NN IP: Doubts about Bolsonaro’s effectiveness

There are doubts about whether Brazil’s President-elect will implement necessary reforms as he faces tough coalition-building.

02.11.2018 | 13:54 Uhr

Throughout the emerging markets turmoil that started in April, the Brazilian elections were one of the main endogenous threats possibly exacerbating the problems created by global factors such as rising US rates, a higher oil price and US protectionism. Already weeks before the first round, polls suggested that Jair Bolsonaro would win, triggering a rally in Brazilian assets. The right-wing candidate received attention in the campaign because of his anti-gay statements and disrespectful speech towards women as well as his view that the solution to Brazil’s security problems is to arm people and increase the role to the army. However, Bolsonaro has a market-friendly economic agenda and his support for fiscal discipline, material pension reforms and an ambitious privatization program is the reason why investors have welcomed his expected victory.

It should also be stressed that the declining odds for Bolsonaro’s opponent in the second round of the elections, Fernando Haddad, have played at least an equally important role in pushing Brazilian asset prices higher. A victory for Haddad, who wanted to abolish the fiscal rule and who had no credible plan to reform Brazil’s unsustainable pension and social security system, would likely have caused market panic in Brazil. Indeed, it would possibly have created considerable contagion to other emerging markets. So the outcome of the Brazilian elections has taken away a serious tail risk and might have some lasting positive impact on EM sentiment if the new president can show that he will be a credible reformer.

However, serious doubts remain whether Bolsonaro can be an effective president. His party has only 10% of the seats in Congress, which means that he will have to build coalitions and buy the support of other parties in the highly fragmented political landscape. In the past, Brazilian presidents never had problems forming majorities. But the fact that Bolsonaro has been presenting himself as an outsider (despite the fact that he has been a member of Congress since 1990) with outspoken criticism of the political system and how it works, should make coalition-building more difficult this time around. One important way to buy political support has always been to give ministerial posts to other parties. Bolsonaro has promised that he will more than halve the number of ministries to fifteen, which automatically complicates the power-brokering process.

Currently, Bolsonaro has the explicit support of evangelical Christians and has alliances with the powerful agribusiness and armament lobbies. But this is not enough. He will also need to gain the support of the centre-right parties that have always been at the core of Brazil’s power structure. All right-wing parties in the new Congress account for 60% of seats, which is enough to approve constitutional amendments. Bolsonaro will need the support of the whole right field to push through important legislation, such as the social security reforms. At this stage, it looks unclear how he will achieve this. Possible obstacles to a broad coalition might be the envisioned appointment of five army generals to his cabinet and his plans to create much more room for large-scale agriculture and hydroelectric dams in the Amazon. The agribusiness lobby might be powerful, but the same can be said of the environmentalist lobby.

Cabinet picks will be a signal of reform intentions

In the coming weeks it will be important to watch out for confirmation of reform intentions through the appointment of the new economic team in Bolsonaro’s cabinet. Signs of possible success in future coalition building can come from the election of the new head of the lower house of Congress. Will Bolsonaro push for someone new from his own ranks or will he accept a candidate from one of the other parties? A re-election of the current head, Rodrigo Maia, would point to a conciliatory stance and a higher likelihood of productive cooperation in Congress.

It is too early to draw significant conclusions about the new Bolsonaro government. In a more polarized and darker political environment, there is still room for positive change on the economic front. That requires cooperation with other parties. Pension reforms are crucial to stop the unsustainable social security expenditure growth. This is not only causing a 5-percentage-point increase in the public-debt-to-GDP ratio on an annual basis, but also narrows the budgetary space for the productive investments in social and physical infrastructure that Brazil so badly needs.

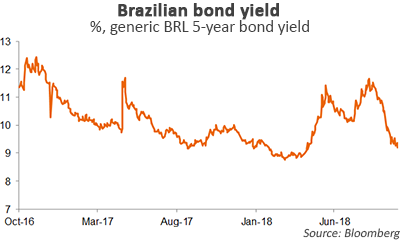

Since the moment investors started to price in a Bolsonaro election victory, Brazilian interest rates have come down substantially. Indeed, the five-year local currency bond has fallen by 250 basis points (see graph). The optimism about prudent macro policies and social security reforms under Bolsonaro might last a bit longer. But in the current fragile global environment for EM assets, the new president will have little room to drag his feet. Without concrete steps towards a productive alliance with the reformist centre-right parties in Congress, Bolsonaro can expect to see the current benefit of the doubt among investors evaporate quickly.

Diesen Beitrag teilen: