positive on markets for this year. There will be volatility and there’s likely to be significant disparity between the winners and losers, but I see significant opportunities for the careful stock picker.

On the side of companies to avoid, there are those with more challenged business models and financials, which have rallied hard in the reflation trade and are now perhaps more than fully valued. Here, an ample supply of cheap credit is having the negative effect by sustaining obsolete companies.

With regards to technology, many commentators have pointed to their high valuations, but we believe they’re not near bubble levels. There’s also a great deal of dispersion: some software-as-a-service companies and COVID-19 winners are at more stretched valuations, while other stocks are trading at compelling prices. We believe tech deserves a premium multiple relative to the broader market given its better growth prospects and improving returns on invested capital.

In assessing a company’s prospects and market valuation, we think it’s useful to consider longer-term themes.

For instance, ecommerce. The pandemic has accelerated this, but should we expect the post-pandemic consumer to return in numbers to shopping malls or will ecommerce technology remain a growth area?

Consider electrification in transport. Eight million electric vehicles are currently on the road globally. This number is expected to increase to 1.1 billion in 2050. There will be big winners and losers. We can expect significant changes in industrial and commercial processes. Technology will be at the fore.

Another example would be residential solar. In the US, market penetration currently stands at 2.5%. This will increase dramatically over time, which will benefit those companies with pricing power, the right technology and the right solutions.

Three main risks

I’d like to highlight three elements for equity markets in aggregate:

- Stresses and strains in the rollout of COVID-19 vaccines together with questions over efficacy and effectiveness, and the impact on lockdown measures, will result in volatility. For longer-term investors, this is less relevant. I should note that equities have remained liquid throughout periods of market stress.

- The prospect of more regulation with likely result in volatility, from anti-trust investigations into big tech companies through to uncertainty over the US barring investments in Chinese companies. This should be assessed company-by-company. That includes valuations.

- This is not a central element of our view, but a sharp steepening in yield curves would affect both the leadership and ultimately the direction of equity prices.

I’d stress that we remain confident that investors can find great companies, with deep moats, growing markets and great prospects.

- Also listen to thepodcast with Guy Davies

Any views expressed here are those of the author as of the date of publication, are based on available information, and are subject to change without notice. Individual portfolio management teams may hold different views and may take different investment decisions for different clients. The views expressed in this podcast do not in any way constitute investment advice.

The value of investments and the income they generate may go down as well as up and it is possible that investors will not recover their initial outlay. Past performance is no guarantee for future returns.

Investing in emerging markets, or specialised or restricted sectors is likely to be subject to a higher-than-average volatility due to a high degree of concentration, greater uncertainty because less information is available, there is less liquidity or due to greater sensitivity to changes in market conditions (social, political and economic conditions).

Some emerging markets offer less security than the majority of international developed markets. For this reason, services for portfolio transactions, liquidation and conservation on behalf of funds invested in emerging markets may carry greater risk.

Diesen Beitrag teilen: