Janus Henderson Investors: High yield bonds: dealing with volatile markets

Tom Ross, credit portfolio manager, comments on the crisis gripping markets and how the Corporate Credit team is responding in terms of positioning within the Global High Yield and Euro High Yield strategies.

16.03.2020 | 09:34 Uhr

Key takeaways

- Coronavirus developments will determine market sentiment. We are in a grey area as the world tries to ascertain whether the virus can be contained without deeper economic disruption, while a sustained oil price war adds further tail risk.

- At the technical level, weak market returns could prompt outflows from corporate bonds. So far, liquidity in the market has deteriorated but is still available in smaller sizes.

- The sharp correction in corporate bond markets means valuations have improved. Spreads could widen in a downside scenario, but a fair amount has already been priced in.

Fundamentals (economic growth and corporate health)

The Coronavirus

While we continue to monitor the situation very closely, we have no more insight than the medical experts as to how it will develop from here. The best-case scenario is that new cases globally will slow within the next couple of weeks or months. The worst-case scenario sees further countries in lockdown (similar to Italy), causing a more sustained growth slowdown through disrupting demand and supply chains. It remains to be seen whether countries such as the UK and the US can control the spread better than those that were affected earlier.

OPEC+

The breakdown in talks between Russia and Saudi Arabia is another huge uncertainty for the markets and comes at a time when investor sentiment is already fragile. A sustained price war, meaning oil prices around the US$20-$30 a barrel range, has a significant impact on US oil producers. Whilst many have hedges in place for a while, sustained low prices will mean a significant pick up in energy company defaults (energy is 8.9% of the global high yield market and 9.3% of the US high yield market, although only 2.7% of the European high yield market1). The US oil and gas industry employs more than 1 million people2, so a drop in production or rise in defaults would lead to increased unemployment.

1Source: Bloomberg, ICE

BofA Global High Yield Index, ICE BofA US High Yield Index, ICE BofA

European Currency Index, weights at 12 March 2020.

2Source: 2019 US Energy & Employment Report, USEnergyjobs.org

Market Dynamics

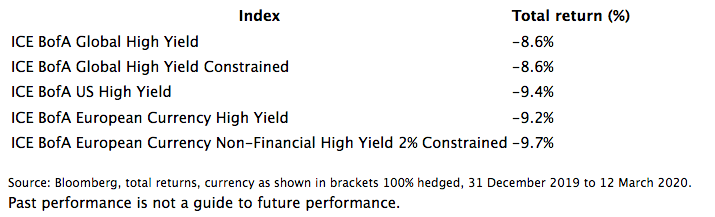

The main risk here is potential outflows based upon poor total returns from the market. Year to date, returns from the high yield indices have turned negative.

Valuations

Here’s the bright spot. The global high yield market now yields close to 8% with spreads in the mid 700s (as at close 12 March 2020)3. We estimate, based on looking at historical levels of prior crises, that current credit spreads are pricing in something in the region of 60-70% likelihood of a meaningful recession. So spreads could still clearly go wider in a downside scenario, but at the same time a fair amount has already been priced in.

3Source: Bloomberg, ICE BofA Global High Yield Index, yield to worst versus government, spread to worst versus government, at 12 March 2020. The spread to worst represents the additional yield over equivalent government bonds, taking into account possible early redemption calls.

Positioning

We had become more cautious on the high yield market last week given the prevalence of the coronavirus and the uncertainty of the near-term outlook given its further spread and potential impact on global growth. Hence, we have been positioning a little underweight overall credit risk versus the index. Our relatively defensive positioning is focused on issuers we fundamentally like, with an underweight to cyclical sectors that are more exposed to a weakening economic landscape such as autos, consumer goods and services. We further reduced risk in some energy names on Monday 9 March as well as to issuers indirectly related to energy or those more cyclical in nature. We will look to reduce risk at the margin from here in names whose prices or spreads have held in relatively well, or whose fundamentals are more likely to be negatively impacted by a weakening in the economic backdrop.

Global High Yield: For the energy sector, we are neutral overall, through an underweight to US and a small overweight to European and emerging market names

Euro High Yield: For the energy sector, we have a small overweight position.

What else are we doing?

As always, we are sticking with our process, including cutting a couple of energy positions by a third as per our stop loss process. Liquidity has deteriorated but is still available in smaller sizes. We are able to trade, although we are keeping trading activity to a minimum to avoid unnecessary trading costs. There are some dislocations being created between different securities; however, with volatility at its current level we are choosing to trade in smaller sizes to limit execution risk.

Diesen Beitrag teilen: