Janus Henderson Investors: Beyond the nadir

Just over two months has passed since global markets dramatically sold off as the COVID-19 pandemic unfolded. There is much talk of the ‘new normal’ in every aspect of our lives, but what does this mean for fixed income?

10.06.2020 | 12:15 Uhr

Nick Maroutsos, Dan Siluk and Jason England, co-managers of the Absolute Return Income Strategy, answer some of the key questions.

Key takeaways

- The last few weeks have seen a marked improvement in liquidity with traders/brokers being more active and prepared to make a two-way market.

- The widening in credit spreads makes credit more attractive from a forward returns perspective and Fed purchasing offers implicit support to sub-five-year investment grade bonds.

- We continue to favour shorter-dated bonds given that in the event of a spread widening episode these bonds carry lower duration risk and roll back to par value more quickly.

Are global fixed income markets back to ‘normal’?

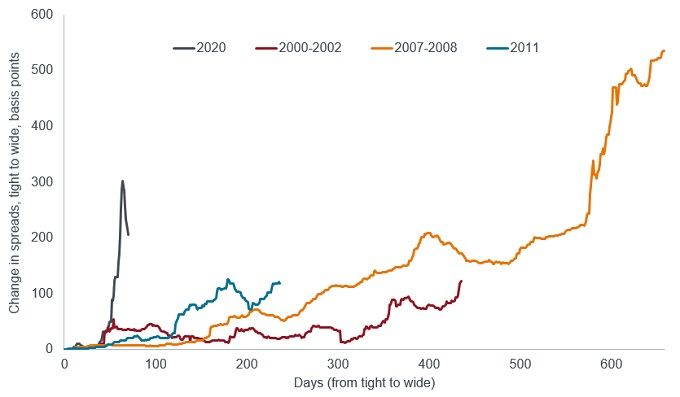

No. But significant improvement has taken place over the past month or more. Bid/ask spreads on bonds have started to narrow, and while some sectors are moving closer to more normal levels, challenges remain in certain areas. While ‘unprecedented’ has been a word used extensively over these past several weeks, it is entirely apt in describing the change we saw in credit spreads. The chart below highlights this well compared to prior widening periods.

Rapid pace of credit sell-off (US investment grade credit spreads)

Source: Deutsche Bank, ICE BofA US Corporate Index (C0A0), Government option-adjusted spreads (OAS), at 31 March 2020. Option-Adjusted Spread (OAS) measures the spread between a fixed-income security rate and the risk-free rate of return, which is adjusted to take into account an embedded option. The ICE BofA US Corporate Index represents US dollar-denominated investment grade corporate debt publicly issued in the US domestic market.

The chart shows US investment grade credit spreads. The key message conveyed is just how rapidly the sell-off impacted credit spreads. In only a handful of days spreads rose by more than 300 basis points. In prior widening periods, for example the Global Financial Crisis, the expansion of spreads was much slower, providing market participants with time to increase portfolio defensiveness. Time was a luxury no one had this time around.

What about fixed income market liquidity?

Over recent weeks we have seen marked improvement in liquidity across some investment grade sectors. A combination of strong central bank action, led by the US Federal Reserve (Fed), has improved liquidity and we have started to see significant improvement in two-way trading and brokers/market-makers being more active. Corporates across most sectors have also started to trade more actively, particularly in the new issue market. In Australia, mortgage backed securities (MBS) have historically been less liquid than corporate bonds, however recent Australian Office of Financial Management (AOFM) actions have provided positive assistance to this segment of the market.

With global government bond yields remaining low, and talk of more countries moving to negative interest rates, it has been remarked that ‘investment grade credit is the new sovereign’, is this true?

Well yes… and no, depending on how sovereign assets are used in a portfolio. As a hedge to risk assets, we believe that sovereign allocations still offer greater resilience than credit in the event of a risk-off event, so here sovereigns appear superior. However, the dramatic widening of credit spreads in the March-April period has the effect of pushing corporate bond yields higher in relative or absolute terms. This makes credit relatively more attractive from a forward returns perspective. Put simply, investors can get paid more now to own credit bonds than they did a few months ago.

Furthermore, the recent US Federal Reserve (Fed) corporate bond programmes have served as a backstop to the investment grade space. While not explicitly backing corporates, providing buying support on assets with five years maturity or less gives investors implicit support.

But is it riskier to own credit today than a few months ago?

Technically – if ‘the market’ is accepted as an efficient pricer of risk – then one has to say yes. For companies issuing bond debt today compared to a few months back, they typically have to pay a higher interest coupon to bond holders. So that means that the market is effectively pricing in a higher degree of risk, right? At a broad market (index) level, it is hard to say otherwise.

Uncertainty over future earnings for companies in so many sectors and industries will undoubtedly lead to problems for some – not just affecting their ability to service debt but also meaning further hits for their equity holders. And sovereign issuers, whose own debt levels are skyrocketing with successive aid and intervention packages aimed at ‘propping up’ troubled economies, are by no means immune.

So, it has become more important to be selective. We are avoiding 'BEACH' names given they have higher betas and are likely more heavily impacted – such as Booking agencies, Energy, Airlines and Autos, Cruise lines, and Hospitality (entertainment, hotels, tourism). Instead, we are favouring issuers that we believe have more robust financial structures and greater resilience. With a somewhat more risk-averse nature than most, we have avoided most of the worst hit sectors.

How are you positioning portfolios given the still elevated levels of uncertainty?

Our portfolio asset allocations have remained largely unchanged. We came into the crisis fairly defensive, owning a predominantly short-dated portfolio of high quality bonds (almost 100% investment grade) combined with high cash levels. The shorter maturity profile was, and remains key, in our opinion. We had held this position throughout most of 2019, believing then that credit spreads were historically tight, so erring on the side of caution preferred shorter-dated bonds, which in the event of a spread widening episode should roll back to par value far quicker than, say, a 7-year or 10-year bond. So even if the market temporarily marks down the value, provided there is no default, those bonds should ultimately ‘bounce back’ to their par value in a shorter period of time.

All things considered, we prefer the shorter-dated part of the yield curve, especially so in this environment when the bar for central banks to hike interest rates is so high. We retain a higher than normal cash exposure, conscious of the risk of a further sell-off should major markets experience a ‘second wave’ of COVID-19 infection. Our priority remains the preservation of capital, and the appealing investment opportunities we see today should be with us for some time, so we do not feel compelled to ‘rush’ to redeploy excess cash.

Notes

Bid/ask spread – the difference between the highest price that a buyer is willing to pay for the asset and the lowest price a seller is willing to accept.

Diesen Beitrag teilen: