Morgan Stanley IM: Wating for Godot, Fixed Income Edition

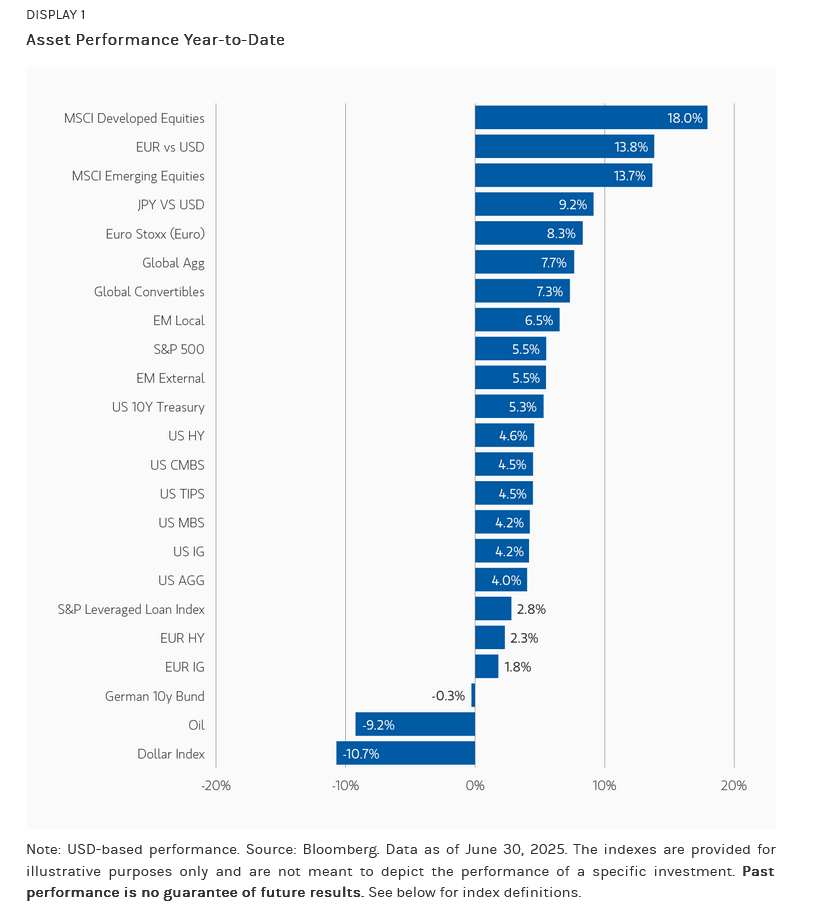

June was marked by a continuation of the risk-on sentiment that began earlier in the quarter, supported by resilient economic data, a modest decline in volatility, and easing geopolitical tension following the brief conflict between Israel and Iran.

17.07.2025 | 05:30 Uhr

Here you can find the complete article

Developed market government bond yields were mixed: U.S. 10-year yields fell 17 basis points (bps) to 4.23%, while German Bund yields rose 10 bps amid hawkish ECB signals and increased fiscal spending. The U.S. dollar weakened 2.1% against a basket of currencies, with all G10 currencies except the yen appreciating, and Emerging Market (EM) currencies broadly outperforming.

Emerging market debt posted strong returns, buoyed by a weaker dollar, positive fund flows, and tightening spreads across both sovereign and corporate credit. Local rates outperformed global peers, and geopolitical risks had limited lasting impact on market sentiment. South Africa, Brazil, and Indonesia saw notable yield declines, while countries like Hungary and South Korea experienced modest increases.

Corporate credit rallied across the board. U.S. and European high yield outperformed investment grade, driven by strong technicals, solid corporate fundamentals, and declining Treasury yields. Euro Investment Grade (IG) led within investment grade, supported by robust demand and favorable issuance dynamics. Securitized products also performed well, with agency MBS spreads tightening by 8 bps and non-agency Residential Mortgage-Backed Securities (RMBS) and Commercial MBS (CMBS) spreads narrowing amid strong issuance and resilient credit fundamentals.

Looking ahead, markets are pricing in two to three Fed rate cuts by year-end, though inflationary risks from tariffs and fiscal expansion remain a key uncertainty. We remain constructive on duration in developed markets, favor steepening exposures in the U.S. and Europe, and continue to see value in EM debt and securitized credit, particularly agency MBS and residential mortgage-backed securities.

Diesen Beitrag teilen: