Morgan Stanley IM: Welcome to the Brave New World!

April delivered surprising fixed income results. After rising significantly in March, U.S. Treasuries and most other developed market government bond yields fell measurably.

25.05.2021 | 08:21 Uhr

Here you can find the complete article

Despite solid, surprisingly strong economic data (economic surprise indexes continue to be “surprised” with positive economic data), aggressive U.S. fiscal expansion plans, and good news on the pandemic front.

European yields rose significantly, a very unusual occurrence given the behavior of U.S. Treasuries and relatively weak European economic data; and emerging markets were as usual fairly diverse in their performance, driven mostly by local idiosyncratic factors, with external markets outperforming and with local markets supported by the U.S. Treasury rally tailwind.

The rise in European yields was surprising as it bucked the rally in the U.S. and went against the European Central Bank’s (ECB) stepped up Quantitative Easing (QE) buying and dovish communication. On the other hand, negative EU Q1 GDP growth was already well known, while the vaccination program accelerated and optimism prevailed about the ability of Europe to exit lockdown in Q2. German 10-year bonds ended the month near their year highs, with most other Euro markets performing worse.

Contrary to the underperformance of European peripheral bond markets, Euro and U.S. credit markets, investment grade, and high yield, fared well once again, with credit spreads tightening over the month. Outperformance of high yield was notable, with spreads tightening by double digit basis points (bps). Outperformance was supported by the search for yield, growing economic optimism, higher equities and, most importantly, falling real yields. Notably, spread compression between higher- and lower-quality rating buckets dissipated, despite all the good news, with CCC bonds only marginally outperforming BB- and B-rated sectors.

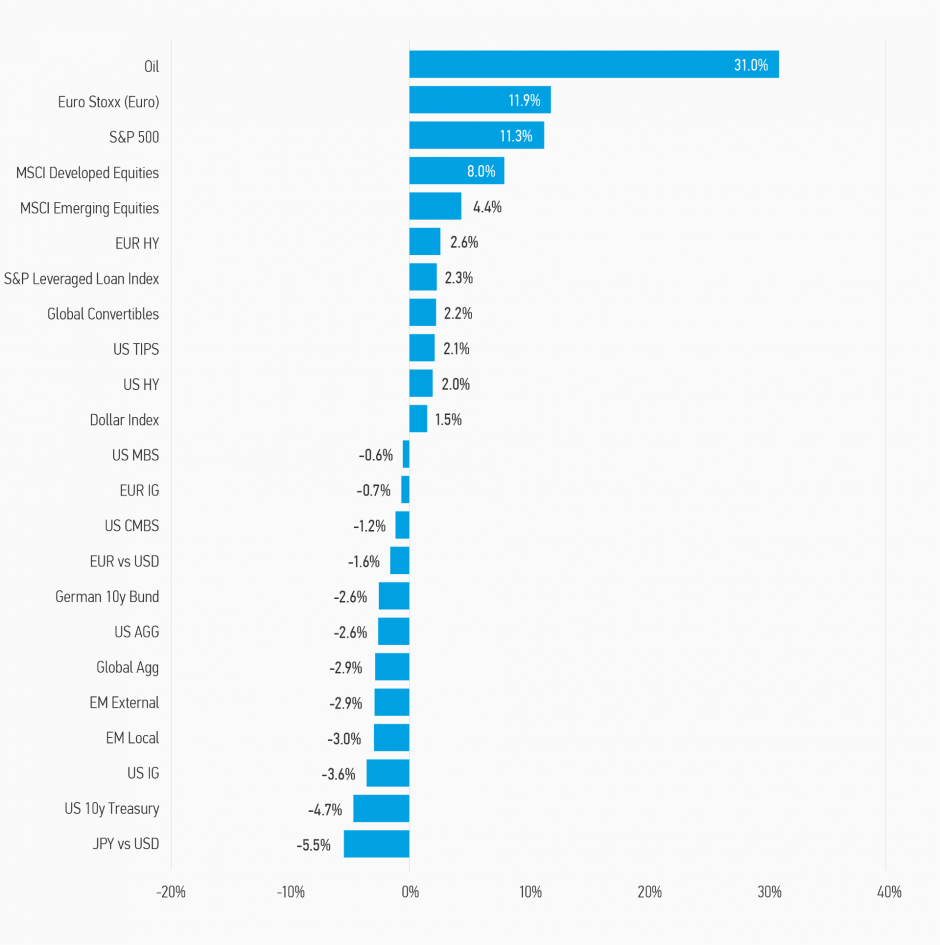

Display 1: Asset Performance Year-to-Date

Note: USD-based performance. Source: Bloomberg. Data as of April 30, 2021. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See below for index definitions.

The key driver for lower yields and stronger risk markets was a market recalibration of likely Fed policy. During April, the Fed continued to aggressively push its dovish narrative, laying out the case for no change in either QE or rates until late 2023 at the earliest. Given the market’s opposite view in March, when it had priced the Fed to be raising rates in 2022, there was ample room for yields to fall if the market decided to move closer to the Fed narrative, which it did. This led to a fall in real yields matching the fall in nominal yields, a testament to the Fed’s ability to convince the financial markets that it was serious about keeping real yields low in support of a “boomy” economy in order to get unemployment back to pre-pandemic levels with, of course, the requisite equitable distribution across population cohorts.

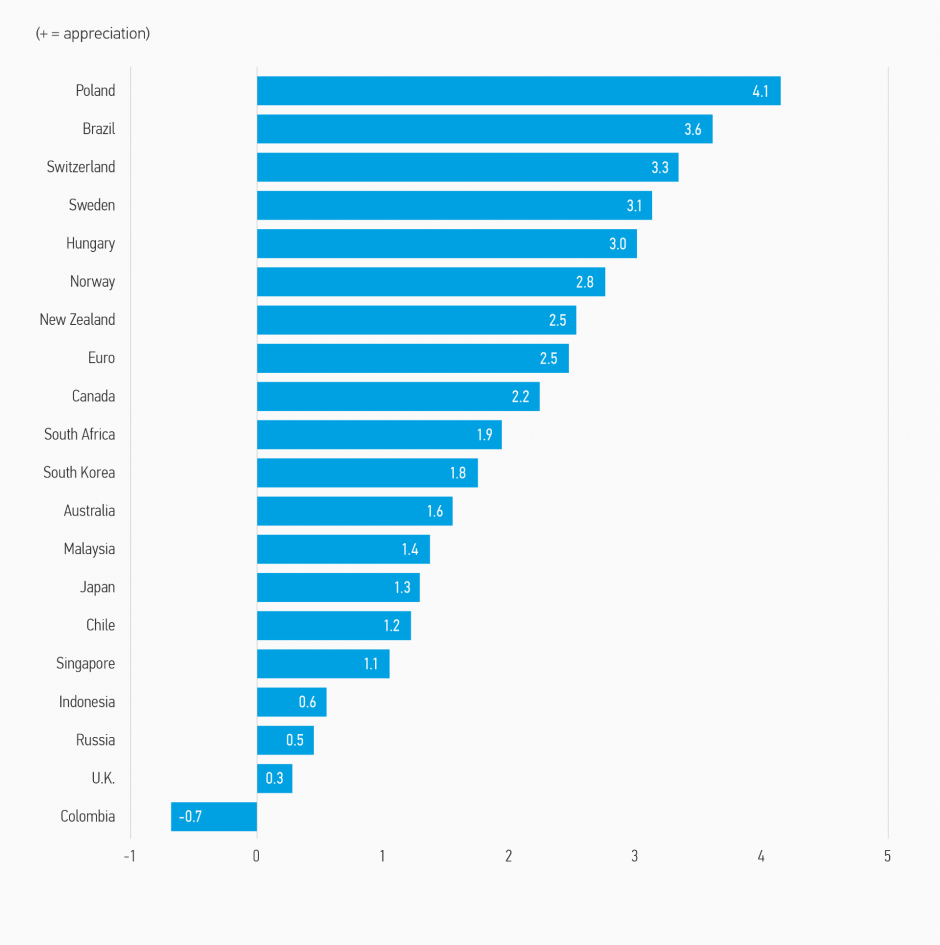

Display 2: Currency Monthly Changes Versus U.S. Dollar

Note: Positive change means appreciation of the currency against the USD. Source: Bloomberg. Data as of April 30, 2021.

A renewed confidence in the Fed’s willingness and ability to keep nominal, but most importantly real, yields low has important implications for investment strategy. While yields are likely to go higher medium term (i.e., the Fed and fiscal policy will likely succeed in lowering unemployment and raising inflation and growth), the near-term outlook is a lot murkier. In fact, we would not be surprised if government bond yields as well as credit spreads settle into a range with little momentum either way. While investors are not well compensated for taking duration/ interest rate risk currently, volatility in rates is not likely to be an impediment to returns in the months ahead: Low yields will! We remain positioned to benefit from credit-sensitive assets outperforming during the upcoming anticipated economic boom.

Display 3: Major Monthly Changes in 10-Year Yields and Spreads

Source: Bloomberg, JPMorgan. Data as of April 30, 2021.

Fixed Income Outlook

In April, the markets saw continued support for risk assets, with additional fiscal announcements in the U.S. and continued monetary support from the ECB and the Fed, both maintaining it was too early to be considering tapering. Through the month, there was improving economic data with coronavirus cases falling in developed markets and economies focused on reopening. This was further aided by the rally in commodity prices, driven by the containment of oil supply and the strengthening in demand for metals to support infrastructure spending plans.

While the performance of U.S. Treasuries (and the government bonds of other English-speaking countries) was a bit of a surprise given the data/information flow, valuations and market technicals were positioned the other way (i.e., for yields to fall). At the beginning of the month, the market was pricing in a relatively aggressive Fed tightening cycle, and with the market positioned commensurately short interest rate risk, maybe it was not too surprising we had a counter-trend rally. But, there is more to it than that. The Fed is on a mission to communicate/ educate its new monetary operating strategy, Flexible Average Inflation Targeting (FAIT). In March, markets questioned whether or not the Fed would actually implement it. By the end of April, the market has moved its forecasts towards the Fed’s view, even if it is not entirely convinced, given its obsession with near term inflation risks. Contrary to our worries in early April that the market would price in even earlier rate hikes, undermining growth optimism, the opposite occurred. Potential bear market averted. Keep an eye on real yields. They remain a key indicator of value and risk premium.

Looking further out, we see inflation concerns as overdone. This does not mean inflation will not be higher in 18 months or that the Fed will not be talking about or even raising rates. It does mean, as of now, these pressures are likely to be relatively contained, or transitory in nature. Analysts are forecasting very high year-over-year inflation prints, on both headline and core inflation measures, over the rest of the year. But these are not expected to persist, as they are driven by base effects (many prices, especially for commodities, collapsed last year but have now normalized and won’t rebound to the same extent again), the reversal of temporary tax cuts and other anomalies like changes in the timing of seasonal sales. But with employment and labor market participation rates still well below pre-pandemic levels there is likely to be a long road before we see wage pressures materialize that would jeopardize the Fed’s inflation mandate. Admittedly, there is a lot of labor market churn going on as workers change jobs, moving from declining sectors to growing ones, which could put upward pressure on wages and appear inflationary. However, we would advise caution and not read too much into this. What is happening is natural and part of the dynamic capitalist process and is not inherently inflationary. As the Fed has communicated, we are likely to see a temporary rise in inflation due to the economic healing process. But, this is transitory, not “troubling,” in their parlance. This seems a reasonable view to have at the moment but needs careful watching.

Importantly, with the Fed desiring a higher inflation rate (remember FAIT), we do not see the usual cyclical upswing in Fed-induced real interest rates (the usual cause of bear markets in fixed income) happening for a long time. While cyclical strength, combined with easy monetary and fiscal policy, will keep the economy strong, underlying structural forces (digitalization, productivity gains) are likely to help contain any inflationary impulse that does occur. On the other hand, it is also unlikely U.S. yields, or for that matter global yields, fall meaningfully from current levels absent a large new shock, such as a resurgence in the pandemic or financial incident. Yields are likely to remain range bound for now, good for risky assets, good for falling volatility.

In terms of strategy, the combination of falling real yields, healthy household balance sheets, fiscal expansion, strong, but maybe moderating growth, gently rising inflation expectations, and a rapidly healing labor market augers well for cyclical assets. We remain constructive on credit, both corporate and securitized housing, despite somewhat lofty valuations by historical standards, and hold lower-than-average credit quality, and are overweight external emerging markets. However, the spread or return compression between higher and lower rated high yield bonds looks nearly complete. Down-in-quality moves into CCC rated bonds are likely to lead to much smaller capital gains opportunities going forward. That said, the economic environment is so good, it is also hard to see default risks increasing in the next 12 months, so remaining overweight lower quality bonds still makes sense to us in order to capture the additional yield potential. Significant risk taking should be confined to idiosyncratic opportunities where risk premiums are elevated. The danger, of course, is that this usually only occurs when something goes wrong and risks have risen! Good research; bottom-up analysis remains key. Caveat emptor.

MONTHLY REVIEW

Developed Market (DM) Rate/Foreign Currency (FX)

In April, most developed-market government bond yields fell, or plateaued, in spite of continued strong economic data. Mass vaccinations forged ahead and economic reopenings in several developed market countries began as coronavirus cases remained at manageable levels. After lagging the U.S. and U.K.’s initial vaccine rollout, Europe has begun to accelerate its rate of vaccination, and coronavirus cases appear to be declining after additional lockdowns were imposed in the region.

OUTLOOK

Recent data and information flow continue toimply 2021

economic growth will be very strong. Falling infection rates, vaccine

rollouts, strong efficacy results, massive U.S. fiscal stimulus, high

savings rates, economic reopenings and dovish central banks are

buttressing a very positive outlook for economies. With the $1.9

trillion support/stimulus package being implemented, U.S. fiscal policy

is on a trajectory to significantly improve 2021/2022 growth globally,

not just in the U.S.

While we do not expect a dramatic sell-off in government bond markets, we think the risk is skewed to yields rising, as valuations are still rich relative to history and there is potential for additional term premia to be priced across the yield curve. Central banks in general have not expressed significant concern about the rise in yields, presumably because it has not yet led to an unwarranted tightening of financial conditions. We expect significantly higher inflation in 2021, but for it to be transitory, and for central banks not to respond to it.

MONTHLY REVIEW

Emerging Market (EM) Rate/FX

EM debt posted positive returns in April across the board, i.e., in both local and hard currency bonds. From a sector perspective, companies in Oil & Gas, Television, Media and Telecom, Metals & Mining, Industrial led the market, while those in the Financial, Consumer, Utilities, Infrastructure, Pulp and Paper underperformed.

OUTLOOK

We remain constructive on EM Fixed Income assets on the back of

steady monetary policy accommodation and rapid progress on vaccine

rollouts in the developed world, and looser fiscal policy in the U.S.

boosting commodity prices and growth in the rest of the world. The

slower deployment of vaccines in several EM countries makes them more

vulnerable to new virus strains, leading to tighter lockdown measures in

the near term, weighing on growth and already fragile fiscal accounts.

Potential disappointments of optimistic expectations about Biden

policies vis-à-vis growth and trade could negatively impact the

performance of growth-sensitive assets. Finally, reemergence of

geopolitical risks (as evidenced by recent escalation in U.S.-Russia and

U.S.-China tensions) could also disrupt our relatively benign outlook

for EM.

MONTHLY REVIEW

Credit

Credit spreads tightened over the month across both Euro and U.S. Investment Grade (IG). Credit markets also benefitted from higher equities and lower volatility in the month. Sector and corporate news in the month was dominated by Q1 earnings reports, where results in most cases exceeded increased expectations. Spreads also tightened due to improving economic data, with coronavirus cases falling in developed markets and economies focused on reopening. This was further aided by the rally in commodity prices, driven by the containment of oil supply and the strengthening in demand for metals to support infrastructure spending plans.

OUTLOOK

We see credit being supported by expectations of an economic rebound in 2021 as well as continued positive support from monetary and fiscal policy as rates stay accommodative and QE strong. We expect continued strength with a potential price overshoot in the first half of the year, with a correction in the second half as M&A increases, questions are asked over the level of QE in 2022, and as fear of missing out buying activity turns to fear of owning valuations that look historically expensive.

MONTHLY REVIEW

Securitized Products

Interest rates stabilized in April and spreads continued to tighten on both U.S. agency mortgage-backed securities (MBS) and credit oriented securitized products. U.S. non-agency residential mortgage-backed securities (RMBS) and Commercial mortgage-backed securities (CMBS) spreads were largely unchanged in April. However, U.S. asset-backed securities (ABS) spreads continued to grind tighter as did European RMBS spreads, which tightened as both new issuance and secondary trading volumes were low.

OUTLOOK

We continue to have a positive outlook on residential and consumer credit sectors and a more cautious view on CMBS. We believe agency MBS now looks expensive on a historical level basis and a risk-adjusted basis. U.S. non-agency RMBS have largely recovered to pre-pandemic levels, but still offer reasonably attractive relative value. U.S. ABS continues to have mixed outlook for 2021, with traditional consumer ABS (credit cards and auto loans) looking relatively expensive while the more COVID-challenged ABS sectors continue to offer much greater recovery potential. CMBS valuations remain very idiosyncratic, with some attractive value opportunities and some potential credit problems as well.

Risk Considerations

Diversification neither assures a profit nor guarantees against loss in a declining market.

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in a portfolio. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Certain U.S. government securities purchased by the strategy, such as those issued by Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. It is possible that these issuers will not have the funds to meet their payment obligations in the future. Public bank loans are subject to liquidity risk and the credit risks of lower-rated securities. High-yield securities (junk bonds) are lower-rated securities that may have a higher degree of credit and liquidity risk. Sovereign debt securities are subject to default risk. Mortgage- and asset-backed securities are sensitive to early prepayment risk and a higher risk of default, and may be hard to value and difficult to sell (liquidity risk). They are also subject to credit, market and interest rate risks. The currency market is highly volatile. Prices in these markets are influenced by, among other things, changing supply and demand for a particular currency; trade; fiscal, money and domestic or foreign exchange control programs and policies; and changes in domestic and foreign interest rates. Investments in foreign markets entail special risks such as currency, political, economic and market risks. The risks of investing in emerging market countries are greater than the risks generally associated with foreign investments. Derivative instruments may disproportionately increase losses and have a significant impact on performance. They also may be subject to counterparty, liquidity, valuation, and correlation and market risks. Restricted and illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Due to the possibility that prepayments will alter the cash flows on collateralized mortgage obligations (CMOs), it is not possible to determine in advance their final maturity date or average life. In addition, if the collateral securing the CMOs or any third-party guarantees are insufficient to make payments, the portfolio could sustain a loss.

Diesen Beitrag teilen: