Janus Henderson: Is the stockbuilding cycle peaking?

The US ISM manufacturing new orders index – an important gauge of US / global industrial momentum – fell back between December 2017 and April 2018 but rebounded in May / June.

23.07.2018 | 13:36 Uhr

The US ISM manufacturing new orders index – an important gauge of US / global industrial momentum – fell back between December 2017 and April 2018 but rebounded in May / June. This recovery has been cited as evidence in favour of the consensus view that the global economic slowdown since early 2018 represents a temporary “soft patch”. The judgement here, by contrast, is that the ISM new orders increase will prove to be a “head-fake” caused by rapid inventory accumulation as the three- to five-year stockbuilding cycle reaches a peak.

Conceptually, new orders from customers received by ISM firms can be divided into trend and transitory components, reflecting respectively final demand and customers’ efforts to adjust their inventories to a desired level. The transitory component, by definition, is high at the peak of the stockbuilding cycle. New orders subsequently move back to trend and then below it as the cycle downswing develops.

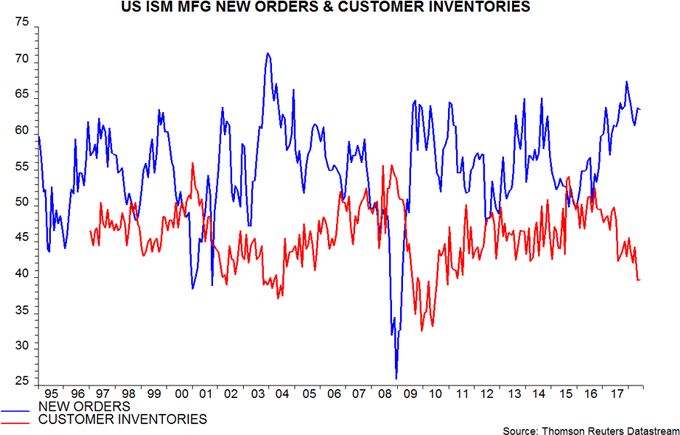

The ISM survey does not distinguish between these two sources of order flow. The transitory component, however, should be related to the customer inventories index, which measures whether stock levels are judged to be too high or too low. A low level of the index should be associated with high customer orders related to stockbuilding. A low index, that is, should imply strong transitory demand and a future decline in aggregate new orders as this fades.

The customer inventories index fell below 40 in May / June versus an average of 45.8 between its inception at the start of 1997 and end-2017 – see first chart. The index has been below 40 in 22 previous months historically. The average change in the new orders index over the subsequent six months was -3.6 points. Such a fall would more than offset the May / June rise.

The suggestion that ISM new orders index will resume a decline over coming months is supported by the Conference Board CEO confidence survey for the second quarter, conducted between mid-May and mid-June. Expectations for manufacturing business conditions in six months’ time correlate with and sometimes lead the ISM new orders index, and fell to a seven-quarter low – second chart.

Stockbuilding strength may have been exaggerated by firms boosting inventories of items at risk of tariff-related price increases or supply disruption. The ISM imports index rose sharply in June and is far above its long-term average. Front-loading of orders and production due to tariffs, that is, may have supported industrial activity at the likely expense of greater weakness later in 2018 as the stockbuilding cycle turns down.

Diesen Beitrag teilen: