Robeco: Sustainable thematic investing and UN SDGs, a natural fit

The UN’s Sustainable Development Goals (SDGs) provide an excellent framework for investors to seek returns while helping shape a more sustainable world. But which strategies can really help investors address these goals in practice? We believe Robeco’s sustainable thematic equities strategies are a good way to make a difference.

14.12.2020 | 08:37 Uhr

Rainer Baumann, Head of Investments Robeco Switzerland

Speed read

- The SDG mindset is taking hold in public and private sectors

- The SDGs and sustainable thematic strategies share a common vision

- Sustainable thematic strategies directly contribute to achieving SDGs

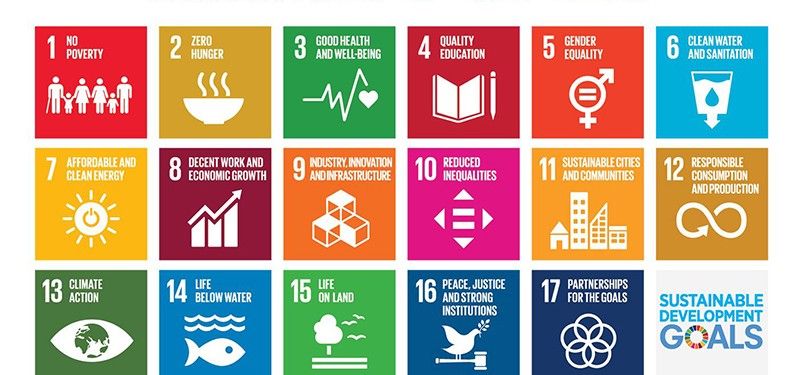

The SDGs are a comprehensive set of 17 global challenges that must be addressed to help ensure a universally safe, healthy, and prosperous future. The goals span a broad range of issues relevant to both developing and developed populations, including improving health and education, combating climate change and environmental pollution, enhancing diversity, reducing inequalities and building resilient cities, communities, infrastructures, and institutions.

The SDGs and sustainable thematic strategies both share a common vision and commitment to overcoming challenges that reduce the potential of capital and lead to suboptimal outcomes. In this way, they can be characterized as complementary and mutually reinforcing trends – investment in one contributes to the success of the other.

Figure 1: The 17 UN Sustainable Development Goals

Source: United Nations

Sustainable thematic strategies support the SDGs by allocating capital to companies that work to create solutions for sustainability challenges and that are directly contributing to achieving SDG targets. A clear illustration of strategies with a very tangible impact on SDGs is our RobecoSAM Sustainable Water strategy.

The strategy invests in firms offering products and services that address challenges related to the quantity, quality and allocation of water. As a result, it has a direct impact on SDG 6, “ensure availability and sustainable management of water and sanitation for all”. But it also indirectly contributes to achieve other goals, such as ending poverty (SDG 1) or ensuring healthy lives (SDG 3).

Similarly, our RobecoSAM Smart Energy strategy aims to capture strong growth potential from the decarbonization, electrification and digitization of the energy sector. As such, the strategy clearly contributes to achieve SDG 7, “ensure access to affordable, reliable, sustainable and modern energy for all”.

A multi-trillion dollar opportunity

Sustainability challenges are too big, too complex, and too expensive for the public sector alone. Effective action and solutions need the innovation, know-how and financing of companies in the private sector. But private sector intervention shouldn’t be construed as charitable giving. The SDGs represent a multi-trillion dollar opportunity for committed and enterprising firms whose products and solutions are not only innovative but also sustainable .

With so much potential value at stake, it is no surprise to discover corporate interest in SDGs is intensifying. Since their launch in 2015, more than 15,000 organizations, including 9,500 companies representing every economic sector and geographic region, have committed to supporting and achieving these 17 SDGs.

Sustainable investment portfolios benefit directly from greater awareness and support from companies, regulators, governments, consumers, and other stakeholders. The strong waves created by the SDG mindset taking hold in public and private sectors will make investment themes that have a head start in addressing sustainability challenges even more effective.

Diesen Beitrag teilen: