NN IP: Bond yields have stabilized

After a rapid rise in yields at the end of June and early July, government bond markets are in calmer water again – at least for now. The US-German 10-year yield spread has declined significantly this year, to a large extent due to fears of ECB tapering.

10.08.2017 | 13:49 Uhr

Bond yields have stabilized

10-year government bonds in developed markets seem to have settled down a bit after the rapid yield rise at the end of June and beginning of July. The 10-year Bund yield rose by almost 40bp between mid-June and mid-July. Comments by ECB President Mario Draghi triggered the initial spike in yields, but since then we have on balance seen some dovish comments by central bankers, enabling yields to decline somewhat again. Currently the 10-year Bund yield is trading 14bp below the peak again. Nevertheless, we are still about 23bp above the June yield trough in 10-year Bund yields.

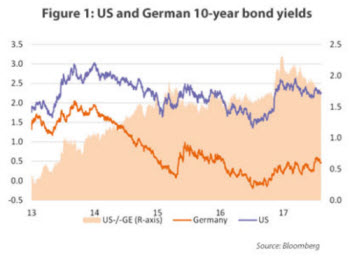

Although the initial trigger of the bond yield spike was centred around the ECB, correlations among DM government bond yields are generally high. Hence, the US 10-year yield rose along with Bund yields, albeit less aggressive (27bp up and currently 13bp below the early July peak). In a somewhat longer time perspective, we have seen the US-German yield spread declining since at least the beginning of the year. The election of Donald Trump initially drove 10-year US Treasury yields sharply up, as a result of sizeable fiscal easing expectations and also increased monetary policy expectations as a result of that (i.e. higher Fed Funds rates). But slowly these expectations have been priced out again.

The combination of the declining trend in US 10-year yields since the beginning of the year and recent ECB tapering fears has driven the US-German 10-year yield spread sharply lower. The spread reached a peak of 235bp on the 27th of December and has declined to about 180bp now. This is roughly equally a result of a US yield drop (-30bp) and a Bund yield rise (+25bp). That having said, the US-German yield spread has not dropped as far as the lows from before Trump’s election. Early November the spread stood at 164bp.

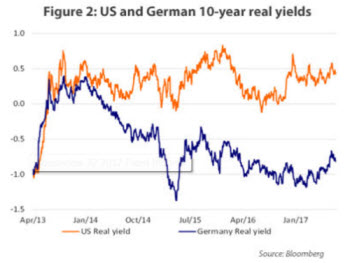

Much of the weakness in US yields and the inability of Bund yields to achieve a sustained upward trend this year has to do with the drop in market-implied long-term inflation expectations. These have dropped in both regions. Figure 2 shows the development of the real yield component of both the 10-year Bund yield and Treasury yield. Like the nominal yield, also the US real yield declined at the beginning of the year, but, contrary to the nominal yield, the real yield stabilized fairly soon. The real Bund yield has been on an increasing trend since the beginning of the year. Falling inflation expectations kept 10-year nominal Bund yields in a range for a long time. Only after the yield rise at the end of June/early July did nominal Bund yields break out of this range. In terms of real yields, the gap between the US and Germany is still large. The gap opened after the Fed had signalled the beginning of the reduction of bond purchases and the market started to focus on sovereign bond purchases by the ECB.

Uncertain outlook for UK yields

The Bank of England did not alter its monetary policy stance last week, despite two members voting for a rate hike (six voted for no change). As a result, the 10-year UK yield declined a bit after the MPC announcement, which was also helped by the growth forecast reduction. The 10-year yield had been rising as several BoE members signalled the possibility of a rate increase. The growth environment does not really signal a need for a rate increase. Even though growth held up fairly well after the Brexit vote, economic momentum has weakened recently. Inflation has risen, but particularly as a result of Sterling depreciation, not as a result of rising wage growth. Although a weaker Sterling has helped the export sector, this source of inflation acceleration is rather a negative factor for real consumer income. In short, this environment should keep bond yields low. That having said, BoE governor Carney signalled in the press conference that he still sees the need for less stimulus over the forecast horizon and implied that the BoE may respond fairly quickly to positive growth surprises. The BoE sees little spare capacity, particularly due to weakness on the supply side. In our view, the current economic conditions do not justify any tightening soon. Although so far it has not, the possibility remains that the continued uncertainty around the Brexit negotiations and outcome may feed into producer and consumer confidence. We see risks to the UK growth outlook on the downside.

Diesen Beitrag teilen: