Henderson: Is EM credit still a buying opportunity?

Emerging market (EM) corporate bonds have produced a strong year-to-date total return of c.11%* with each month, except for January, delivering positive performance. Emerging market investment grade corporate bonds gained 8.2%* over the year while high yield has delivered an impressive 14.4%*. Here we look at the drivers of the gains and explore the future direction of the asset class.

23.09.2016 | 13:41 Uhr

Why have EM corporate bonds rallied so strongly?

The simple explanation: it is due to a lack of supply of available paper and an unprecedented structural, rather than cyclical, demand for EM corporates. In a world where interest rates and global bond yields look set to stay lower for longer, emerging markets corporates can deliver yield and diversification in a US dollar-based format. EM corporates as a whole yield 4.5%**, while EM investment grade corporate bonds yield 3.6%**. These yields look very attractive when compared to developed market investment grade bonds. We know that Asian investors have sought out US dollar-denominated investment grade bonds, and we believe that they have bought not only developed market but also emerging market debt. European asset allocators are also switching out of the euro into US dollar-based markets.

The turning of the tide?

After seven strong months of returns for EM credit, recent days have produced weaker price action. We believe this weakness stems almost entirely from the government bond market. Volatility and term premia have been crushed this year, which has led to high correlations across G7 bond markets. Thus a small change in sentiment in any G7 market can be amplified across them all.

A rise in European, Japanese and US government bond yields — due to concerns over the continued usefulness of quantitative easing (QE) in Japan, the less dovish rhetoric in Europe and strengthening US data — has recently led to a general risk-off sentiment. We believe this move is a buying opportunity, particularly in Latin American long-dated investment grade corporates.

Risks to watch in Q4

A rise in US interest rates is certainly one of the key threats facing EM corporates. It will create volatility in the US currency and a corresponding rise in market risk levels, which would negatively impact both commodity and oil prices, as well as the broader EM market. Furthermore, since more than 60% of EM corporates are investment grade, their returns are allied to duration (interest rate sensitivity); much more than the lower yielding, high yield markets in the developed world.

We believe a rate hike is possible in December, however just as likely is the realisation in 2017 that the last rate hike in December 2015 was a policy mistake. The US presidential election in November also poses a pivotal risk, particularly for Mexico. The election carries a great deal of uncertainty both in terms of who wins the presidency and what the post-election policies mean for EM. A Trump victory would surprise and disrupt markets, which would undoubtedly, negatively, impact EM. However, we believe this would represent a buying opportunity as there will be a realisation that much of the rhetoric will not lead to material policy change.

The fundamentals picture

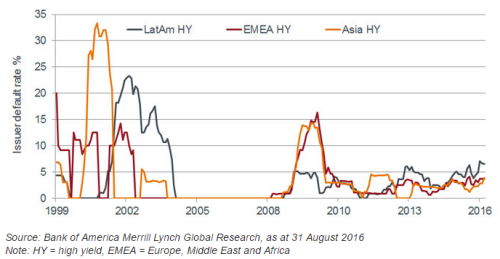

EM default rates have risen in 2016 but the increase has taken place almost exclusively in Latin America. Trailing 12-month defaults are currently running at 3.5% globally, but at 5.5% in Latin America. We expect this trend to continue, with Latin American, especially Brazilian, corporates dominated by the commodity and energy sectors. Asian defaults are also expected to stay low as Chinese companies focus on the domestic market for their financing needs.

Figure 1: a fairly benign default backdrop

The technical picture

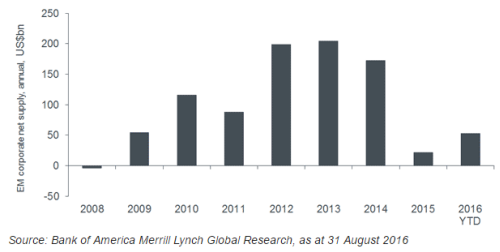

That said, technical conditions in EM corporates continue to remain supportive and dominate market movements. Contrary to the rapid expansion of the asset class earlier this decade, foreign currency-denominated debt issuance currently remains subdued in EM. According to Bank of America Merrill Lynch, the trailing 12-month net supply in EM investment grade market is low, while net supply in high yield is negative. JP Morgan also estimate that more EM companies will pay off their foreign currency debt this year than they would borrow.

Figure 2: Diminishing supply of EM corporate bonds

At a time of reduced debt issuance by EM corporates, inflows into the asset class continue to be extremely strong, driven by low or negative global government bond yields creating a strong search for yield among investors. Importantly EM corporates have seen large flows from non-EM investors, which make the asset class susceptible to large outflows of money if market sentiment turns sour. However, in the near term, accommodative central bank policy from the European, UK and Japanese central banks is likely to continue to sustain the global hunt for yield and benefit the EM market.

What about valuations?

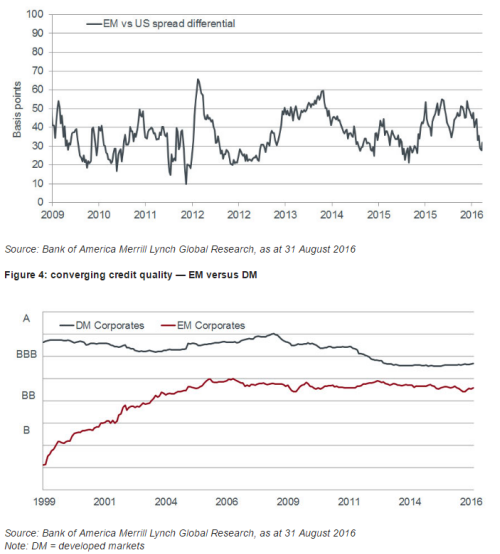

Global bond yields are low and emerging market corporate bonds are no exception to the rule. Compared to historical levels, the spread between developed and emerging market corporate bonds looks stretched (as shown in figure 3); however, the composition of EM corporate bonds has steadily improved over the last 10 years as figure 4 shows, which is in contrast to developed market corporate bonds.

Figure 3: the narrowing of divergence in spreads

Diesen Beitrag teilen: