Morgan Stanley IM: Jackson Hole - Dovish Fed reassures markets

The much-anticipated Jackson Hole Economic Symposium took place on 26 - 28 August, with pricing immediately prior to the event suggesting that markets were expecting a dovish statement from the Federal Reserve.

14.09.2021 | 07:10 Uhr

Here you can find the complete article.

Chair of the Federal Reserve, Jerome Powell, did not disappoint markets, opting for an even more dovish statement than expected. The Chairman pushed any prospect of interest rate rises far down the line, stating they will only increase once maximum employment is reached and inflation ‘is on track to moderately exceed 2% for some time’.1 Whilst he acknowledged that inflation is a concern, ‘the elevated readings are likely to prove temporary’.1

That said, Chairman Powell indicated that the Fed’s monthly bond purchases could be reduced this year. Therefore, tapering continues to be well telegraphed in contrast to the 2013 Taper Tantrum, a repeat of which the Fed is clearly trying to avoid. The markets reacted positively and the US 10-Year Treasury yield fell further from its already low point, to below 1.28.2 The S&P 500 also reacted positively, up 0.9% on the day of the speech (27 August 2021) and overall ended the month positively returning 3.0% (USD). The S&P 500 once more outperformed the MSCI Europe Index, which nevertheless returned a positive 2.0% (EUR). The MSCI Japan Index returned 3.2% (JPY)3.

The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See Disclosure section for index definitions.

However, August was not without its challenges. Earlier in the month (18 August), the Federal Reserve minutes led the market to expect tapering to start between November 2021 and January 2022. At the time, there was a broad-based decline on the news. Whilst tapering is not a surprise, the Fed’s language that valuations are too high and loose monetary policy supporting this is causing instability, was a surprise. Chairman Powell also communicated at the time that rate hikes may start as early as 2022. This, compounded by virus news, was not enough support on the upside and pushed the S&P 500 down in mid-August. The S&P 500 rebounded subsequently, with most of August’s positive return coming in the second half of the month.

Is the Fed making a policy mistake?

We are still concerned as we were last month, that the Fed appears to be excessively dovish and we believe that this is due to fears that signalling of tightening could spook markets. One explanation for the drop in yields generally seen of late is the supply and demand dynamics. By maintaining bond purchases, despite Treasury issuance being down, on a net basis, the Fed is effectively loosening monetary policy. In the face of a strong and growing economy, we believe the Fed should have kept monetary policy the same or even tightened. It also appears that developed markets may be dealing with the Delta variant of COVID-19 better and it will not necessarily derail the economy. It is worth noting that the sharp rise in reverse repos by the Fed result in returning T-Bills back to the economy, however the Fed is simultaneously taking these out of the economy with its bond buying programme. This means the Fed has actually been effectively “tapering” – buying a net smaller number of T-Bills – even while it has not “officially” tapered.

Government actions globally are disrupting markets

Government intervention in the markets has been increasing in many regions. Notably in China, but the US and European governments have also increased their focus on climate change, antitrust and data privacy. This has both pros and cons, but with respect to antitrust, if pursued aggressively, it may constrain business, creating potential headwinds and volatility spikes.

Q2 2021 earnings season review – as good as it gets?

The US earnings season was exceptionally good, but the same could not be said of the market response. Companies with earnings beats had muted price reactions and were not rewarded in some parts of the market, suggesting that a lot of the good news had already been priced in. However, companies with earnings misses were punished severely. This, and the fact that it is hard to find areas of the market which are not overvalued, indicate that cautious positioning is warranted.

Investment Implications

We are maintaining prudent risk exposure as we are concerned that there is a substantial degree of complacency, despite high valuations and the interest rate outlook. As mentioned in our last outlook, we are monitoring any potential catalysts which could cause volatility, including antitrust and geopolitical risks. In August, within equities we removed our overweights to Germany (DAX) and the UK (FTSE 100). We describe the rationale for these changes below:

The DAX and FTSE 100

We moved to neutral on both the DAX and FTSE 100, having been overweight since August 2020 and January 2021, respectively. Our initial thesis on the reflation and cyclical trade has played out to a certain extent. With respect to the FTSE 100, the initial valuation discount gap has narrowed as markets have since rebounded. Both the DAX and FTSE 100 still trade at a discount to the US and MSCI ACWI. However, at the industry, sector and single stock levels, the valuation discount gap seems to be fairly priced, as we do not expect outperformance from those laggard industries such as insurance (a substantial proportion of the financials in the DAX), in addition to a lack of conviction in certain idiosyncratic developments.

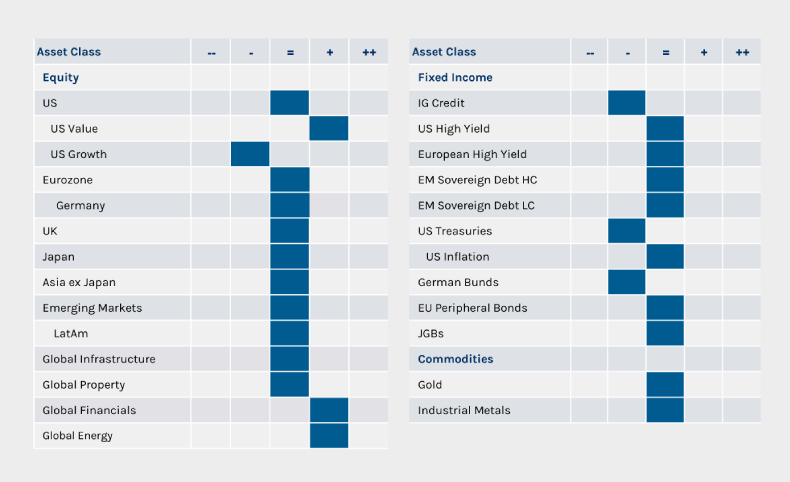

Tactical positioning

We have provided our latest tactical views as follows:

Source: MSIM GBaR team, as of 31 August 2021. For informational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The tactical views expressed above are a broad reflection of our team’s views and implementations, expressed for client communication purposes. The information herein does not contend to address the financial objectives, situation, or specific needs of any individual investor.

RISK CONSIDERATIONS

There is no assurance that the Strategy will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this portfolio. Please be aware that this strategy may be subject to certain additional risks. There is the risk that the Adviser’s asset allocation methodology and assumptions regarding the Underlying Portfolios may be incorrect in light of actual market conditions and the Portfolio may not achieve its investment objective. Share prices also tend to be volatile and there is a significant possibility of loss. The portfolio’s investments in commodity-linked notes involve substantial risks, including risk of loss of a significant portion of their principal value. In addition to commodity risk, they may be subject to additional special risks, such as risk of loss of interest and principal, lack of secondary market and risk of greater volatility, that do not affect traditional equity and debt securities. Currency fluctuations could erase investment gains or add to investment losses. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Equity and foreign securities are generally more volatile than fixed income securities and are subject to currency, political, economic and market risks. Equity values fluctuate in response to activities specific to a company. Stocks of small-capitalization companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Exchange traded funds (ETFs) shares have many of the same risks as direct investments in common stocks or bonds and their market value will fluctuate as the value of the underlying index does. By investing in exchange traded funds ETFs and other Investment Funds, the portfolio absorbs both its own expenses and those of the ETFs and Investment Funds it invests in. Supply and demand for ETFs and Investment Funds may not be correlated to that of the underlying securities. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large negative impact on the portfolio’s performance. A currency forward is a hedging tool that does not involve any upfront payment. The use of leverage may increase volatility in the Portfolio.

Diesen Beitrag teilen: