Janus Henderson Investors: The case for high yield bonds

Using a combination of eight charts and tables, corporate credit portfolio managers Seth Meyer and Tom Ross consider some of the potential risks and opportunities within the high yield sector of fixed income.

18.05.2020 | 09:01 Uhr

Key takeaways

- High yield corporate bonds have historically offered an attractive source of yield, which in turn has contributed to competitive total returns.

- Occupying the centre ground between investment grade bonds and equities from a risk-return perspective, they offer the potential for diversification in a portfolio and have historically been less sensitive to interest rate risk.

- Given the high degree of idiosyncratic risk in high yield bonds, it is an asset class that can reward good security selection.

What is a high yield bond?

Companies issue corporate bonds to raise funds, promising to pay the investor interest (the coupon) each year and repay the par value of the bond when the bond matures. High yield bonds are corporate bonds that carry a sub-investment grade credit rating. This means they are rated equal to or lower than Ba1 by Moody’s or BB+ by S&P or Fitch, the credit rating agencies. They are typically issued by companies with a higher risk of default (the failure to meet repayments to bondholders), which is why they offer higher yields to attract investors.

The high yield bond market is well developed and established, having its origins in the US more than 40 years ago. Today, the global high yield market comprises a vast range of issuing companies, from household giants such as Fiat Chrysler, Netflix and Banco do Brasil, through to small and medium-sized companies that are raising funding via the bond markets for the first time. This creates a diverse mix of issuers that can reward strong credit analysis.

An attractive source of income

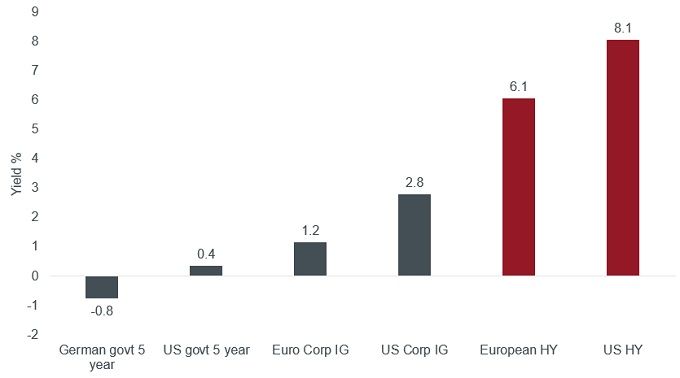

Trying to achieve an attractive yield on investments has become a challenge as central banks have driven interest rates lower. This has been compounded by unconventional policy measures such as central bank asset purchase schemes (quantitative easing), which involves creating money to purchase government and corporate bonds to keep financing costs low. As Figure 1 shows, high yield bonds offer a strong yield pick-up compared with other forms of debt.

Figure 1: Yields on different types of fixed income

Source: Bloomberg, govt = government, Generic German 5-Year Government Bond (GDBR5), Generic US 5-Year Government Bond (USGG5YR); ICE BofA Indices, Euro Corporate IG (investment grade) = ER00, US Corp IG = C0A0, European HY (high yield) = HP00, US HY = H0A0. Yield to maturity for government bonds, yield to worst for corporate bonds, as at 30 April 2020. Yield to worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting. Yields may vary and are not guaranteed.

Risk and reward

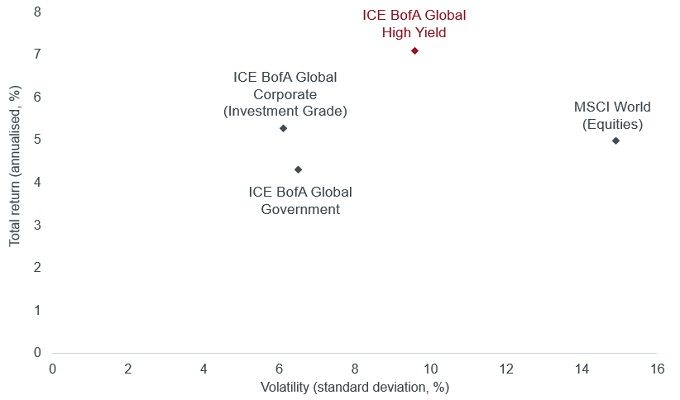

From a risk-return perspective, high yield bonds are typically seen as occupying the space between investment grade bonds and equities. As Figure 2 shows, over the last 20 years, global high yield bonds have outperformed government bonds, investment grade corporate bonds and equities, with much less volatility than equities. This argues for a strategic allocation to high yield in a diversified portfolio. The high income element in high yield bonds has been a valuable component of total return.

Figure 2: Total return versus volatility, 1999 to 2019

Source: Refinitiv Datastream, total return indices in US dollars, 31 December 1999 to 31 December 2019. Volatility is standard deviation, using monthly data returns. Past performance is not a guide to future performance.

While typically not as volatile as equities, high yield bonds are issued by companies that are often sensitive to the economic cycle and to events within individual sectors and companies. By holding a diverse portfolio of high yield bonds, this can help an investor to reduce the idiosyncratic risk of an individual bond. High yield bond investors should be prepared to accept some volatility. For example, during the financial crisis, the global high yield bond market experienced a drawdown (peak to trough decline in value) of 36%*. Historically, however, the high yield market has a tendency to bounce back strongly after sharp falls as demonstrated in Figure 3.

Figure 3: ICE BofA Merrill Lynch Global High Yield Bond Index 12-month rolling returns

Source: Refinitiv Datastream. Monthly rolling 12-month total returns, in US dollars, 30 April 2000 to 31 April 2020. *ICE BofA Global High Yield Bond Total Return Index, 21 May 2008 to 12 December 2008. Incidentally, the index had recovered its 21 May 2008 peak value by 5 August 2009. Past performance is not a guide to future performance.

Diesen Beitrag teilen: