Morgan Stanley: Coronavirus - Positioning for tactical opportunities

Having increased the equity allocation in our portfolios in late May, we have also identified a number of tactical opportunities in the fixed income space. In this week’s update we discuss each investment idea which led to these position changes:

08.06.2020 | 09:14 Uhr

European Peripheral Bonds

Although the outlook for Europe remains uncertain, the news of a EUR 750bn recovery fund proposed by the European Union, following earlier proposals by France and Germany, is an important development. The recovery fund is likely to allocate resources to countries hardest hit by the coronavirus pandemic, and would directly address the asymmetric hit to growth that was one of the factors driving our move to an underweight position in March. Whilst the criteria for allocating the funds to individual countries are yet to be determined, exposure to tourism could potentially guide the allocations, given this is an area particularly hard hit. If this is the case, peripherals are likely to benefit given their high exposure to the sector.

We are fairly confident of a positive outcome, despite a pushback by the “frugal four”, Austria, Denmark, the Netherlands and Sweden, who issued a counter-proposal, which included the provision of loans rather than grants. Whilst the ECB has provided a strong short-term commitment to support markets, once the proposed recovery plan is finalised it could offer the longer-term support needed. In the meantime, their measures such as the ECB purchase programmes should support spreads during this transition towards stronger fiscal support for peripheral economies.

Whilst there may be some volatility during the negotiation phase, a positive outcome should reduce downside risk materially and warrants a removal of our underweight and move to a neutral positioning. The markets rallied on the news of the recovery fund, however although recent performance suggests that sentiment has improved, it is not exuberant. Moreover, whilst spreads on Spanish and Italian bonds have tightened to an extent, they remain cheap.

There are also further dynamics to consider. The recovery fund would make the EU the second-largest AAA issuer in Europe after Germany, creating a new supply of AAA-rated bonds at yields more attractive than core country yields, so they could attract investors in search of better carry. This would be a big game changer, with potential implications for European core countries which could see a reduction in demand. A ramp-up in the higher-rated debt universe in the euro area may not lead to outright selling of Bund holdings, but may lead to less demand for them in the future.

Emerging Market Local Currency (EM LC) Sovereign Debt

Emerging Market Hard Currency (EM HC) Sovereign Debt

There are a number of developments which justify an upgrade to our signal on EM LC Sovereign Debt from underweight to neutral and EM HC Sovereign Debt from neutral to overweight. Whilst fundamentals indicate that global growth is likely to be weak in 2020, we believe that the worst is behind us. A lot of the negative factors have to a certain extent been priced into EM Sovereign Debt, including slower global growth, the fall in oil prices, weakness in economic fundamentals (current account, FX reserves and debt), the impact of COVID-19 and downgrades.

With the expectation that the recovery of the global economy and confidence are very gradual, and in the absence of a second wave of the virus hitting growth, we anticipate that EM Sovereign Debt spreads will tighten towards the end of 2020. Backtests show that EM Sovereign Debt tends to experience sharp drawdowns within a short period, but is also often spared from second waves.

We downgraded our signal to EM LC Sovereign Debt at the beginning of April, motivated by concerns that emerging markets economies were likely to face severe pressure related to the pandemic. We believed this firstly because there appeared at the time to be limited options for stimulus to buffer the economy against the shock. Secondly, we were also concerned about the healthcare infrastructure which is generally less robust than in developed economies.

However, we were positively surprised by the size of the stimulus response by emerging markets, which has been largely on a par with developed markets, and also emerging market’s relative success, particularly in Asia, in limiting the impact of the virus. Consequently, we feel the tail risks to EM currencies have diminished meaningfully, justifying our move from underweight to neutral EM LC Sovereign Debt.

The fall in oil prices is one of the negative factors which has been priced in. That said, the oil price futures curve is currently trading at contango, meaning that WTI prices are expected to recover. However, we are still wary of the risk of a further collapse in oil prices and continue to monitor this closely. There is also the potential for additional risks which we are staying alert to, such as second wave escalation, the revival of USChina trade tensions, the US presidential election, the de-globalisation of supply chains and higher market volatility.

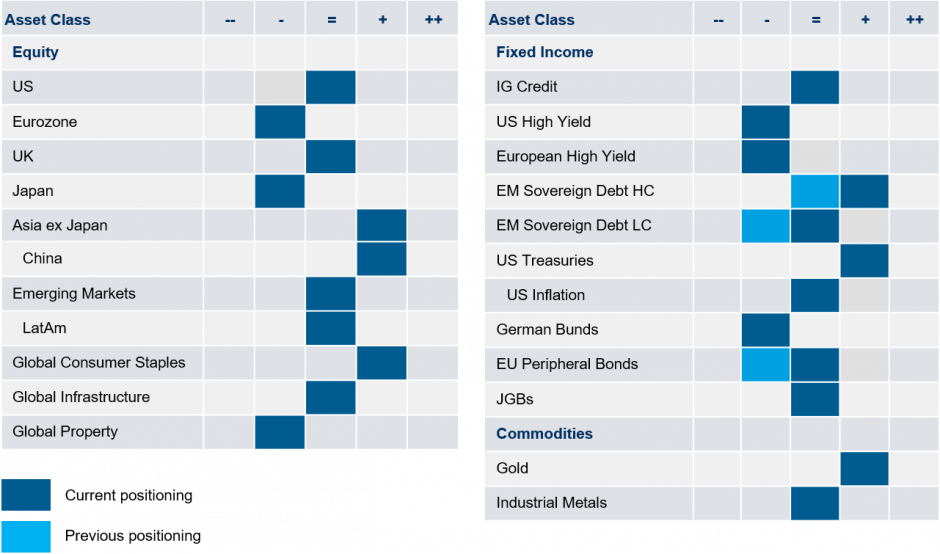

Tactical Preferences

We have provided an overview of our latest tactical views below:

Source: MSIM GBaR team, as of 29 May 2020. For informational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The tactical views expressed above are a broad reflection of our team’s views and implementations, expressed for client communication purposes.

RISK CONSIDERATIONS

There is no assurance that the Strategy will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this portfolio. Please be aware that this strategy may be subject to certain additional risks. There is the risk that the Adviser’s asset allocation methodology and assumptions regarding the Underlying Portfolios may be incorrect in light of actual market conditions and the Portfolio may not achieve its investment objective. Share prices also tend to be volatile and there is a significant possibility of loss. The portfolio’s investments in commodity-linked notes involve substantial risks, including risk of loss of a significant portion of their principal value. In addition to commodity risk, they may be subject to additional special risks, such as risk of loss of interest and principal, lack of secondary market and risk of greater volatility, that do not affect traditional equity and debt securities. Currency fluctuations could erase investment gains or add to investment losses. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes.Equity and foreign securities are generally more volatile than fixed income securities and are subject to currency, political, economic and market risks. Equity values fluctuate in response to activities specific to a company. Stocks of small-capitalization companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Exchange traded funds (ETFs) shares have many of the same risks as direct investments in common stocks or bonds and their market value will fluctuate as the value of the underlying index does. By investing in exchange traded funds ETFs and other Investment Funds, the portfolio absorbs both its own expenses and those of the ETFs and Investment Funds it invests in. Supply and demand for ETFs and Investment Funds may not be correlated to that of the underlying securities. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large negative impact on the portfolio’s performance. A currency forward is a hedging tool that does not involve any upfront payment. The use of leverage may increase volatility in the Portfolio. Diversification does not protect you against a loss in a particular market; however, it allows you to spread that risk across various asset classes.

Here you can find the complete article

Diesen Beitrag teilen: