Janus Henderson: Why value now? - US equities view

Growth has outperformed value since the market bottom in 2009, a period characterised by extremely low interest rates and sub-par economic growth. However, with the US Federal Reserve (Fed) steadily normalising monetary policy, with as many as three interest rate hikes (possibly four) likely in 2018, is the market leadership of growth stocks finally being challenged?

23.04.2018 | 10:33 Uhr

Rising rates have favoured value

Rising rates have favoured value

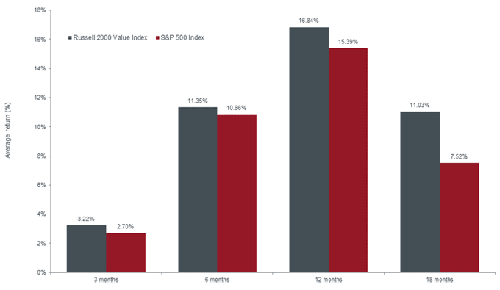

Value has historically performed well during rising interest rate environments, with chart 1 showing the average outperformance of the Russell 2000 Value Index, a measure of US small-cap value equities, versus the broader equity market (as represented by the S&P 500 Index), in the periods following Fed interest rate hikes.

Chart 1: Average index returns after US Federal Reserve rate hikes

(Source: Morningstar, S&P 500 Index and Russell 2000 Value Index, as at 22 March 2018.

Notes: The average returns are for the noted time periods after rate hikes on the following dates: 7 August 1980, 1 February 1983, 1 October 1986, 4 February 1994, 30 June 1999 and 30 June 2004. The 3-, 6- and 12-month average returns are cumulative, and the 18-month average returns are annualized.)

Growth cycle is long in the tooth

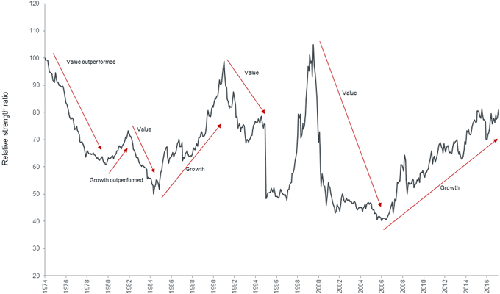

The current growth cycle has lasted far longer than is typical. When examining market trends from 1987 to 2016, the average growth cycle lasted six quarters, with the longest cycle lasting 12 quarters (1988–1991). Conversely, the longest value cycle lasted 15 quarters, from 2002–2006 (another period with rising rates).

As chart 2 indicates, it is normal for the market to shift between cycles in which either value or growth are outperforming. Given how long the current growth-driven market has lasted, and given the recent rise in volatility to a more ‘normal’ long-term level, we believe that we may soon see an environment in which value outperforms growth.

Chart 2: Growth vs value

(Source: The Leuthold Group. Data as at 28 February 2018.

Notes: The data is drawn from Leuthold’s Royal Blue universe which includes the 99 largest institutional equity holdings as determined by Leuthold research. The 33 highest price-to-earnings ratio (P/Es) companies are categorized as ‘growth’ and the 33 lowest P/Es are categorized as ‘value’. The relative strength ratio measures the cumulative monthly performance of the growth vs value baskets (total return including dividends, equally weighted). The ratio is set to 100 at inception in December 1974.)

Moreover, the same economic factors that have boosted growth stocks may soon favour value. Inflation, which has remained stubbornly low despite economic growth, finally seems to be manifesting, as shown by strengthening wage growth and manufacturing data. Its emergence has the potential to diminish the present value of future earnings of growth stocks and weigh on these companies’ multiples.

Capitalising on economic tailwinds

In our view, investors should focus on areas of the market that stand to see greater benefits from the current environment of rising rates and strengthening economic growth, along with tax reform and fiscal stimulus. Companies in the small- to mid-size capitalisation range of the value segment appear particularly well positioned to benefit from a number of these trends. For example:

1) These companies will likely benefit more from tax reform, as they typically have an outsized proportion of revenues coming from the US and pay a higher tax rate than large caps.

2) Continued regulatory relief should ease pressure for many industries, particularly banks.

3) Domestic GDP improvement should find its way into increased earnings estimates, and will disproportionately benefit domestically oriented companies.

Look beyond the headlines

Despite the 10% correction in the S&P 500 at the beginning of February 2018, the equity market has quickly retraced most of its losses. Even with the correction, as at 28 February 2018, the index is up 55%, including dividends, since its lows in February 2016. Moreover, valuations have remained elevated, with the Shiller price-to-earnings (P/E) ratio at 32x earnings at the end of February – well beyond its long-term average.

Given this bullishness, while we believe it makes sense to have general exposure to the equity market, we also caution investors to remain mindful of downside risk and, therefore, consider securities that are ‘off the beaten path’. We think that these less mainstream opportunities may be less exposed to a reversal in the level of bullishness. It is also important to maintain an eclectic mix of holdings. We believe a healthy mix of different drivers of alpha may help to strengthen a portfolio’s ability to withstand a variety of news headlines and potential economic outcomes.

Diesen Beitrag teilen: