UBS Economist Insights: Giving credit

The latest round of monetary stimulus policies announced by the ECB should, in theory, be pumping ample liquidity into the system, stimulating recovery. But do increased liquidity and looser financial conditions necessarily equate to increased borrowing?

30.03.2016 | 16:35 Uhr

The evidence suggests not. Is it that firms have more attractive alternatives open to them, or might they simply be sceptical about the economic and political outlook? And what are the wider implications of their reluctance to borrow?

There is an old saying that you can lead a horse to water but you can't make it drink. The European Central Bank (ECB) is now finding that you can lead a firm (or household) to liquidity but you can't make it borrow. The ECB has to be given credit for having delivered a quite comprehensive package of measures to stimulate the recovery in the Eurozone and to boost domestic inflationary pressures. In particular, the ECB itself is supplying credit, in the form of a new version of the Targeted Long-Term Refinancing Operations (new TLTRO). This has the potential to significantly expand the ECB balance sheet (see Hot potato, 14 March 2016) and in theory should inject plenty of liquidity into the system.

That's the theory. In reality, not only will the ECB find it difficult to get firms to borrow, it may well find it difficult to get banks to actually provide the extra liquidity. Thus far, banks have been willing to lend to households for house purchases in particular. However, what matters for the ECB at this point in the recovery is providing loans to financial corporations which are designed more to facilitate investment spending.

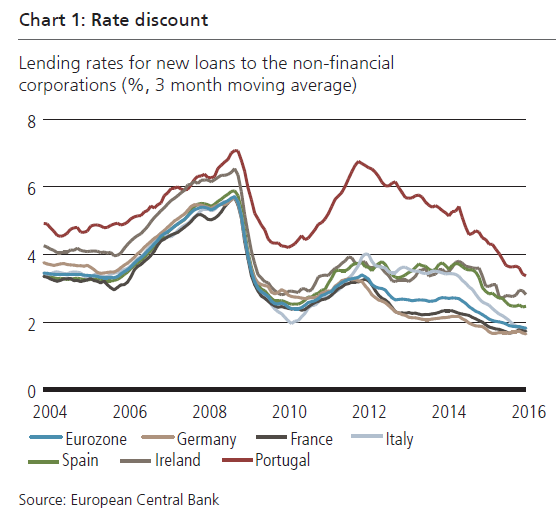

On the one hand, the ECB does not want to fuel a housing bubble by boosting mortgages, while on the other hand business investment provides a greater boost to potential growth than housing construction. For these reasons, lending for house purchases has not been deemed eligible for the new TLTRO. On the surface, it appears that banks have become more willing to lend to non-financial corporations. Or, at least, it has become cheaper for such firms to borrow. The various measures introduced since the height of the sovereign crisis have managed to bring down borrowing costs in the Eurozone quite remarkably (chart 1). In many countries, it has never been cheaper for firms to borrow since the EURO was introduced.

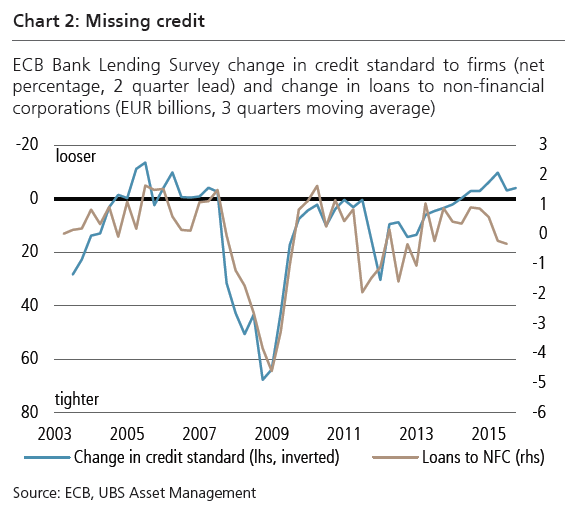

Yet a drop in borrowing costs does not necessarily imply stronger credit creation. Even if the ECB has been successful in increasing the supply of credit, demand for the loans could be lower. That would force banks to keep interest on loans low as they compete to supply credit to a limited number of firms. Unfortunately, this appears to be a pretty accurate description of the Eurozone situation. The ECB's Bank Lending Survey (BLS) shows that banks have become less strict with their credit standards since the events of 2012, and initially this helped to support a stabilisation of loan growth (chart 2). But the recent outright loosening of financial conditions has in fact been met with slowing loan growth.

Diesen Beitrag teilen: