BNP Paribas AM: Euro high-yield bonds - too much of a good thing

The prospects for Euro high yield in 2018 are drawing some conclusions from the recent short-lived correction. Over the medium term, the market needs to prepare for such jumps in volatility and by doing so it should change the composition of demand for high yield bonds.

05.12.2017 | 14:20 Uhr

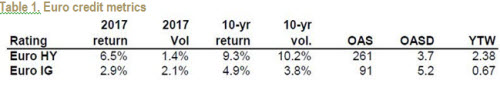

What’s not to love about European high-yield bonds? A supportive central bank that suppresses yield across the region, purchasing managers’ indices at six-and-a-half-year highs, more upgrades than downgrades, a low default rate, improving fundamentals and strong technical factors. With that backdrop, European high-yield bonds had generated a return of 6.5% year to date (to October), a little over twice that of European investment-grade bonds and with only about two thirds of the volatility (see table). High yield is supposed to be riskier than investment-grade, right, not less? Too good to be true, yes? After such good performance, one wonders where we go from here.

What’s not to love about European high-yield bonds? A supportive central bank that suppresses yield across the region, purchasing managers’ indices at six-and-a-half-year highs, more upgrades than downgrades, a low default rate, improving fundamentals and strong technical factors. With that backdrop, European high-yield bonds had generated a return of 6.5% year to date (to October), a little over twice that of European investment-grade bonds and with only about two thirds of the volatility (see table). High yield is supposed to be riskier than investment-grade, right, not less? Too good to be true, yes? After such good performance, one wonders where we go from here.

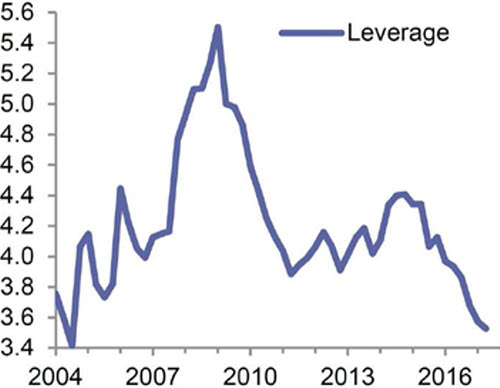

Our view is that conditions are likely to remain supportive, certainly from a fundamentals perspective. Default rates are expected to remain low, at about 1% in 2018. Companies are generally continuing to reduce their debt metrics and – thanks to accommodative financial conditions – improve their cash flow with lower interest payments (see figures 1 and 2). With solid economic activity across the region, companies should be able to find pricing power, allowing them to further improve their cash flows and debt metrics. This should contribute to keeping default rates low for the foreseeable future.

It is anomalous, however, that high-yield bonds are less volatile than investment-grade bonds, and we think this will correct itself in time. Just how long that will take is difficult to say, but the end of the ECB’s quantitative easing program could provide a good starting point. In our view, the mini sell-off we saw in November 2017 is a sign that we are heading for that normalization. It is difficult to point to one single factor that drove the repricing, but we think the significant fall in Altice’s share and bond prices following its profit warning was the catalyst. Expectations of future cash flows had disconnected from reality and the profit warning from the management of this telecommunications conglomerate led to massive reductions in bond positions. What started as an idiosyncratic situation quickly morphed into a general deterioration in sentiment and rising distrust of the most highly-indebted companies. Spreads on bonds of other higher beta names widened in sympathy, while higher-quality issues held their value much better. Mutual funds and exchange-traded funds suffered outflows and it looked like things could turn ugly quickly. However, the market stabilized; after all, investment managers have been conditioned to buy the dip and bargain-hunting helped bonds find a floor. In the end, the sell-off was well contained and — as long as there is no macroeconomic shock — one could even envisage a ‘Santa rally’ that could pave the way for decent performance in January.

So, with everyone back in the pool, does the party now continue? In the short term, quite possibly so. We believe, though, that over the medium term, the market needs to prepare for such jumps in volatility and by doing so it should change the composition of demand for high yield bonds. Spreads have compressed by about 100bp year-to-date and thus capital appreciation has contributed to 40% of the total return for the year, with the coupon contributing ‘only’ 60%.

Interestingly, high-yield mutual fund flows have on average experienced small outflows this year. This means the marginal demand for high-yield has not come from traditional buyers, but rather from fixed-income investors that have ventured beyond their natural mandate to boost returns, while quite exceptionally also reducing the volatility of their portfolios. As “reality checks” between valuation and fundamentals do inevitably happen, we think even a measured increase in high-yield volatility could prove too much for these investors to stomach.

That should enable high-yield bond investors to demand compensation via higher spreads, especially as we expect many high-quality BB issues to be upgraded back to investment grade, leaving a smaller pool of investments to pick from, with on average a slightly riskier profile. In the end, we think long-term investors in high yield will benefit from a stickier pool of money, higher spreads and – assuming German Bunds also ‘normalize’ at a higher level – from a better all-in yield. As long as the fundamentals remain sound, we can live with some short-term volatility and believe this will provide opportunities for the active investor.

Figure 1. European high-yield net debt / EBITDA

(Data as at June 2017. Issuer leverage weighted by debt. Sources: J.P. Morgan, Bloomberg, BNP Paribas Asset Management.)

Den vollständigen Marktkommentar "Euro high-yield bonds: too much of a good thing" können Sie hier in englischer Sprache lesen.

Diesen Beitrag teilen: