Columbia Threadneedle: The peak in rate hikes is an inflection point for bonds

You don’t have to be bearish on the economy to be optimistic on the bond market. Here’s why.

01.12.2023 | 09:03 Uhr

As we head into 2024 we think that the next phase for the US Federal Reserve is likely a pause while the central bank assesses the impact of the tighter lending and financial conditions it has established. Investors should expect a lot of talk about whether the Fed will achieve a soft landing, but bond investors have a unique opportunity to generate attractive returns either way. Here’s our rationale:

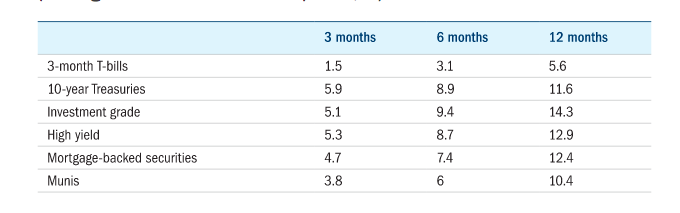

Bonds have performed well around Fed pauses

Typically, Fed pauses like this last less than a year, and it doesn’t take a cut in rates for bonds to rally. History suggests that when the Fed reaches the peak of its rate hike cycle, overall bond performance in the period afterwards is exceptional (Figure 1).

Figure 1: bond returns after Fed rate hike peaks1

(Average forward return after a pause, %)

Source: Columbia Threadneedle Investments

We’re not in the hard landing camp, but given the unknown magnitude of an economic slowdown and the level of inflation, we think that where investors are on the quality spectrum will make a difference. While lower-rated bonds have been strong performers in 2023, we think the market is going to be more discerning as we head into 2024. We expect higher quality bonds will be the best bond performers over the next year.

We also think performance will be more dispersed than it has been. As we enter a higher-for-longer rate environment we should see more separation between the winners and the losers – especially in lower-quality segments of the market. This will make credit selection more important, which is one of our core strengths.

We’re not in the hard landing camp, but given the unknown magnitude of an economic slowdown and the level of inflation, we think that where investors are on the quality spectrum will make a difference. While lower-rated bonds have been strong performers in 2023, we think the market is going to be more discerning as we head into 2024. We expect higher quality bonds will be the best bond performers over the next year.

We also think performance will be more dispersed than it has been. As we enter a higher-for-longer rate environment we should see more separation between the winners and the losers – especially in lower-quality segments of the market. This will make credit selection more important, which is one of our core strengths.

Investors can lock in higher rates for the long term

Bond yields have risen to levels we haven’t seen in decades. We think investors shouldn’t miss the opportunity to lock in higher yields for the long term – not to mention the total return potential as prices on those bonds rise. It is also a great incentive to move out of cash. There has been a money market renaissance as investors realised they can own cash and get a competitive yield. The attractiveness of cash will start to fade when short-term interest rates move lower and the diversification benefits of owning high-quality, long-term bonds at higher yields start to make more sense.

Looking outside the US, opportunities may be even more striking in Europe, despite lower absolute yields. Unlike the US, Europe is coming off not just near-zero interest rates, but negative rates. Now, we’re not only seeing positive real interest rates but also wider credit spreads. That means you’re going to get more risk premium for a similarly rated bond in Europe than you would in the US.

There’s more than one way to take advantage

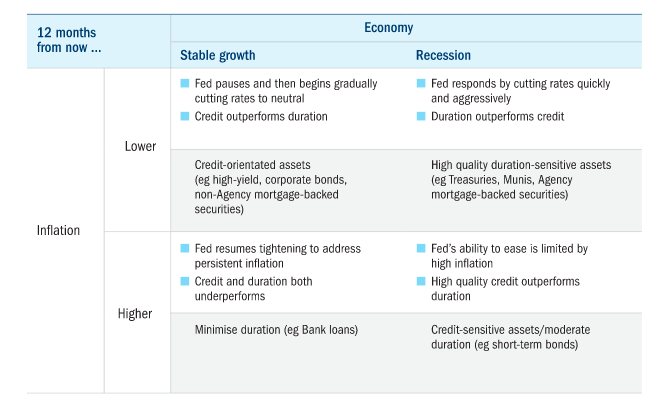

There are two ways to invest in the bond market in 2024 that we think are equally valid, depending on how you feel about the economy:

1 Get paid with higher-yielding credit

If you feel growth will remain resilient (Stable growth in Figure 2) and are comfortable with the risk, the income from high yield bonds and bank loans can be a good addition to a diversified portfolio.

Figure 2: economic and inflationary outcomes

2 Seek income and protection with high-quality bonds.

If you’re not as confident about the economic outlook (Recession in Figure 2), you can take advantage of high-quality, duration-sensitive assets like Treasuries or municipals. These can be higher-quality assets that may help to protect from loss if we do have a harder landing.

"We believe the peak in rates is near and a Fed pause will be a significant market event."

Bottom line

Our optimism for bonds is balanced by a realistic view of a still uncertain economy, but we think a hard landing is unlikely. More importantly, we believe the peak in rates is near and a Fed pause will be a significant market event. It’s an inflection point that has historically delivered outsized returns for bond holders. Combined with the opportunity to lock in attractive yields, we think now is an opportune time for investors to participate in the bond market.

Diesen Beitrag teilen: