Janus Henderson: UK money trends improving

UK money trends have firmed since early 2017, suggesting that GDP growth will recover from its soft first-half pace.

02.10.2017 | 10:23 Uhr

(Foto: Simon Ward)

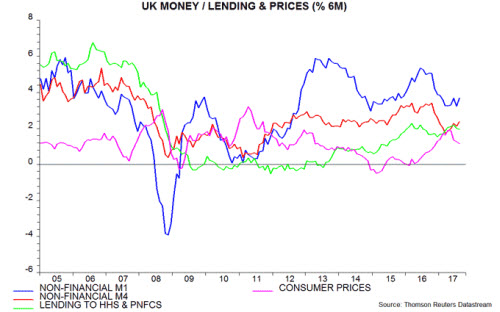

Non-financial M1 – which, as in Euroland, outperforms other monetary aggregates as a leading indicator of the economy – rose by a solid 0.7% in August following a 0.4% July gain. Six-month growth bottomed in March and moved up to 3.7% or 7.5% annualised in August, very close to the Euroland pace – see first chart and previous post.

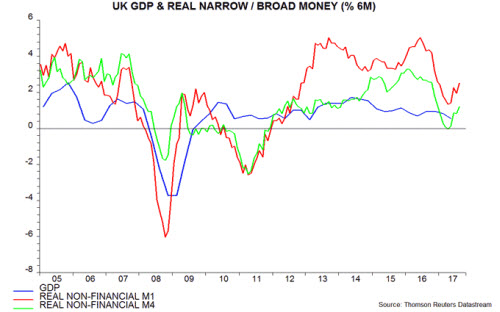

The broader non-financial M4 measure rose by 0.6% in August after 0.1% in July, while its six-month growth increased to 2.4% or 4.8% annualised – the fastest since December 2016.The turnaround in six-month real (i.e. inflation-adjusted) money growth has been more pronounced because the six-month rate of increase of consumer prices (seasonally adjusted), while still elevated, has moderated from a peak in April – first and second charts. Real money growth, however, is lower than over 2014-16, suggesting that GDP expansion will remain subdued by recent standards.

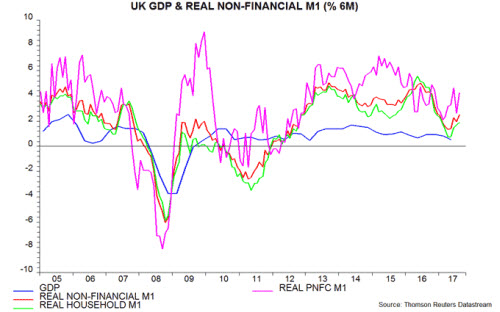

The sectoral split of non-financial M1 supports ae growth is at a respectable level by historical standards, consistent with businesses maintaining expansion plans despite Brexit uncertainty.

The Office for National Statistics today released national accounts revisions through the second quarter of 2017 as well as July services output. GDP growth in the second quarter was unchanged at 0.3% but first-quarter expansion was revised up from 0.2% to 0.3%. Growth estimates for the third and fourth quarters of 2016, however, were lowered, i.e. the slowdown between the second half of 2016 and first half of 2017 was less pronounced than previously reported.

Services output fell by 0.2% in July from June. Incorporating previously-released data on industrial and construction output, July GDP was only 0.1% above the second-quarter level. July services weakness, however, was mostly accounted for by a fall in motion pictures output, which is volatile and now below its recent trend. Assuming a rebound in such output, GDP is probably still on course to meet the Bank of England staff's projection of 0.3% growth in the third quarter.

Diesen Beitrag teilen: