Columbia Threadneedle: Three reasons to allocate to European High Yield

From an evolving market to higher yields with modest default rates, here's why you should consider European High Yield.

12.01.2024 | 07:05 Uhr

Reason #1 The market has evolved and hosts blue chip companies

Since Columbia Threadneedle Investments launched its first high yield bond fund in 1999 the market has transitioned from a marginal asset class of low quality and small issuers to one with depth and breadth that is home to blue-chip companies such as Ford1, Rolls Royce, IAG (British Airways owner) and Telecom Italia2.

Since 1999, the European high yield universe has increased in market value by more than 20 times, with the number of issuers increasing by more than five times. In 2000 the market contained 11 sectors, with telecommunications and media making up 50% of the space. Now it has 18 sectors (the same 18 as the investment grade market) with, incidentally, telecommunications and media now only an 18% weighting3.

This more developed market gives us a greater number of issuers for credit selection opportunities which, alongside issuers offering a wider range of maturities, gives us more scope for curve trades. The more diversified sector composition provides us, as an active asset manager, more freedom to make the most of both tactical and thematic sector tailwinds.

Reason #2 Higher yields with a modest default outlook

At the time of writing4, the European high yield market offers a 6.9% yield to maturity – an attractive total return prospect for a fixed income asset class. In the context of equity returns, the Euro Stoxx 50 has delivered a 3.0% annualised return since 2000 and a 6.8% annualised return since 20105.

Despite the prospect of defaults within the asset class, our high yield desk forecast expects modest default levels – a cumulative rate of 3.9% from October 2023 to October 2025, or 1.9% annualised. This compares with the long-run average European high yield default rate at 2.7% a year6.

Reason #3 History is on your side

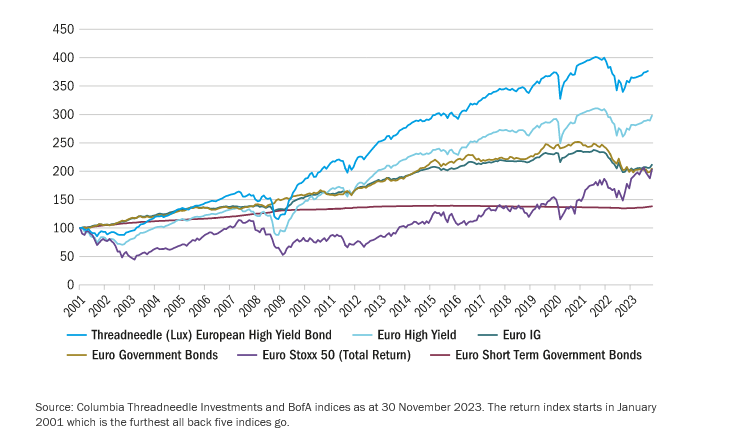

Over the long run the euro high yield market has outperformed its European peers (see Figure 1). Since January 2001, the high yield market index return has almost tripled, in absolute terms.

Figure 1: European high yield outperformance

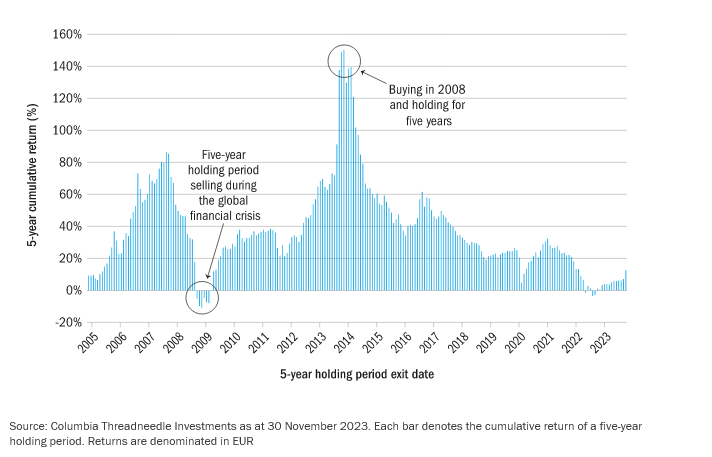

We believe that for a long-term investor, European high yield offers an attractive return. Figure 2 illustrates every five-year holding period of the market going back to 2000 (all 228 of them). During this time, the market delivered a median five-year cumulative return of 32.7% and a negative return on only nine out of the 228 holding periods.

Figure 2: European high yield five-year returns

Despite the impressive returns offered to a long-term investor, market returns can still be adversely affected by rising defaults during times of market stress. Being cognisant of this, at Columbia Threadneedle our investment process focusses on the avoidance of permanent capital loss. This is achieved through our focus on risk management and research intensity, which is afforded by our well-resourced analyst team.

In summary, in the long run the European high yield market has outperformed the aforementioned competing asset classes while consistently delivering over a five-year time horizon.

1 Ford is a rising star and left the market following an upgrade by S&P to investment grade on 30 November 2023

2 Mention of specific stocks is not a recommendation

3 Columbia Threadneedle Investments analysis, 2023

4 3 January 2024

5 All figures Bloomberg, as at 3 January 2024

6 Figures based on the Deutsche bank five-year average cumulative default rate at 14.4% annualised to 2.7% per annum, as at 8 December 2023

Diesen Beitrag teilen: