Multi-Asset Insights: Oil spills into high yield sector

Die Fondsmanager Remi Ajewole und Urs Duss analysieren den Einfluss des Ölpreises auf High-Yields.

30.01.2015 | 16:39 Uhr

Global cycle turning amber; pause for thought

We believe that, although the global recovery is set to continue in 2015, the headwinds are sizeable: slowdown in China, dollar squeeze and potential deflation in Europe.

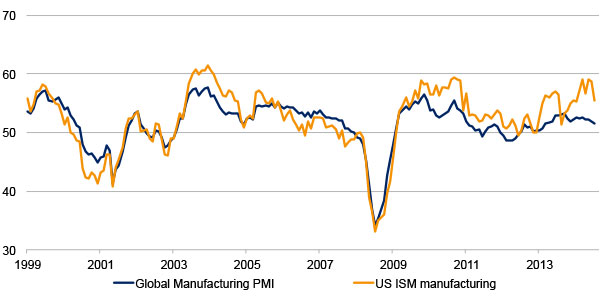

The US economy is currently the main growth engine for the global economy (Fig:1). Therefore, the big question is whether the slowdown in other parts of the world will contaminate the recovery in the US. We believe the improvements in the US labour market will be maintained, and view the recent decline in oil prices as beneficial for the US consumer. However, our fear is that the risk emanating from the other economies, the severity of the oil decline and the strength of the dollar could all have a destabilising effect on financial markets.

Figure 1: Global and US manufacturing surveys

Source: Schroders, 31 December 2014

Over the past 12 months, earnings have made a meaningful contribution to overall equity returns. However, macroeconomic uncertainty has begun creeping into the outlook for corporate earnings. Unlike previous years, the outlook for earnings is no longer so clear-cut. This is particularly true in the US where the breadth of analysts’ estimates has been increasing; an undesirable trend.

The drop in oil price and the stronger dollar threaten optimistic forecasts for US earnings. The last time oil dropped to $50 a barrel, in 2009, realised earnings on the S&P 500 energy sector subsequently fell by over 40% in the following weeks. Today, though there is considerable risk of further downgrades, the good news is that forecasts needed to, and have, come down to more sensible levels. The dollar impact is more difficult to quantify, but what is clear is that the uncertainty around the outlook for corporate earnings is likely to weigh negatively on the market in the coming months.

Finally, market volatility has crept higher recently, which is generally associated with weaker equity markets. All in all, the score from the cycle has been downgraded from positive to neutral.

Oil spills into high yield

The dramatic move in the oil price following OPEC’s decision not to cut output has significantly impacted energy-related high yield credits and the broader asset class. Energy is the largest sector in high yield, constituting 13.4% of the BAML US HY Master II Index. Whilst we have seen the greatest spread moves in more cyclical sub-sectors (exploration & production and oilfield services), the more defensive sub-sectors (midstream and refiners) have also suffered, as investors sold indiscriminately to reduce their exposure to the sector and meet redemptions.

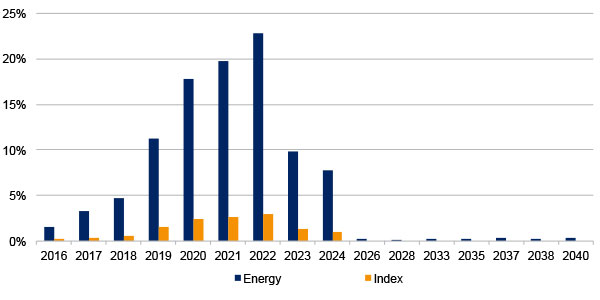

Fundamentals for high yield energy companies contrast favourably, with leverage and interest coverage ratios both comfortably better than the index. However, we should be cautious given the potential for a sharp decline in revenues and financial stress for smaller, cashflow negative companies going forward. A mitigating factor is that only 0.2% of the index comes due for maturity through 2016 from energy names. Therefore, there is little immediate rollover risk within the sector.

Figure 2: Maturity profile, % energy sector and BAML US High Yield Index

Source: Schroders, 31 December 2014

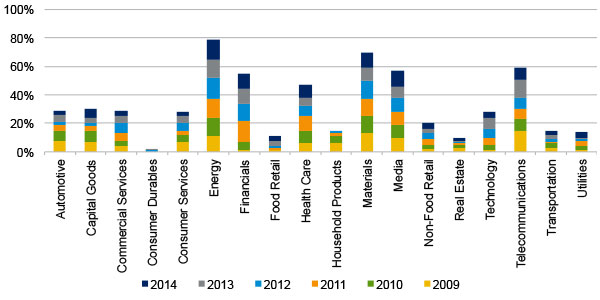

There has been a high level of high yield issuance by energy companies recently on the back of growth in shale oil producers in the US. Investor concentration in the sector has lead to poor liquidity and difficulty selling positions following the recent oil-related volatility. The prevalence of lower quality new issues over the past few years has been a particular source of concern for investors.

Figure 3: Developed market high yield issuance by sector

Source: Schroders, 31 December 2014

There are a number of consumer-related sectors which are set to benefit from a prolonged decrease in the oil price; however, the broader financial market stress we anticipate should the price fall further could outweigh this positive effect.

Diesen Beitrag teilen: