NN IP: Continued widening US vs German yield spread

Following a dip in market-implied Fed expectations, a recovery is now visible. Germany remains the ultimate safe haven in Europe, but other core countries continue to benefit.

08.06.2018 | 12:21 Uhr

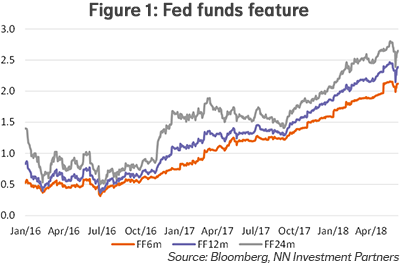

The recent flight to safe government bonds, induced by the Italian political turmoil, pushed both German and US 10-year bond yields down. With Europe at the centre of events, Bund yields fell a bit faster than US yields. That having said, also US Treasuries benefited from the heightened uncertainty. In addition to that, the market has downgraded the expectations for Fed Fund rate hikes. In total one hike was priced out for the coming 6 months and another half a hike for the following 6 months. Figure 1 shows the dip in the market-implied Fed expectations. Although markets have become calmer, Fed expectations are rising again. The graph shows that, so far, Fed rate expectations have risen gradually for a long period now, particularly for the 6-month horizon. There has almost been a continuous trend of slowly rising Fed rate expectations since September last year. In our view, this trend can continue further and we do not see the recent market sentiment induced reduction of market-implied Fed expectations as a trend changer.

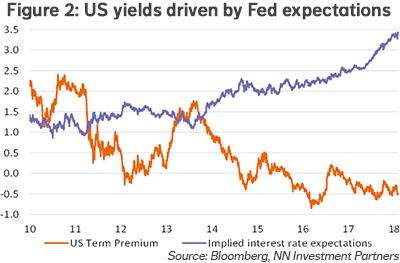

The US term premium is still very low and has recently fallen again. Figure 2 shows the low level of the term premium. When we split the US 10-year yield into the term premium and the implied interest rate expectation development, it is clear interest rate expectations which have driven up the yield. The latter still has a bit of potential to go up further, despite the rise over the past years. However, the term premium has most potential to rise, given the low and still negative level. However, we expect this to be a slow process. The German term premium as shown by our model has remained fairly stable but in negative terrain, which indicates that the fall in the Bund yield can be explained by a fall in interest rate expectations. Indeed, the probability of a rate hike (in the deposit rate) in the meeting of October 2019 has fallen and became much more volatile.

German Bunds key safe haven market in euro area

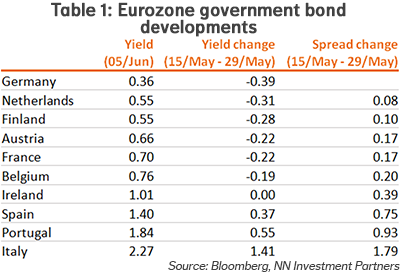

During the flight to safety in late May, we saw safe Euro government bond yields fall and yields of riskier countries rise. Germany was the ultimate beneficiary of the safe haven flows and all Euro members saw their spread rising relative to Germany. Table 1 shows the countries, ranked on yield level (as per 5 June). It then shows the yield change for the period of the bond market turmoil (15-29 May) to see how the different government bond yields responded in the flight to safety environment. The final column shows the evolution of the spread versus Germany. The table shows a 39bp decline for Bunds, and countries in the table up to Belgium benefited from the uncertainty spike as yields on these bonds declined. Ireland was flat, but Spain, Portugal and Italy saw their absolute yield levels increase. As mentioned, all countries saw the spread versus Germany increase, but this was the least for the Netherlands and Finland (with 8-10bp).

The French yield did decline, but at the same time fairly little for a core country. It is also interesting that the CDS spread of French government bonds rose. The spread doubled from 15 to 30bp, where the German and Netherlands’ CDS spreads were largely unchanged. A reason could be that during the selloff, the market was worried about Italian spill-overs to France, possibly through financial linkages, rather than a direct worry about France. The weakness of France has been quite limited. CDS spreads stayed well below last year’s peak (70bp at the time) and in absolute sense France still benefited from safe haven flows, as the absolute level of the 10-year yield declined.

Diesen Beitrag teilen: