NN IP: Market assumes delayed ECB hikes

Market implied ECB rate expectations are volatile, but rate hikes are priced out further and further. Market implied Fed expectations have become more realistic, but there’s still potential for repricing.

25.06.2018 | 13:19 Uhr

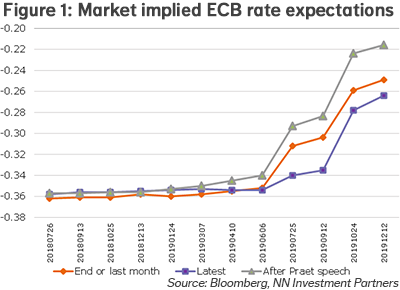

After the ECB’s chief economist speech of about two weeks ago, the market started to anticipate a faster pace of normalisation. This consisted of an expectation that QE would end more quickly, and a steeper path of interest rate normalisation. Figure 1 shows that the day after the speech of Peter Praet, Chief Economist of the ECB, expectations for the rate normalisation had indeed steepened. However, the dovish delivery by Mario Draghi and the comment that rates would remain unchanged until at least the middle of 2019, pushed expectations down again. After this, expectations were actually lower than where they were before Praet’s speech.

Having risen sharply following the speech, yields on 10-year bunds yields declined after the ECB meeting. Peripheral bonds were also supported, with a decline of the different peripheral yields. In all, Italian bonds are lower than their peaks, but still remain quite volatile (in both directions). Fixed income spreads also had a fairly good week with both investment grade (IG) and high yield (HY) spreads narrower, but EMD continued to suffer from outflows and spread widening.

Market implied Fed expectations rise again

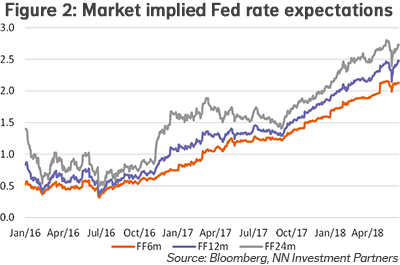

During the market turmoil in May, the market-implied Fed expectations were priced out a bit. This can be seen in Figure 2. Over the past few weeks, we have seen that the market is repricing Fed expectations again, although they are not quite at the levels of before the volatility of May yet. Figure 2 shows the very gradual adjustment of Fed expectations by the market. Since the autumn of 2017 there is a clear gradual rise of expectations on different time horizons (six, 12 and 24 months). The current expectations have become quite realistic in our view, although for both this year and next year there is more potential for repricing Fed expectations.

Record high in US-German 10-year yield spread

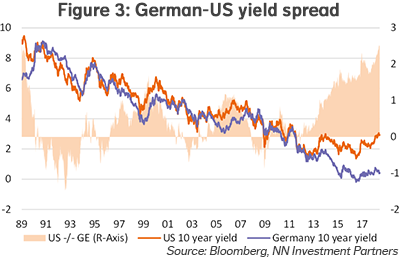

The US and German 10-year yield spread continues to widen further. Figure 3 shows that the current level of the interest rate differential is quite extreme in a historical context. We need go back almost 30 years to find similar gaps. That said, it is hard to see how this will change in the months ahead. The monetary policy cycle continues to diverge. The ECB will hike in well over a year, at the earliest, while the Fed continues in its rate hike cycle. In our view, the market still has potential to reprice Fed hikes further, especially for 2019.

When will the US-German 10-year yield gap narrow again?

In the case of a continuing expansion of the economic and monetary policy cycle, the gap will likely narrow when the ECB has a faster rate of normalisation than the Fed, i.e. when the Fed starts to slow or pause interest rate hikes and the ECB gets into the swing of rate hikes. This is unlikely to happen in the coming 12 to 18 months, in our view. On the other side, the term premium is still low in both the US and Germany. That means, even when the Fed stops raising rates, the term premium can rise further. The Fed balance sheet adjustment will continue, and it will take a long time to normalise the stock of bonds. This high stock of purchased assets by the Fed is one reason that has kept the term premium low. Finally, a premature end to the cycle would reduce the spread, as the US 10-year yield has more potential to fall and would benefit from global safe-haven flows.

Diesen Beitrag teilen: