Morgan Stanley IM: How Big Are the Waves?

October was an unusual month. Waves were coming from all directions and financial markets struggled to understand and react to all the possible scenarios and permutations.

24.11.2020 | 08:00 Uhr

Here you can find the complete article

On one hand, bond yields rose significantly in the U.S. but fell in most other countries. In fact, U.S. Treasury yields rose the most in one month since September 2018. This is unusual: government bond yields across developed economies generally move in the same direction or at least do not diverge as dramatically as they did in October. We think this happened for two reasons: the probability of a Blue Wave (a sweep of the U.S. government by the Democratic Party) rose significantly; and the new COVID-19 wave hit and hit Europe particularly hard.

While U.S. economic fortunes were generally considered to be positively affected by the net effect of these two forces, Europe’s economic outlook dimmed. Not too surprisingly, despite equity market weakness, hope of a large U.S. fiscal package (in a Blue Wave scenario) and trust that the Fed would continue to provide unwavering accommodation supported credit and mortgage markets, whose spreads tightened. On the other hand, equities were hit by worries about capital gains tax increases and a deterioration in the regulatory environment. While in Europe, the effect of the COVID-19 wave was distinctly negative both in terms of growth and inflation.

Despite the likely end of U.S. electoral uncertainty, two big risks remain for the economy and bond markets. The first is the reduced likelihood of aggressive fiscal stimulus in 2021. There will be some, but will it be enough to keep economic growth strong? Fiscal policy is likely to net tighten next year even with the planned stimulus (not Blue Wave stimulus). This would follow the patterns of recent business cycles where fiscal policy was tightened prematurely, undercutting the recovery in growth, employment and inflation. Not a catastrophic outcome but not great either. Second is extended lockdown/restrictions due to a renewed wave of COVID-19 infections. Hopefully, the European one will be short (it is so far not that extensive) and not too damaging, although the risk is that it exacerbates the strain health sectors are already under in the northern hemisphere from winter. We continue to believe any U.S. restrictions will be local and not too damaging, clearly dependent on health care systems not being overwhelmed.

The good news is that monetary policy makers are still on the case. While the Fed has gone relatively quiet (not surprising given their big news in September and the November election) other central banks have been responding. Indeed, from the Fed leading the “easing” charge, leadership is shifting elsewhere. The ECB is expected to add to stimulus in December; the Bank of England expanded its QE programme in November; and the Reserve Bank of Australia lowered its yield targets and significantly expanded QE. These monetary policy backstops will only increase, if economic data disappoints for whatever reason, and, with inflation weak and U.S. fiscal policy unlikely to be on an overly aggressive trajectory into 2021, the Fed is likely to also join the party and increase accommodation further. And, of course, we cannot count on better therapeutics and vaccines which could significantly reduce health risks and boost the economy back to normal.

We remain comfortable with a modestly long risk position in portfolios. Looking into 2021, we still see economies improving as the economic data continue to come in better than expected, and assuming modest COVID-19 lockdowns. We remain positioned to benefit from riskier fixed income assets outperforming and government bond yields moving sideways.

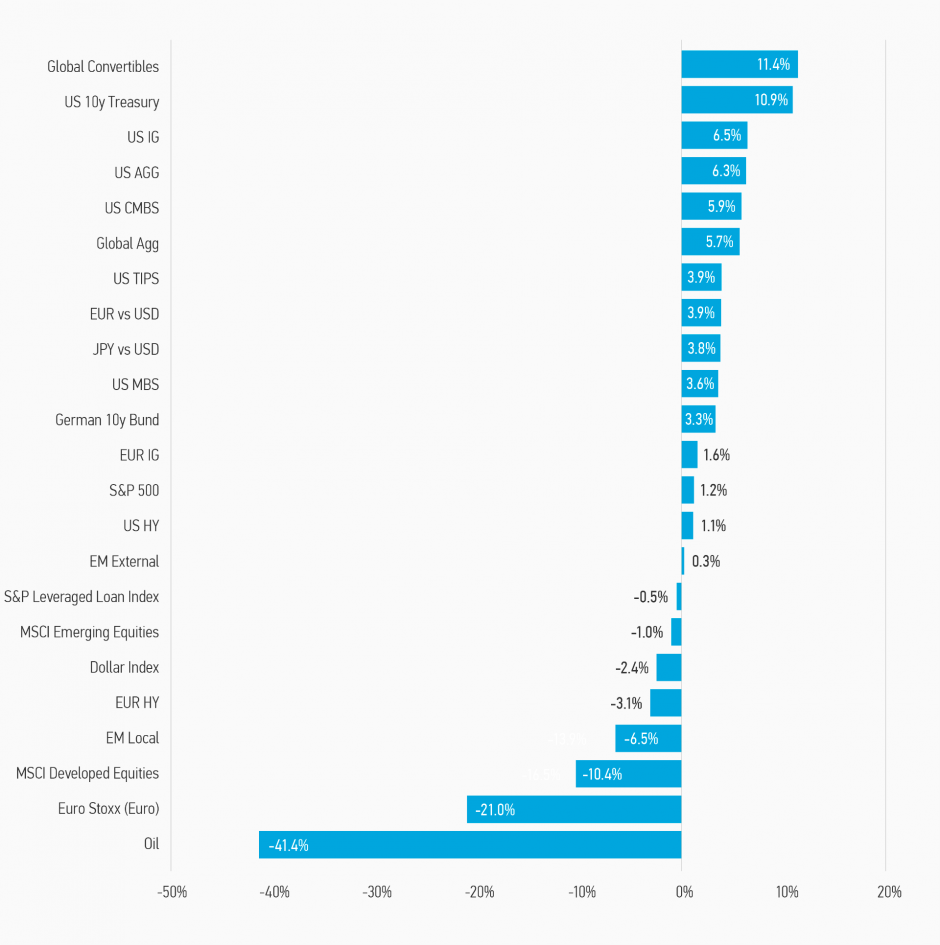

Display 1: Asset Performance Year-to-Date

Note: USD-based performance. Source: Bloomberg. Data as of October 31, 2020. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See below for index definitions.

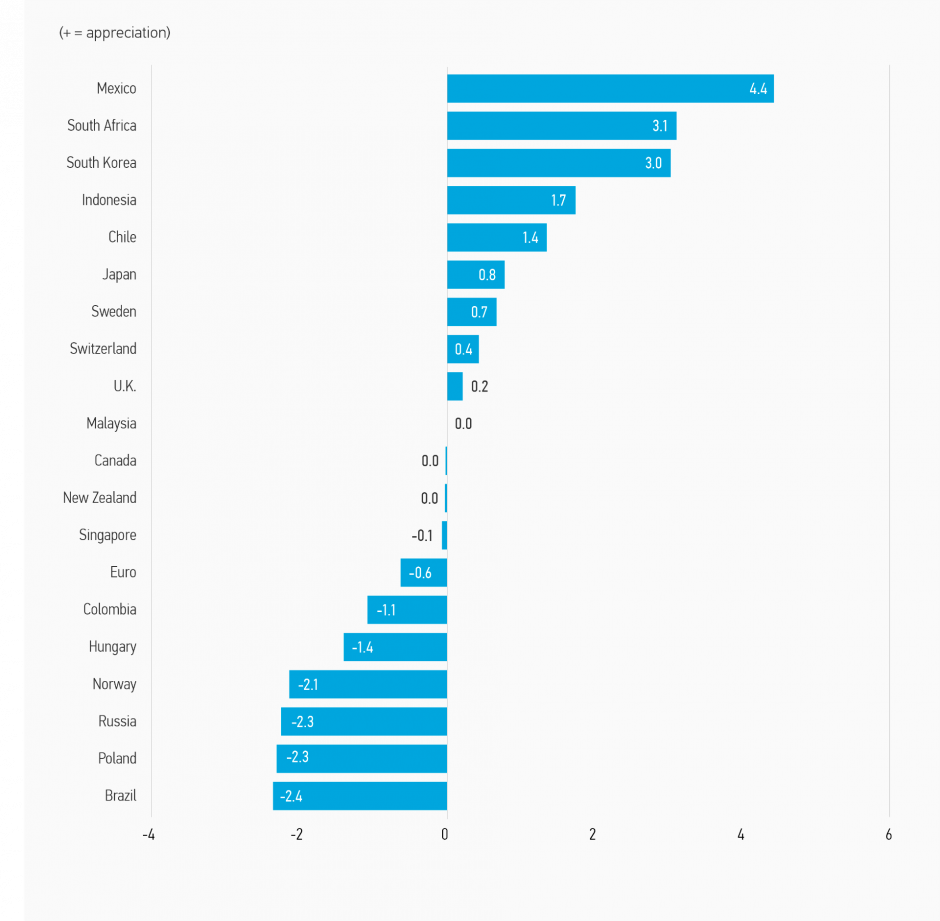

Display 2: Currency Monthly Changes Versus USD

Note: Positive change means appreciation of the currency against the USD. Source: Bloomberg. Data as of October 31, 2020.

Display 3: Major Monthly Changes in 10-Year Yields and Spreads

Source: Bloomberg, JPMorgan. Data as of October 31, 2020.

Fixed Income Outlook

The U.S. election has come but not gone. As of now it looks like a split government: Democrats in the White House and House; Republicans in the Senate (probably). If this indeed holds, and we might not know for sure until the state of Georgia has its Senate runoff in January, we are getting something financial markets would seem to like: split government and no Blue Wave. But a second, COVID-19 wave has appeared and intensified. New infections are rising rapidly, reaching a new global high, and while hospitalizations and mortality rates remain well below previous highs, they are increasing. This might necessitate exactly what the now unlikely Blue Wave will not deliver: a big fiscal stimulus package. Again, the outlook comes down to the course of the pandemic and how policymakers respond.

Economic risks have risen. Fiscal policy action in the U.S. is unlikely to be as large as the package previously under negotiation between Congress and the White House. Policy gridlock is possible. But, these risks still appear manageable. First, the U.S. is not locking down, at least as of yet. And, if a more stringent lockdown becomes necessary, it is likely to be the catalyst for another large bipartisan fiscal support package. Second, a vaccine looks increasingly likely to be approved soon, significantly improving the economic outlook for 2021 and beyond. Third, European economic weakness should not significantly impact the rest of the world. It is service sector led and designed to work/end before the holidays and thus likely to be relatively short. Fourth, we have to keep in mind that Asia is in a very good place with regard to the virus and the economic outlook. China, in particular, looks increasingly likely to return to “normal” by early next year. This will be supportive for the global economy and help further cushion the impact of a European downturn. Another bit of good news is that the southern hemisphere is moving into summer which should reduce health risks. This should help Latin America in particular. Virus cases are already on the decline in Brazil, Chile and Peru. Of course, a big risk, which cannot be dismissed, is that the type of lockdowns that are happening in Europe will happen in the U.S. and elsewhere.

Despite all the noise around the U.S. election and rising COVID-19 cases, we still remain medium term optimistic and are not changing our investment outlook. Economic growth in the fourth quarter is likely to be weaker than expected, but we expect a bigger bounce in 2021. A modestly bullish position with respect to credit and emerging markets looks sensible with a fairly neutral bias to interest rate risk (favoring countries running easiest monetary policies or those with the most commitment to ease further). Emerging markets in particular could be well placed to outperform in months ahead as they have not experienced a second COVID-19 wave (as they never exited the first!); China and seasonality are supportive; and a Democratic administration, if confirmed the winner, will be more internationalist and less anti-globalist.

This outlook is predicated on the idea that monetary policy globally will continue on its easing trajectory (pandemic is more deflationary than inflationary), keeping liquidity abundant and government yields low AND fiscal policymakers will ease further, although it may take some bad news on the COVID-19 front to act decisively. Moreover, the heavy sectoral impact of the pandemic strongly supports the case for further significant fiscal support. That said, we remain discriminating in our choice of assets and continue try to avoid the two tails of the risk spectrum: very high quality/low yielders and very low quality/high yielders, in both credit, securitized and sovereign markets.

Developed Market (DM) Rate/Foreign Currency (FX)

Monthly Review

In October, markets were in a “wait and see mode” as the U.S. election quickly approached, while a pickup in coronavirus cases was seen across the globe. Europe reimposed strict lockdowns in some countries to combat the spike in cases. Government bond yields rose in the U.S., Australia, Canada and New Zealand and generally fell across Europe. The 10-year Treasury yield increased by 19 basis points, which is the biggest increase seen since September 2018.

Outlook

We expect central banks to extend accommodation further as economic risks remain skewed to the downside and inflation is no impediment to easing further, or is so low it compels central banks to ease. As a result, we expect government bond yields to remain at low levels, although there is potential for some differentiation as economic performance varies. 2020 was about policy that supported solvency to reduce the risk of longer-lasting credit impairment for corporations (QE) and individuals. Credit impairment needed to be addressed first because it would reduce the potential for stronger and faster recovery. 2021 is about stimulus and recovery. What was unknown was how this stimulus would be applied and by whom.

Emerging Market (EM) Rate/FX

Monthly Review

Risk appetite returned during the month, given continued expectations of monetary and fiscal support for markets, expectations of a market friendly outcome to the U.S. elections, and better-than-expected Q3 corporate earnings. From a broad market perspective, Venezuela, Cote d’Ivoire, Kenya, Ghana and Belize were the best performers in October, while bonds in Sri Lanka, Argentina, Suriname, Zambia, Lebanon and Costa Rica were the worst performers. From a sector perspective, companies in the pulp and paper, metals & mining, industrial and real estate segments led the market, while those in the oil & gas, transport, consumer, and infrastructure business outperformed.

Outlook

We remain cautiously optimistic on EM debt in the near term on the back of continued global monetary support and prospects of further fiscal policy accommodation. The U.S. presidential elections will play a major role in determining asset performance in the weeks ahead. However, stricter lockdown measures as the ones imposed in several countries in Europe, and increased odds that similar measures could be announced in the U.S. and other countries, could jeopardize our relatively constructive view on EM assets.

Credit

Monthly Review

Spreads were tighter on the month. The key drivers were continued expectations of monetary and fiscal support for markets as evidenced by ECB commentary, expectations of a Biden victory in the U.S. elections coupled with a possible “Blue Wave”, positive Q3 corporate reporting relative to lowered expectations and continued strong demand for IG credit (including ECB QE purchases) in a month when supply slowed.

Market Outlook

Looking forward, we see the remainder of the year as characterized by lower liquidity with market direction driven by the latest headline. Our base case reflects the consensus view that coronavirus is transitory and monetary policy is credit risk friendly. Overall, we expect monetary and fiscal stimulus to remain in place well into 2021, likely driving spreads tighter in the medium term.

Securitized Products

Monthly Review

U.S. Agency mortgage-backed securities (MBS) performed well in October and securitized credit spreads continued to grind tighter in October. Mortgage prepayment speeds showed no signs of slowing as mortgage rates again hit new historic low again in October. U.S. asset-backed securities (ABS) spreads were generally unchanged or tighter. U.S. commercial mortgage-backed securities (CMBS) spreads tightened another 5-10 basis points in October. European RMBS spreads were largely unchanged in October, but have almost fully recovered to pre-COVID-19 levels.

Outlook

Agency MBS now look marginally expensive, but should remain a relative safe haven given the expected Fed’s purchases. 2.0 non-agency MBS look expensive, but attractive opportunities exist in other less traditional RMBS. We expect the U.S. housing market to remain stable and non-agency RMBS to continue to perform relatively well from a credit perspective. We expect auto loans, credit cards and consumer loans to continue to perform reasonably well. Delinquencies could rise if some of the stimulus measures are not extended or if further economic shutdowns develop. There is material upside to aircraft and small business loan ABS in an economic recovery. The outlook remains positive for multi-family, office and logistics CMBS, but we have concerns about properties in large cities. Hotel and shopping center CMBS are likely to remain very stressed. European markets are experiencing similar sector-specific performance dynamics to the U.S., but should remain well supported by the ECB’s €1.35 trillion PEPP fund.

RISK CONSIDERATIONS

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in a portfolio. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Certain U.S. government securities purchased by the strategy, such as those issued by Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. It is possible that these issuers will not have the funds to meet their payment obligations in the future. Public bank loans are subject to liquidity risk and the credit risks of lower-rated securities. High-yield securities (junk bonds) are lower-rated securities that may have a higher degree of credit and liquidity risk. Sovereign debt securities are subject to default risk. Mortgage- and asset-backed securities are sensitive to early prepayment risk and a higher risk of default, and may be hard to value and difficult to sell (liquidity risk). They are also subject to credit, market and interest rate risks. The currency market is highly volatile. Prices in these markets are influenced by, among other things, changing supply and demand for a particular currency; trade; fiscal, money and domestic or foreign exchange control programs and policies; and changes in domestic and foreign interest rates. Investments in foreign markets entail special risks such as currency, political, economic and market risks. The risks of investing in emerging market countries are greater than the risks generally associated with foreign investments. Derivative instruments may disproportionately increase losses and have a significant impact on performance. They also may be subject to counterparty, liquidity, valuation, correlation and market risks. Restricted and illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Due to the possibility that prepayments will alter the cash flows on collateralized mortgage obligations (CMOs), it is not possible to determine in advance their final maturity date or average life. In addition, if the collateral securing the CMOs or any third-party guarantees are insufficient to make payments, the portfolio could sustain a loss.

Diesen Beitrag teilen: