NN IP: We reduce spread products to neutral

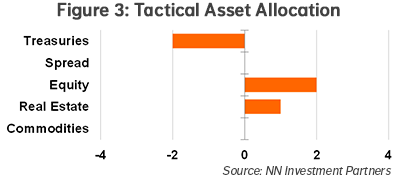

We decided to reduce our stance on fixed income spread products to neutral as valuation in certain categories is high, behavioural dynamics have weakened and liquidity is getting low towards the end of the year.

15.12.2017 | 11:17 Uhr

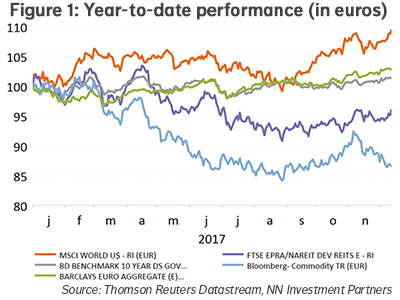

he past week was further characterized by strength in equities and real estate. Fixed income assets were more or less stable. Commodities weakened, led by agriculture and gold. Year-to-date, equities are the best performing asset class delivering almost 10% return (in euros). We made one change in our tactical asset allocation (TAA) by reducing fixed income spread products from a small overweight to neutral.

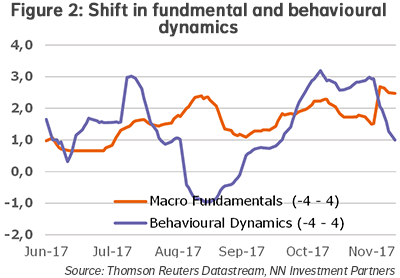

The factors behind the downgrade of spread products are the high valuation in certain categories (like investment grade where spreads have fallen to record-low levels), a weakening of the behavioural dynamics (price momentum, sentiment and flow momentum) and a lack of liquidity around year-end. Overall, even if the corporate fundamentals are strong (reflected in our high fundamental score) and the ECB is providing support through its purchase program, we are late-cycle for this asset class. Shifting Fed expectations and an increase in corporate leverage could become stronger headwinds. For these reasons we decided to take profit on what has been a strong performer year-to-date.

|

|

Diesen Beitrag teilen: