NN IP: A new crisis in the making

Political risk is evolving rapidly in Italy and continues to weigh on Italian assets. Global risk appetite takes a hit as well, although contagion remains limited. We keep our underweight Italy versus Germany.

01.06.2018 | 08:58 Uhr

The political environment in Italy is changing rapidly over the past few days. Instead of a coalition composed of the populist parties Five Star Movement and League (the once called nightmare scenario) we are now in all likelihood heading towards new elections, possibly already as early as July 29. Also the formation of a technocratic government is stalling. This creates more uncertainty for markets and it is difficult to see Italian equities outperforming the rest of the Eurozone in this environment.

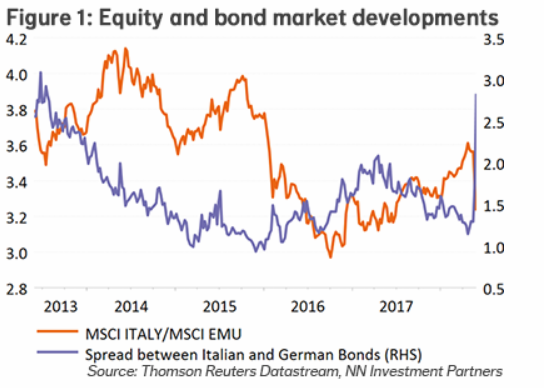

The market reaction was severe with Italian assets underperforming, but at least in equities it did not appear disorderly to us and the fluctuations were certainly more contained than on the bond market. The yield spread between Italian and German government bonds soared to the highest level in almost 5 years. US bond yields dropped the most since Brexit. In equities, financials were unsurprisingly hit the hardest with the bond-proxies doing well. The euro extended its weakness and made new year-to-date lows against the US dollar. This may be a silver lining for some other Eurozone markets, especially for export-heavy and USD-sensitive Germany.

It is not easy to judge how the Italian market will evolve over the next couple of weeks, but more volatility looks for sure. Much will depend on the potential election coalitions that will be made, whereby the Lega looks to have the trump card in either deciding to liaise with the 5SM or with the centre-right Forza Italia. The second choice would certainly be more market-friendly than the first one. The first one would in our view mean a return to square one, or worse, and create more uncertainty. It is also possible, even if current opinion polls indicate the opposite, that the electorate will get cold feet (like it did in France) and moves back to the centre of the political spectrum.

In these circumstances, underperformance of Italian equities will continue. We must not forget either that the Italian market is sensitive to changes in the government bond spread, which may be its Achilles’ heel. More than a third of the Italian equity market consists of financials, a sector that was supported by an improvement in the loan book

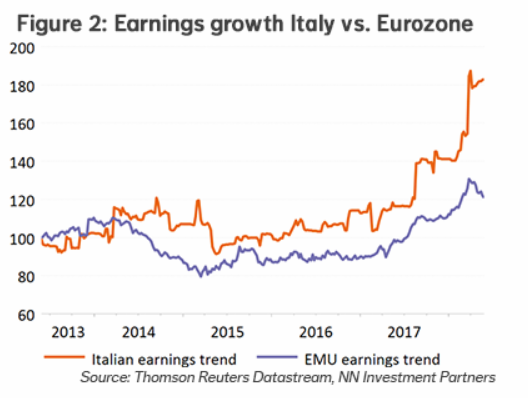

Investors had been very complacent up until the beginning of May. They were not sufficiently discounting the risk of a populist government or rise in euro-scepticism and instead focused on improving economic and corporate fundamentals. Going into the turmoil, positioning in Italian equities was high, supported by the strong improvement in earnings growth coupled with a valuation discount.

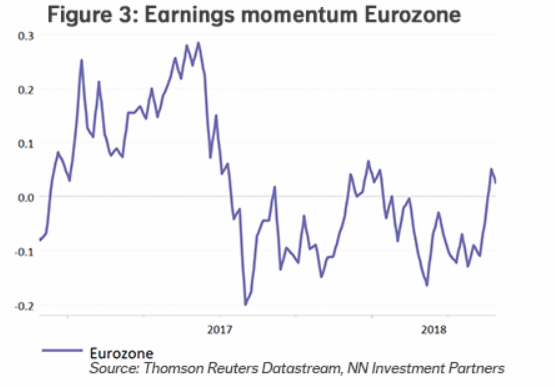

Taken these elements into account, we have adopted an underweight in Italian equities at the benefit of German equities. We believe it makes sense to steer away from the problem child. German corporates may benefit from the strength of the US dollar. For the time being, we keep our neutral position in Eurozone equities. Earnings estimates are modest and given were the USD is heading, we may soon start to see earnings momentum moving up.

Diesen Beitrag teilen: