Morgan Stanley: Consolidation Is the Name of the Game

August can be a tough month for investors, if negative macro shocks coincide with the summer lull in liquidity, leading to amplified price actions and canceled holidays.

25.09.2020 | 11:53 Uhr

Here you can find the complete article

Fortunately, this August proved to be more benign, with a continuation of the positive trends seen over the previous three months: macro data continued to come in generally better than expected, central banks stood ready to accommodate and fiscal policy remains expansionary. Equities, globally, continued to perform well. While a rise in government bond yields meant that most fixed income products delivered negative or only marginally positive returns, the sell-off seemed nothing more ominous than yields returning to the middle of the tight trading range they have been in since March, having (in many cases) reached all-time lows at the end of July. Credit spreads tightened over the month, but at a slower pace than in previous months, given the amount of spread compression that has already taken place.

With not much having changed, it makes sense that our investment strategy has not changed much either: We remain positioned to potentially benefit from riskier fixed income assets outperforming, and low-risk government bonds trending sideways. However, on the margin, we continue to marginally reduce risk, as increasingly demanding valuations mean future return expectations have moderated. Most credit spreads have reversed nearly all of their widening from earlier this year and are close to their long-term averages. So while the policy stance remains supportive, and it is not unusual for spreads to trade close to, or even below, their long-term averages for extended periods, expected future returns have moderated, and hence it makes sense to reduce the risk we take as well.

There is also a danger that the backdrop becomes less supportive for credit products. The macro risks that have troubled investors in the past—rising infection rates, U.S./China tensions, Brexit—persist, and there is a chance that the powerful support that governments and central banks have provided financial markets will falter, even if temporarily. The fiscal boost in the U.S. is starting to fade and a new stimulus program is yet to be agreed upon; furlough and other income support schemes in many countries are drawing to an end, and it’s not clear if increasingly indebted sovereigns can afford to renew them. In addition, the pace of the economic recovery appears to be slowing, as the support from pent-up demand fades and economies have to deal with renewed lockdowns as infection rates start to increase once again. While economic data in general continues to be better than expected, it seems unlikely that the current pace of upside surprises can be sustained.

That being said, we think it is too early to get nervous. Developments could lead to even tighter spreads by year-end or in 2021. With inflation well below central bank targets and economic risks skewed to the downside, it is difficult to imagine any central bank being anything but very accommodative for years to come. The decline in government bond yields central banks have engineered means governments have been given carte blanche to spend more if they feel they have to. The economic data still points to improvement, and with medical progress being made on COVID-19, there are both up and downside risks around the epidemic. We are still inclined to believe buying the dip is the right strategy, but we need some consolidation in market prices and data (both medical and economic) to be sure.

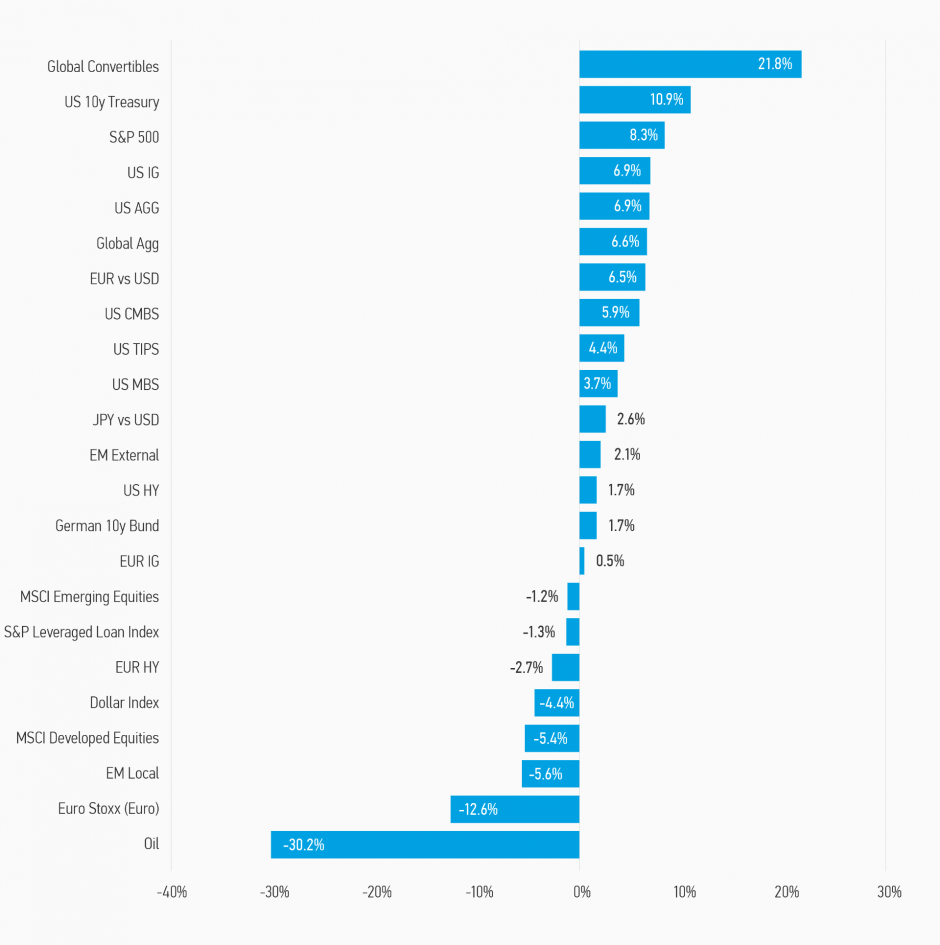

Display 1: Asset Performance Year-to-Date

Note: USD-based performance. Source: Bloomberg. Data as of August 31, 2020. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See below for index definitions.

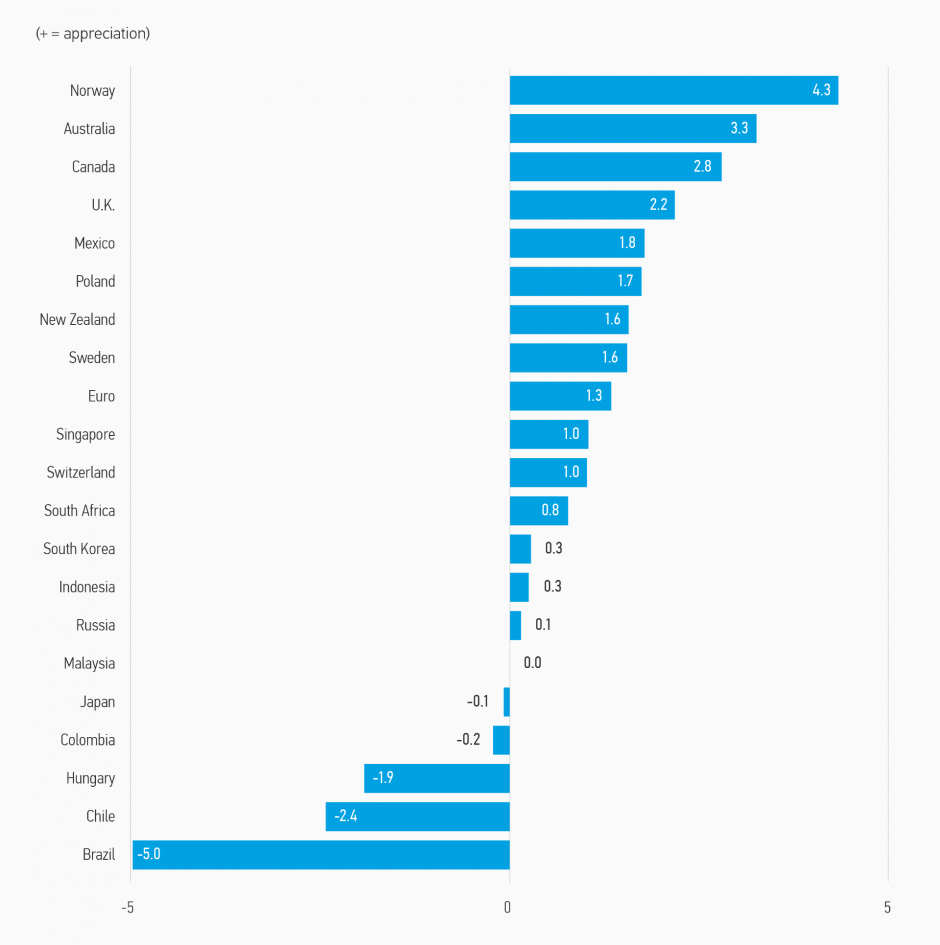

Display 2: Currency Monthly Changes Versus USD

Note: Positive change means appreciation of the currency against the USD. Source: Bloomberg. Data as of August 31, 2020.

Display 3: Major Monthly Changes in 10-Year Yields and Spreads

Source: Bloomberg, JPMorgan. Data as of August 31, 2020.

Fixed Income Outlook

August was a largely uneventful month in the financial markets, which was undoubtedly a relief to many investors, who relished having some time off following the travails of earlier this year. With economic and market trends largely unchanged, our investment outlook is also largely unchanged: We remain cautiously bullish, given the improving economic data and considerable monetary and fiscal support. However, richening valuations cause us to reduce our exposure to risky assets, although we remain long.

Considerable downside risks persist. Even though economies have recovered far quicker from the COVID-19 shock than initially anticipated, economies are still operating significantly below their usual capacity, especially in the services sector. Some of the pent-up demand that fueled the initial rebound in activity is now fading, and in some cases, fiscal support programs are coming to an end. Many developed economies, especially in Europe, are facing rising COVID-19 infection rates, leading to local lockdowns and restrictions that are hindering economic normalization. Many of the geopolitical risks that have troubled investors in the past—U.S./China tensions, deadlock over renewed U.S. fiscal stimulus measures, Brexit, tensions between Russia and Europe—persist.

At the same time, progress continues to be made in developing potential COVID-19 vaccines, which could lead to a more sustained resolution of the pandemic. Central banks and governments also remain committed to doing whatever is necessary to keep the economic recovery on track. A shift in Fed policy toward average inflation targeting, which means it is likely to normalize policy slower once the economic recovery is well established, has been effective in boosting U.S. inflation expectations, which has in turn pushed real yields lower and made real policy settings more accommodative. Market-based measures of inflation expectations are still subdued, however, meaning no central bank is likely to tighten policy anytime soon in response rising inflation. On the contrary, the risks are skewed toward them easing further in a bid to achieve their inflation mandates. Similarly, economic data have been better than expected, but economies are still operating at levels so far below what is normal that stronger data poses little threat to the accommodative bias.

This central bank support is helping to give governments the freedom to spend freely to support the economy. While many developed economies are expected to see their government debt to GDP ratios rise above 100%, government bond yields continue to trade around all-time lows, implying that investors are decidedly nonchalant about deteriorating fiscal balances. Part of the explanation is a shift in expenditure between governments and households—while governments are spending more, household savings rates have been rising, increasing the potential for households to pay back government debt through higher taxes in the future. But the main reason is the extent to which central banks have pegged interest rates at very low levels, both by (credibly) promising not to raise interest rates for a long time, and through the direct purchase of government bonds and other assets.

We therefore see little risk of government bond yields rising meaningfully anytime soon. Further declines in yields also seem unlikely, given most central banks have now cut interest rates to as low as they feel comfortable doing. Cutting rates further, especially into negative territory, is not expected to help the economy much and could be disruptive to the financial sector. Nonetheless, further cuts and other policy innovations could still happen if there is a turn for the worse, so there is still a case, we believe, for owning high-quality government bonds as a hedge against further stress.

Central bank easing is causing a cheapening of some currencies, most notably the U.S. dollar. Currency changes are driven by the relative change between two economies, but the Fed has so far shown itself to be more adept at engineering a lower level of real yields, which is helping the U.S. dollar sell off. Given our assessment that the greenback is still rich relative to most other G-10 currencies, we expect it to cheapen further.

We believe corporate credit, in particular investment grade, also remains very well supported by central bank actions, in particular purchase programs. However, this good news is increasingly factored into prices, with credit spreads at or below their long-term averages in spite of the still challenging economic outlook. While we remain long, we continue to gradually reduce risk by reducing the size of our positions and improving the quality of our holdings.

Emerging markets remain an enticing source of yield enhancement. The depreciation of the U.S. dollar and open monetary spigot in developed countries remain highly supportive for the asset class. However, considerable macro risks persist, with many emerging economies not performing better than their developed peers. Valuations have also richened, so while we do see opportunities in specific countries and situations, we exercise caution toward broad-based exposure to the asset class.

High-quality securitized products continue to quietly perform well, offering what we consider to be limited upside, given low yields and refinancing risk, but also limited downside, given central bank support. The low volatility outlook means the asset class is still attractive for portfolios, even if this means a lower level of expected return. Higher return opportunities exist in lower-rated securitized product, where spreads have retraced less, but fundamental risks are greater. In general, delinquencies have been far lower than initially feared.

Developed Market (DM) Rate/Foreign Currency (FX)

Monthly Review

In August, the risky assets rally carried on as most economic activity continued to improve, despite a further spike in cases across the U.S. and other parts of the developed markets. The U.S. dollar weakened against a backdrop of steepening sovereign yield curves and dovish tones from central banks. Inflation expectations continued to rise, especially in the U.S., where the Fed announced a shift to an average inflation targeting regime, which should make it more tolerant of inflation above its target level. The Bank of England (BoE) left interest rates and its bond-purchasing program unchanged, and there were also no significant changes in policy from the ECB.

Outlook

We continue to expect monetary policy to remain accommodative across developed markets, supporting risky assets to help ensure the continued stabilization of the global economy and financial markets. Having eased aggressively in prior months, most central banks are now monitoring incoming economic data and looking at additional fiscal policy response options. Data has generally been better than expected, but with risks still skewed to the downside and inflation expectations at best approaching central bank targets, monetary policy is unlikely to be tightened anytime soon and will be loosened in response to adverse developments. We expect the U.S. dollar to continue to weaken in the coming months versus other G-10 currencies, given it is still rich and Fed policy is likely to be as accommodative as anywhere else.

Emerging Market (EM) Rate/FX

Monthly Review

The Fed’s shift to average inflation targeting is supportive for risky assets and pushed the USD lower, providing a favorable backdrop for emerging markets. EM performed positively with EM Corporates outperforming and local currency bonds lagging. Dollar-denominated sovereign debt performed well, driven by spread compression as U.S. Treasuries detracted from total return. High yield EM Corporates outperformed investment grade. Local currency bonds posted negative returns due to yields selling off and a marginal depreciation of EM currencies versus the dollar. From a sector perspective, companies in the pulp and paper, transport, and metals and mining sectors led the market, while those in the oil and gas, telecoms, and diversified lagged.

Outlook

We remain cautiously constructive on EM debt in the near term on the back of loose monetary policy in the developed world, recently boosted by the Fed’s new strategy of average inflation targeting. Lower real yields in the U.S. and the resulting weaker dollar should be supportive of EM fixed income, primarily in the high-yield segment and currencies, particularly if EM growth improves relative to the developed world. Positive headlines on new treatments/vaccines could lift sentiment further. Our relatively positive view on EM assets is tempered by the fact that valuations are not as compelling as a few months back, particularly on EM investment grade. Additionally, risks abound, including potential setbacks in the fight against COVID-19, heightened U.S./China tensions (trade and technology issues/geopolitics) inflamed by the proximity of U.S. elections, and geopolitical conflicts elsewhere (India-China, potential sanctions against Russia/Belarus) will continue to weigh on risk sentiment.

Credit

Monthly Review

Spreads were tighter in the month of August. The key driver was the technical of supply that weighed particularly on USD spreads and supported euro spreads, given the cheaper currency/hedged funding available in USD. Other drivers of spread tightening include a lack of negative fundamental news, monetary policy remaining supportive and supportive fiscal policy.

Market Outlook

We expect credit spreads to consolidate at current levels close to the long-run average, offering investors carry but limited capital gain. We remain long credit risk with a bias to financials and utilities and underweight industrials. The strong market rally over recent months makes positioning sensitive to valuations and technicals of supply and demand.

Securitized Products

Monthly Review

August was a repeat of June and July in the mortgage and securitized markets, with credit spreads continuing to tighten, slowly reversing the spread widening from earlier in the year. Agency MBS were essentially unchanged in price, despite the sell-off in rates, largely due to the continued buying of agency MBS by the Fed. U.S. on-agency RMBS spreads continued to grind tighter. Office and residential CMBS performance has been much more stable, while more distressed ABS sectors, such as aircraft and mortgage servicing rates ABS, experienced modest spread tightening, although still trading at substantially wider levels than they were in February.

Outlook

AAA spreads have now retraced 80%-90% of the COVID-19 widening and seem unlikely to tighten materially further given current credit conditions, but are also unlikely to widen materially, given the lower issuance volumes and $100 billion of TALF money poised to take advantage on any spread cheapening. The Fed continues to buy large volumes of agency MBS. The fundamental picture in lower-rated sectors varies significantly, depending on the pandemic impact. Overall, we think lower-rated assets have significant room to tighten further.

RISK CONSIDERATIONS

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in a portfolio. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Certain U.S. government securities purchased by the strategy, such as those issued by Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. It is possible that these issuers will not have the funds to meet their payment obligations in the future. Public bank loans are subject to liquidity risk and the credit risks of lower-rated securities. High-yield securities (junk bonds) are lower-rated securities that may have a higher degree of credit and liquidity risk. Sovereign debt securities are subject to default risk. Mortgage- and asset-backed securities are sensitive to early prepayment risk and a higher risk of default, and may be hard to value and difficult to sell (liquidity risk). They are also subject to credit, market and interest rate risks. The currency market is highly volatile. Prices in these markets are influenced by, among other things, changing supply and demand for a particular currency; trade; fiscal, money and domestic or foreign exchange control programs and policies; and changes in domestic and foreign interest rates. Investments in foreign markets entail special risks such as currency, political, economic and market risks. The risks of investing in emerging market countries are greater than the risks generally associated with foreign investments. Derivative instruments may disproportionately increase losses and have a significant impact on performance. They also may be subject to counterparty, liquidity, valuation, correlation and market risks. Restricted and illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Due to the possibility that prepayments will alter the cash flows on collateralized mortgage obligations (CMOs), it is not possible to determine in advance their final maturity date or average life. In addition, if the collateral securing the CMOs or any third-party guarantees are insufficient to make payments, the portfolio could sustain a loss.

Diesen Beitrag teilen: