NN IP: Search for yield drives investors back to EMD

Pressure on emerging market debt has eased, despite ongoing market pricing of more Fed rate hikes in 2018. As long as this pricing remains orderly, the risk-reward of the EM carry trade remains attractive.

18.12.2017 | 13:07 Uhr

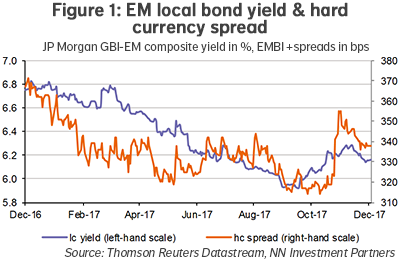

After widening between September and November, EMD rates and spreads have narrowed again in the past weeks. A third to half of the widening has been recovered (see Figure 1). It is not clear what has changed or what concretely explains the more constructive market sentiment. EM endogenous factors have remained supportive throughout the year, even from September through November. They never were the cause of the correction. The only credible explanation for the rising EM yields from mid-September is Fed pricing. Two additional Fed rate hikes have been priced, which has made the EM carry trade look less attractive and caused some modest profit-taking in both local-currency and hard-currency emerging debt.

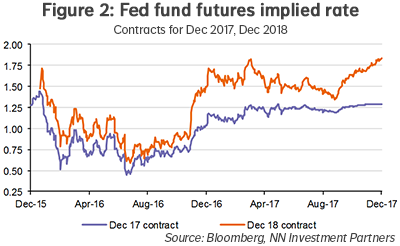

But this does not explain why EMD has regained a substantial part of the lost performance in the past weeks. After all, Fed rate expectations are still continuing to rise steadily (see Figure 2).

The generally held view is that there is not much risk of a more hawkish Fed beyond what markets have been pricing this year. This view is probably what has pulled investors back into EMD. US Treasury yields have not moved much in recent months, which keeps the global search for yield alive. And EMD, compared with other credit categories, still has the juiciest yields. That these yields are not far above multi-decade lows is something that investors in this environment, apparently, find less relevant. The EM carry trade remains in vogue, simply because DM yields are expected to remain low for longer.

The above reasoning should make it clear that the main risk to emerging debt markets is a sudden change in Fed policy stance perception. This could be triggered by several things: the new Fed governor Powell might turn out to sound less dovish than everybody expects, the new Fed board appointments might surprise negatively, or inflation data might rise more than anticipated. These are the risks. The base-case scenario, also for us, looks still OK for EMD. We expect three Fed rate hikes in 2018. The market has priced two. If the market were to price the third hike in a gradual way, with a pace similar to what we have seen in the past months, it would probably not damage EMD sentiment much. In case of a shock, a sudden and quick pricing of more Fed action, EMD could be hit hard. This because positioning in EMD is not light, after years of large inflows.

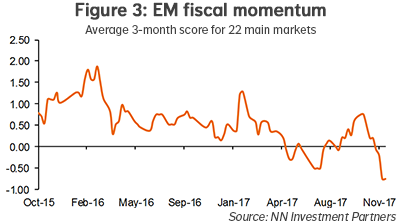

As said earlier, the endogenous EM factors have been positive, already for a while. EM growth momentum remains positive, while external imbalances have narrowed substantially. Inflation continues to be modest, rising a bit from the 2.6% bottom of earlier this year, but unlikely to exceed 4% in the coming quarters. And thanks to the better growth performance and reforms in some countries, fiscal accounts have stopped deteriorating and have even started to improve on an aggregate level. In our EM fiscal momentum indicator (see Figure 3), a negative score means that, on balance, for the 22 main emerging economies, the fiscal deficit is narrowing.

To sum up: EM debt continues to be sustained by a decent macro picture while the global liquidity environment remains a more uncertain factor. We keep our cautious stance, with a small underweight in EMD hard-currency sovereign, primarily because of rising Fed rate expectations.

Diesen Beitrag teilen: