Morgan Stanley IM: The Merits of Hedge Fund Co-Investments

Hedge fund co-investments have an important role to play in client portfolios, explains AIP Hedge Fund Solutions Team Managing Director Jarrod Quigley.

23.03.2023 | 06:23 Uhr

Here you can find the complete article

While co-investing has been a feature of the private equity industry for many years, it is a relatively new but growing trend in the hedge fund industry. We believe that hedge fund co-investments are an important tool to increase the total return of portfolios, while also delivering limited correlation to traditional asset classes and core hedge fund strategies. Co-investments can also be used to respond rapidly to dislocations in markets.

Why are we seeing growth in hedge fund co-investment

opportunities?

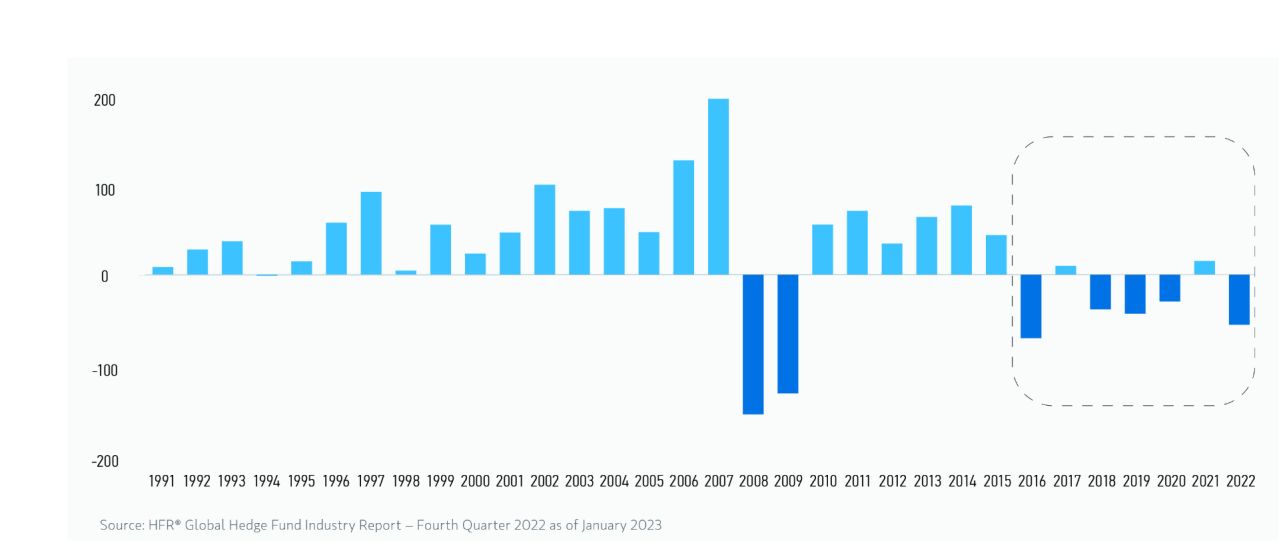

Prior to the global financial crisis the hedge fund industry experienced

strong inflows. Many hedge funds enjoyed relative freedom to pursue niche

opportunities and put less liquid investments into side pockets. However, in

recent years, industry inflows have been more limited and investors have been

more restrictive on permissible investments, particularly less liquid

situations (Display 1).

As a result, hedge funds have had less discretionary capital available to deploy. This, coupled with regulatory changes which decreased bank and insurance company willingness to invest in non-traditional asset classes, led to a greater opportunity for alternative forms of capital to step in and fill that void. The end result has been an increase in established hedge funds seeking co-investment capital for discrete opportunities that do not meet the liquidity, concentration or asset class guidelines of their flagship funds.

Display 1

Net Outflows in Hedge Funds Drives Opportunity

Net Asset Flows in $ Billions

Source: HFR® Global Hedge Fund Industry Report – Fourth Quarter 2022 as of January 2023

What are the benefits of introducing co-investments?

From the investor’s perspective, fees, transparency and correlation are key focal points when it comes to hedge fund allocations. In our view, co-investments have the potential to provide improvement on all three fronts. Furthermore, they can provide a way for investors to target specific exposures and risk/return profiles that meet their investment objectives and aren’t already present in their portfolios. The trade-off however is that co-investments may introduce an element of illiquidity.

We believe co-investments offer a clear and self-sustaining value proposition to hedge fund managers and investors. For hedge fund managers, co-investments represent a new source of capital that enables them to participate in high-conviction opportunities that, absent co-investment capital, they would not be able to pursue. For investors, co-investments offer a means of direct access to differentiated sources of return with potentially bespoke risk/return profiles in addition to attractive fees, transparency and control rights.

How do hedge fund co-investments differ from private equity co-investments?

The primary difference is the universe of managers from which

co-investments are sourced. Co-investing is a mature concept for private

equity firms. Indeed, many private equity managers have established and

often contractual processes for how co-investments are allocated among

existing clients. Co-investing is a newer concept for hedge funds. Most

hedge fund managers do not have a long list of existing investors with

whom they have traditionally partnered on such investment opportunities.

At the same time, most hedge fund allocators are not equipped to make

decisions about co-investments. As a result, these opportunities tend

not to be as heavily trafficked as private equity co-investments and

there tends to be greater potential for tailoring implementation

strategies.

Another important difference is the breadth of investment strategies accessible through each of the two categories. Private equity co-investments typically involve control private equity positions that are subject to the same factors that influence valuation of public equities. Hedge fund co-investments represent a diverse array of asset classes, liquidity profiles and risk. They can be “risk-on” or “risk-off” and everything in between. They can range from publicly traded equity and debt to non-traded investments, such as litigation finance and reinsurance, which have no correlation to traditional assets classes. For this reason, we would generally expect that hedge fund co-investments would have lower correlation to global equities than private equity co-investments. Hedge fund co-investments also tend to have shorter holding periods than private equity co-investments.

How are hedge fund co-investments sourced?

Sourcing is entirely dependent upon having access to a robust

network of idea-generators. The most obvious sourcing channel comes from

hedge fund managers with whom an investor has existing primary fund

investments. However, it is increasingly common for hedge fund managers

to solicit co-investment capital directly from allocators with whom no

primary fund relationship exists. This is happening because few hedge

fund managers have existing investors with active co-investment programs

and managers recognize co-investments as an opportunity to broaden

their client base and support future business growth.

What are the key barriers to entry?

While we believe there are many potential benefits to making co-investments, we see four key barriers to entry:

- SOURCING: Having a wide network of existing hedge funds—idea generators— and a pipeline for new ones is critical. The greatest advantage in this space comes from the luxury of choice, having access to a wide range of potential opportunities and being selective.

- ANALYSIS: Co-investing requires integrating a hedge fund manager due diligence framework with asset-specific underwriting. Many hedge fund investors are not structured or resourced to support this two-pronged approach.

- EXECUTION: Co-investing requires efficient and time-sensitive decision making, often over the course of mere days. In addition, legal documentation and vehicle structuring must be accomplished far more rapidly than is required in traditional fund investing.

- CAPITAL FLEXIBILITY: Co-investments are often presented because the hedge fund manager has constraints on size and/or liquidity that prevent inclusion of these ideas in a main fund. Investors with a broad mandate and appetite to be flexible around these parameters may be able to maximize their opportunity set.

How is alignment typically achieved with the hedge fund manager?

Generally, alignment is achieved in two ways. It can come from

assurance that a manager has “skin in the game” by investing personal

capital alongside that of external investors. It can also come through

fee structures that are akin to “sweat equity.” There are a wide range

of fee structures (including no fees), but structures are typically a

skewed performance hurdle whereby a manager is only compensated if the

investment achieves the investor’s objectives.

What is the role of co-investments in client portfolios? What are the trade-offs?

We believe the primary role of hedge fund co-investments can play

in client portfolios is to potentially increase expected return.

Secondary benefits may include improving transparency, reducing average

fees, and introducing targeted exposures that are not correlated to

existing allocations.

The trade-offs are that co-investments are resource-intensive and require quick response times. In addition, they can have higher risk and exhibit wider distributions of outcomes than traditional fund investments. Finally, co-investments may require more onerous liquidity.

Conclusion

In our view, hedge fund co-investments have a distinct role to play

in well-balanced portfolios, offering important diversification

benefits to traditional asset classes, hedge funds, and opportunistic

investments.1 We believe that hedge fund co-investing will

continue to present itself as a valid and growing investment opportunity

set and reach the level of adoption currently found in private equity.

Diesen Beitrag teilen: