BNP Paribas AM: Let the good times roll

Markets remain firmly focused on positive macroeconomic fundamentals and the longe-term investment implications of a low-rate, low-inflation environment. A few events could throw the market bulls off course, including a material shift higher in developed market sovereign bond yields.

26.10.2017 | 09:25 Uhr

The good times roll on. Risk assets remain on a firm footing, underpinned by solid expectations for growth in both advanced and emerging economies in the year ahead. The monetary policy backdrop in developed markets also remains supportive of risk-taking, as weak inflation readings suggest that any withdrawal of policy accommodation will be extremely gradual. Meanwhile a number of potential risk-off catalysts have barely made a dent in investor risk appetite, including elevated tensions between the United States and North Korea, and the standoff between the Spanish government and an increasingly restive independence movement in Catalonia. Instead, markets remain firmly focused on positive macroeconomic fundamentals and the longer-term investment implications of a low-rate, lowinflation environment.

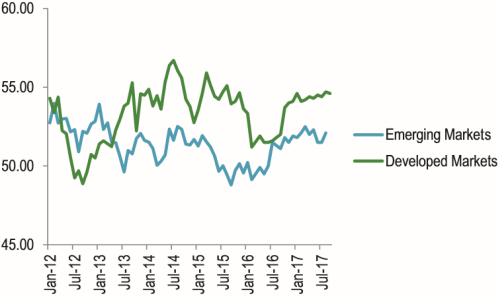

Chart 1: Time series of advanced economy and emerging economy composite PMIs

(Source: Markit, Jan 2010 – Sept 2017)

Given the high level of animal spirits and the ever-widening search for returns, this seems an opportune time to step back and ask, what events could throw the market bulls off course even if global growth expectations are met? One obvious culprit would be a material shift higher in developed market sovereign bond yields. As such, this quarterly takes a different approach from past offerings, as we share views on some of the possible catalysts for higher yields and how likely they are to come about. In particular, we focus on the inflation outlook, the potential for increased supply as a result of central bank balance sheet normalization and fiscal stimulus, and upside growth surprises.

Inflation - the dog that won’t bark

We see little prospect for a material increase in global inflation over the next year, and equally low prospects for central banks sustaining inflation at their targets in the years ahead. First and foremost, the aggregate global output gap still remains in negative territory almost a decade after the financial crisis, suggesting little pressure on resource utilization. Even in countries such as the United States where the labor market is moving past full employment conditions, the globalization of labor supply and the threat that technology poses to job security have served to weaken wage bargaining power, limiting the prospects for cost-push inflation. And while it may be hard to see in academic studies, we have to believe that the expanded consumer opportunity set and price transparency brought about by online shopping are also limiting factors on inflation. Finally, we see few prospects for oil prices to move significantly higher, given the global supply shock resulting from the US shale revolution. A supply-limiting OPEC with high fiscal breakevens for oil prices has been replaced by an increasingly efficient US shale complex as the swing producer.

In addition to a number of structural forces that continue to pull global inflation levels down, recent actions of some developed market central banks may be contributing to weak inflation. Despite somewhat accommodative policy stances, neither the Federal Reserve nor European Central Bank appears serious about hitting their inflation targets. The former is tightening policy even as the United States has experienced disinflation this year and Chair Yellen acknowledges that the inflation shortfall has been “somewhat of a mystery.” The European Central Bank, meanwhile, has signaled further tapering of its asset purchases, accepting chronically below-target inflation so long as deflation risks are well-contained. More broadly, the very policy of low rates and financial repression has caused an unabated demand for higher yield investments, even those that are less fundamentally sound. This has led to zombie firms that under normal lending conditions would otherwise find it difficult to finance themselves. By staying in business, they boost competition more than would be the case, leaving many firms unable to raise prices.

On one level, the relatively relaxed attitude to below-target inflation is understandable – historically, inflation overshoots have presented the more significant economic challenges in both economies, and there could be popular and political opposition to more aggressive attempts to push prices higher. Financial stability risks could also rise if policy were to remain overly accommodative for an extended period. But on the other side of the ledger, low-inflation in good times increases the risks of deflation in the next recession, particularly when a return to the lower interest rate bound will leave central banks with a constrained set of choices for adding stimulus. And if central banks currently are demonstrating a weak commitment to their inflation objective, the credibility of future commitments – such as outcome-based forward guidance in a future recession – will be called into question.

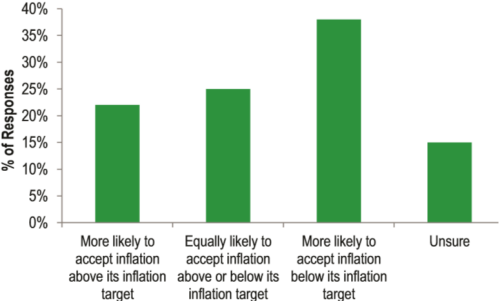

Chart 2: Firm’s perception of Fed’s tolerance for inflation above/below its inflation target

(Source: Federal Reserve Bank of Atlanta, Business Inflation Expectations Survey, April 2017)

While we see limited prospects for a material move higher in inflation, this is a risk that we continue to monitor closely as it would lead to a higher inflation risk premium and steeper expected path for policy rates. We are equally cognizant of the risk that even without higher inflation, the Federal Reserve may tighten policy too aggressively, slowing growth and risking a recession. This scenario would likely lead to lower long-term rates as investors discount a possible recession, but credit spreads would widen, perhaps substantially given current valuations.

Central bank balance sheets - aggregate normalization still a ways off

If the inflation outlook is unlikely to derail risk-taking, what about central bank balance sheet normalization, with the Federal Reserve this month commencing the multi-year process of reversing its quantitative easing (QE) purchases? There are good reasons to expect only a very gradual and limited repricing of Treasuries. Not only is the overall pace of portfolio runoff quite limited for the next half-year, but a drawn-out process suggests non-negligible risks that normalization will eventually be interrupted by a recession – and additional QE. Perhaps most importantly, even as the Federal Reserve reduces its securities holdings, the European Central Bank and the Bank of Japan will continue to add to their own portfolios, albeit at a reduced rate. Thus the aggregate G3 central bank balance sheet will continue to remove duration from the market until around this time next year, mitigating the risk of a material repricing of yields.

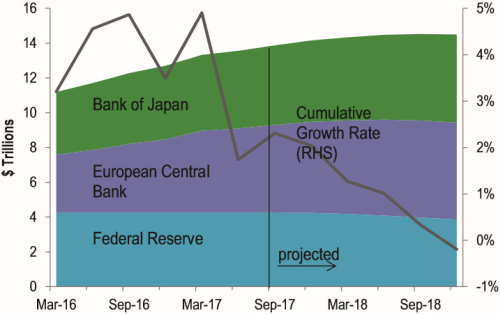

Chart 3: Central bank balance sheet and cumulative growth rate projections

(Source: Federal Reserve Bank of New York, European Central Bank, Bank of Japan, BNPP AM projections)

The larger supply-related risk may eventually come from fiscal as opposed to monetary policy. There is still not a lot of clarity regarding the outlook for tax cuts in the United States, but we recognize that tax cuts are a long-held Republican priority, made more urgent by a desire for a legislative accomplishment before the mid-term elections. And the politics of populism suggest that Republicans may very well set aside their traditional concerns over deficits and support unfunded stimulus, even if budget rules mean that tax cuts will need to be temporary. Such an outcome – especially the focus on corporate tax cuts - may support equities but the need to fund the cuts via additional Treasury issuance suggests a negative impact on fixed income returns. Thus monitoring the outlook for US fiscal policy remains key to managing risk in this space, particularly as stimulus would mean not only additional Treasury supply, but higher upside risks to growth, inflation and the past of the federal funds rate.

Making growth great again?

A final risk to the level of rates stems from the growth outlook. While investors maintain solid expectations for global growth, further upside surprises could pressure interest rates higher. Implications for credit markets would depend primarily on how aggressively central banks would respond. We are also attuned to the possibility that investors may start to price in an increase in trend growth in the United States, given stronger capital spending of late and potentially positive growth effects from deregulation and tax reform. This outcome would lift the natural rate of interest over time – essentially spelling the end of the low-rate “new normal” environment of recent years. This is not our base case, but it too is a risk we continue to monitor.

Investment implications

Navigating this environment from a fixed income positioning perspective means balancing a solid growth outlook and gradual policy normalization, on the one hand, with an appreciation of risks that could upset our base view that risk-free rates should remain relatively low. In addition, we acknowledge that asset values remain full to stretched across many markets, necessitating selectivity in where we choose to focus carry trades. Looking forward into the 4th quarter and beyond into 2018, our expectation for further capital gains in risk asset “Beta” is somewhat limited. Our tempered enthusiasm for risk assets remains nonetheless, due to our expectation of unfettered carry. As described above, we do indeed see some potential catalysts for a negative change in this environment, and we certainly cannot account for the geopolitical herd of elephants in the room. We do not, however, prescribe very high probabilities on any of the quantifiable risks to augment our positioning. Lastly, we continue to maneuver within the risk asset classes to better our overweight propositions as well. For example we remain cautious on global corporate credit overall as the asset class remains fully valued, with little upside potential at the broad asset class level, though single name selection opportunities remain. Looking across regions, strong technicals support better opportunities in European Investment Grade and High Yield. Looking further afield, we remain constructive on emerging markets, and see value in continued carry strategies in the hard currency space and also see capital gain opportunities in local currency debt particularly after recent weakness across many emerging market currencies. Finally, three particular sub-sets of the Structured Securities space are beginning to gain our interest.

1. Hybrid ARMs are interesting given a lower duration profile.

2. Commercial Mortgage Backed Securities (“CMBS”) have sold off significantly given structural and cyclical weakness in the retail sector (some pools of loans include significant exposure to retail malls). This selloff has been indiscriminate and is beginning to look overdone.

3. Three record-setting Hurricanes in the month of September have challenged underlying assets in the Credit Risk Transfer (“CRT”) security space. We continue to monitor the extent to which the market overreacts and will assess whether this already attractive market becomes more so.

Diesen Beitrag teilen: