Janus Henderson: Finding income from equities

As the world’s population ages, finding a sustainable income from investment has never been more critical. Fortunately for investors, this coincides with a growing realisation by companies of the importance of a growing and sustainable dividend policy. What is a good approach to finding the best equity income opportunities.

11.08.2017 | 08:25 Uhr

Freelance journalist Heather Farmbrough questions Ben Lofthouse, Portfolio Manager on the Janus Henderson Global Equity Income Team, on his approach to finding the best equity income opportunities.

The need for investors to find sustainable sources of income has arguably never been greater. The world’s population is becoming increasingly old: According to the United Nations, by 2050, for the first time ever, there will be more people globally aged 60 and over than adolescents and youth aged 10-24 years*.

For investors seeking income, while protecting or potentially growing their capital, it is a challenging time. Rates of return on cash and fixed interest are close to their lowest ever levels and investors remain nervous in the face of global political and economic uncertainty. Although inflation in headline terms is low, it is rising, as Ben Lofthouse observes, and this will cut into peoples’ real (post-inflation) investment incomes.

Many people have been worried about equity markets since the global financial crisis but Lofthouse believes the biggest mistake has been not to be invested. “We have all waited for the dip to buy – and in the current environment, that can be harmful for investors who want income, because we are not being paid to wait. So, the problem is, how do you approach finding income?”

Knowing where to look

“The good news,” he continues, “is that companies offering a good level of dividend yield, such as financial services, are not looking expensive and have a good level of income and cash generation. The market is being quite rational, which is not always the case. The worst thing for equity income investors is when everything is expensive.

“Dividend growth is very good on a stock-by-stock basis; last year, mining firms struggled to grow their dividends but this was offset by financial services, technology and housebuilding companies generating good dividends.”

Lofthouse and his colleagues on the 13-strong Janus Henderson Global Equity Income team concentrate on identifying companies around the world with cash flow and dividend reserves that should allow it to go on paying an income to investors. They seek to invest in stocks yielding between 2 and 6 per cent. Their global remit means that they can avoid those corners of the world where local conditions are less favourable – for instance, some utility companies in the UK are currently less attractive than elsewhere due to political pressure to keep price increases down.

Lofthouse is less concerned with making predictions about companies or economies than ensuring that a company has a safety margin if things do not go as planned. He and the team look at factors like balance street strength, dividend pay-out ratio – the percentage of net income that is distributed to shareholders in the form of dividends – and low volatility of earnings. He adds: “Dividend growth tends to be more stable than earnings growth, so at times dividends may not grow as much, but on the flip side, at more difficult times, they tend not to fall as much as earnings.”

Why it pays to pay dividends

More and more companies are recognising that a strong, sustainable and growing dividend policy helps to attract long-term investors who will form a stable shareholder base. In 2016, the world’s listed companies paid out over US$1.15 trillion in dividends, according to the Janus Henderson Global Dividend Index, a long-term study into global dividend trends. As more growth companies are paying out dividends to shareholders, so investors can enjoy an increasingly diversified portfolio that offers income and the potential for growth.

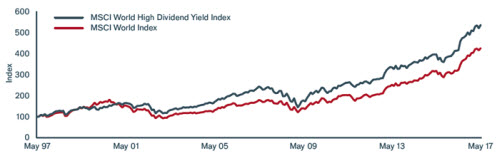

Studies indicate that dividends generate a significant proportion of the total returns from equities over time. The combination of reinvested income along with capital growth has led to the long-term outperformance of higher dividend-paying companies when compared to the wider equity market, as shown in the chart below.

Higher dividend-paying companies have historically outperformed the market

Source: Thomson Reuters Datastream, 31 May 1997 to 31 May 2017, total return indices, in sterling terms, rebased to 100. Past performance is not a guide to future performance. Yields may vary and are not guaranteed.

Being committed to financing a dividend on a continued basis means that companies have to be well-financed and capable of producing a sustained cash flow. There is also evidence that this makes the management team more disciplined when it comes to decision making.

Heather Farmbrough is a freelance financial journalist. She has previously worked for the Financial Times, the BBC and as a fund manager.

*United Nations, World Population Ageing report, 2015

Diesen Beitrag teilen: