Janus Henderson Investors: Real estate bubbles? Chance would be a fine thing

Real estate shares have been out of favour in recent years, and there are indications that listed property is currently undervalued. Portfolio managers Guy Barnard, Tim Gibson and Greg Kuhl assess the indicators and explore the associated risks and opportunities.

02.02.2021 | 07:00 Uhr

Key takeaways:

- Listed real estate underperformance versus the wider equity market appears increasingly stretched relative to history.

- There are indications that REIT debt investors view the risk profile of the asset class as having fully recovered from the pandemic; the same is not reflected in equity markets.

- Cheap and plentiful long-term funding is supporting the refinancing of existing debt and may drive merger and acquisition activity in real estate.

In a recent panel debate we were asked to discuss if we had seen any signs of valuation bubbles; our response in relation to the real estate market, was a somewhat flippant “chance would be a fine thing”. The other panel participants, investors in technology, healthcare and sustainable equity strategies all agreed that there are segments in their asset classes in which caution was certainly warranted – hydrogen technologies anyone?

Unlike the general equity market, listed REITs have not seen high profile examples of stocks recording exponential share price gains in recent years, with the overall performance of the sector having lagged the wider equity market by 25% since the start of 2020. In the five years to 31 December 2020, global real estate stocks returned 4.7% p.a versus 12.9% for global equities.1

As illustrated in figure 1, this level of relative underperformance is rare and was last witnessed in the build up to the dot-com crash. Property stocks subsequently generated returns of 16% p.a. over the five years from 2000 to 2005; in contrast global equities' returns were flat.2 While we would certainly not claim that ‘all else is equal’, it certainly bears some consideration.

Will this time be different?

While the pricing of underlying real estate assets may not be seen as ‘cheap’ in absolute terms relative to their long-term history ̶ the rental yield on a prime long-let London office asset today is circa 4%, the same as in 20063 (prior to the last correction) – the monetary backdrop is very different. In 2006 UK 10-year UK gilts yielded 5%, meaning there was no compelling reason for owning real estate and therefore a bet on future capital growth “greater fool theory?” was needed to justify pricing. Today, with 10-year gilts yielding less than 0.5% there is a close to historically wide spread for REITs over the cost of debt, providing investors with a sound income rationale for owning a real asset, that has also historically shown it can provide long-term inflation protection.4

While much attention recently has fallen on a shift in expectations toward rising inflation and a steepening bond yield curve, the US 10-year Treasury yield (at the time of writing), is around 0.7% lower than it was a year ago. This makes the relative difference in performance between wider equity markets and the real estate sector seem somewhat outsized.

Same assets, different valuations?

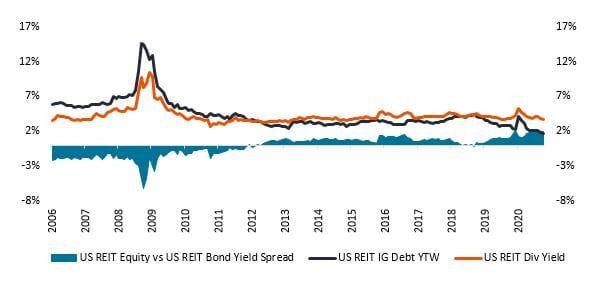

One observation worth highlighting in the current market is the divergence in valuations between the REIT equity and REIT debt markets (US data shown in figure 2). In the debt market, REIT corporate credit and commercial mortgage-backed securities (CMBS) yield spreads over treasuries have returned to pre-pandemic levels, and are also in-line with their longer-term history (figure 3). This suggests that debt investors view the risk profile of the asset class as having fully recovered from the pandemic. However, in the equity market, many valuation metrics including REITs’ dividend yield spread versus the yield on their own debt instruments are at or close to all-time wides.

Figure 2 : REIT equities appear historically cheap versus REIT debt

Source: Bloomberg, Janus Henderson Investors. REIT debt = Barclays Investment Grade (IG) REIT Index REIT equities = FTSE NAREIT Equity REIT Index). Spread: here refers to the difference in the yield of US REITs and REIT debt over that of an equivalent government bond eg US treasuries. Yields may vary and are not guaranteed.

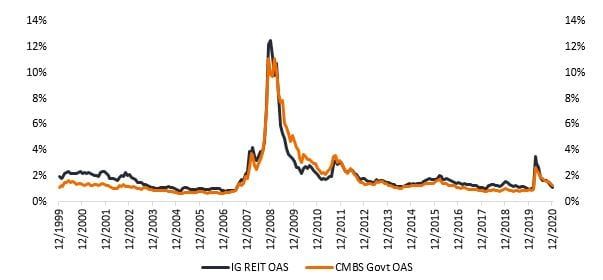

Given that debt financing is a key part of most REITs’ capital structure, it is also hugely beneficial that the yields on REIT investment grade (IG) corporate credit and investment grade CMBS are at around 20+ year lows (both 1.7% at the end of 2020) – see figure 3. This presents REIT management teams with a significant opportunity to generate interest savings by refinancing existing debt, or to fund new acquisitions with very cheap long-term debt. Plentiful debt at low interest rates could also present private buyers with opportunities to generate outsized returns via merger and acquisition activity involving listed REITs or private real estate.

Figure 3: Real estate fixed income spreads over treasuries (%)

Source: Bloomberg, Janus Henderson Investors as at 31 December 2020. Real estate = Bloomberg Barclays Investment Grade REIT Index (IG REIT OAS), US treasuries= ICE BoFA US Fixed Rate CMBS Index (CMBS Govt OAS). Spread: here refers to the difference in the yield of REIT debt over that of an equivalent government bond (US treasuries).The option-adjusted spread (OAS) measures the difference in yield between a bond with an embedded option, such as a mortgage-backed security or calling back the issue.

In conclusion, against a backdrop where return expectations across many other asset classes have declined, we believe real estate income is beginning to stand out as being attractive in both the direct and listed real estate markets. Moreover, in our view, the recent strength in real estate debt markets could be a precursor to future strength in listed real estate.

Footnotes

1,2 Source: Bloomberg as at 31 December 2020. Listed property = FTSE EPRA NAREIT Developed Index, general equities = MSCI World Index. Index returns in USD total return terms. Past performance is not a guide to future performance.

3 Source: Deutsche Bank research, CB Richard Ellis as at 31 December 2020.

4 Source: NAREIT (National Association of Real Estate Investment Trusts) as at 26 January 2021.

Commercial mortgage-backed securities (CMBS): fixed income investment products backed by mortgages on commercial properties. CMBS provides liquidity to real estate investors and commercial lenders. In the event of default, the mortgage loans that form a single commercial mortgage-backed security act as the collateral, with principal and interest passed on to investors.

Die vorstehenden Einschätzungen sind die des Autors zum Zeitpunkt der Veröffentlichung und können von denen anderer Personen/Teams bei Janus Henderson Investors abweichen. Die Bezugnahme auf einzelne Wertpapiere, Fonds, Sektoren oder Indizes in diesem Artikel stellt weder ein Angebot oder eine Aufforderung zu deren Erwerb oder Verkauf dar, noch ist sie Teil eines solchen Angebots oder einer solchen Aufforderung.

Die Wertentwicklung in der Vergangenheit ist kein zuverlässiger Indikator für die künftige Wertentwicklung. Alle Performance-Angaben beinhalten Erträge und Kapitalgewinne bzw. -verluste, aber keine wiederkehrenden Gebühren oder sonstigen Ausgaben des Fonds.

Der Wert einer Anlage und die Einkünfte aus ihr können steigen oder fallen. Es kann daher sein, dass Sie nicht die gesamte investierte Summe zurückerhalten.

Die Informationen in diesem Artikel stellen keine Anlageberatung dar.

Zu Werbezwecken.

Diesen Beitrag teilen: