Janus Henderson: Life Sciences view: headlines mask reality within health care

With revisions to the path of US health care reform expected imminently, Andy Acker and Ethan Lovell, portfolio managers within the Janus Henderson Global Life Sciences Team, outline why they believe opportunities remain within the US health care sector.

19.07.2017 | 13:25 Uhr

In the US, the Republican promise to repeal and replace the Affordable Care Act (ACA) has loomed over the health care sector for months. But members of Congress – having recently returned to Washington after the Fourth of July recess – are still trying to fulfil that goal. A Senate bill introduced in late June, the Better Care Reconciliation Act (BCRA), did not have the necessary votes to pass. Senate Majority Leader Mitch McConnell plans to unveil a revised draft imminently. If reform fails, though, he says the Grand Old Party (GOP; the Republican Party) may have to revert to plan B: working with Democrats to stabilise the insurance markets.

The downside risk

In other words, uncertainty continues. According to the Congressional Budget Office (CBO), in the US 22 million fewer people would have insurance by 2026 under BCRA, driven in large part by deep cuts to federal spending on Medicaid and fewer incentives for people to buy coverage. Given such a bleak forecast, we believe the odds of the Senate approving the current bill are less than 50/50. So what does this mean for investing in health care? In our opinion, hospitals face the most downside risk, regardless of whether the Senate bill becomes law. That’s because we see the number of uninsured and underinsured in the US rising over the near-to-intermediate term. Although the CBO’s forecast may be inflated (the non-partisan group used outdated assumptions to make its projections), if the BCRA becomes law, fewer people would be incentivised to buy coverage (since penalties for not having insurance would be eliminated) and Medicaid benefits would become thinner, hurting hospital revenues. If BCRA does not pass, hospitals could ‘feel the pain’ anyway since a Republican-controlled government could, for instance, decide to inadequately fund ACA subsidies, or more insurers could opt to pull out of money-losing exchanges.

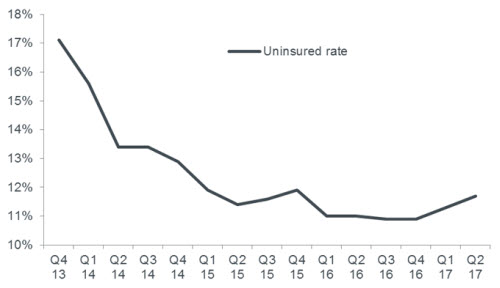

Chart 1: US uninsured rate rises

Uncertainty about health care reform could be driving a recent uptick in the rate of uninsurance in the US

Source: Gallup-Sharecare Well-Being Index, quarterly data from Q4 2013 to Q2 2017

Opportunity despite uncertainty

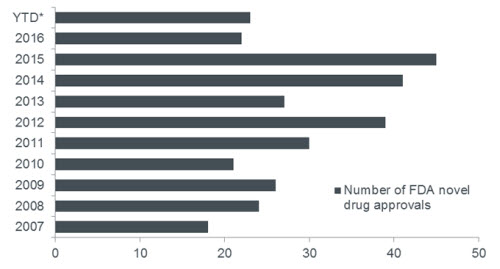

Still, we would point out that hospitals make up only a small portion of the sector, and while reform dominates headlines, many other areas of health care continue to thrive. We are especially encouraged by innovations occurring in biotechnology and medical devices. Today, more companies are developing products that target high, unmet medical needs. At the same time, the US Food and Drug Administration (FDA) is increasingly focused on delivering these therapies quickly to patients. New rules, for example, now allow the FDA and drug sponsors to communicate during the clinical review process, making it possible for sponsors to address deficiencies long before an FDA approval decision is made. As such, the number of product launches is on the rise. In fact, for the five years through 2016, the FDA approved an average of 35 novel therapies annually. During the previous five years, the average was only 24 annually.

Chart 2: new drug approvals

The US FDA has been approving novel therapies at a higher rate in recent years

Source: US FDA. Data as of 11 July 2017

Free-market solutions

Drug pricing has been another challenge for the sector ever since Hillary Clinton first tweeted about “price gouging” in 2015. Yet, here again, we believe the headlines mask reality. In our opinion, Republicans are more likely to embrace free-market solutions to contain drug costs in the US, without stifling innovation. Neither the BCRA, nor the health care bill that passed the US House of Representatives earlier this year, address drug costs. A recent draft of an executive order from President Trump even suggested easing some regulations for pharmaceutical companies. Other solutions that have been floated include speeding competition to the market (making it easier to substitute generics* and biosimilars** for brand-name drugs), allowing greater flexibility in benefits design (thereby increasing affordability) and reforming public programmes such as 340B, which gives providers that serve low-income communities deep discounts on drugs – a programme that critics argue is being used to pad profits.

We believe these kinds of changes would be beneficial for the system and encourage companies to exercise practices that lead to sustainable growth. For example, before launch, Regeneron Pharmaceuticals and Sanofi met with payers to determine an appropriate price for Dupixent, which addresses moderate-to-severe forms of atopic dermatitis (eczema). The treatment still carries an annual price tag of US$37,000, but prescription trends have been robust. We think these kinds of practices will become increasingly common, benefiting patients and, potentially, investors.

Please note: Stock examples are intended for illustrative purposes only and are not indicative of the historical or future performance of the strategy or the chances of success of any particular strategy. References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security.

Glossary:

*Generic = a generic drug is the same as a brand-name drug in dosage, safety, strength, quality, the way it works, the way it is taken and the way it should be used. FDA requires generic drugs have the same high quality, strength, purity and stability as brand-name drugs.

**Biosimilar = a biosimilar is a biologic medical product which is almost an identical copy of an original product that is manufactured by a different company.

Diesen Beitrag teilen: