Roboeco: Sell-off in Italy

Investors leave Italien government bonds due to growing political uncertainty. In Spain - it seems - rises another crisis.

28.05.2018 | 09:57 Uhr

Inhaltsseite

Main market events

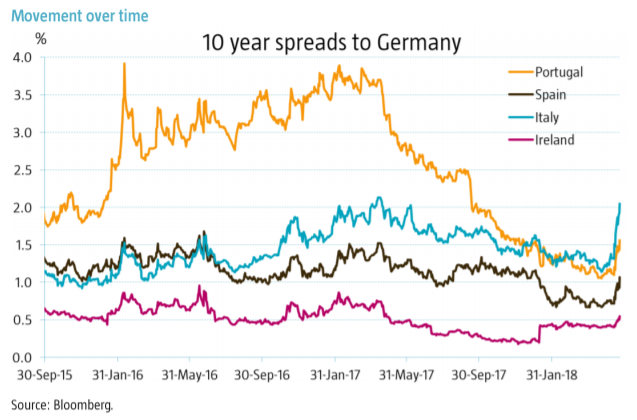

Peripheral spreads widened sharply this week especially in Italy and Portugal. The political uncertainty in Italy and the anti-EU rhetoric of the populist coalition coupled with the corruption scandal from the governing party in Spain have triggered a substantial bond sell-off in the South of Europe and a flight to quality into German Bunds. This financial stress took place amid disappointing PMIs, confirming the mild slowdown in the Eurozone and weaker business confidence. Italian bonds have returned -1.10% year-to-date, Spanish bonds 1.83%, Portuguese bonds 1.22% and Irish bonds -0.08%.

Italy

President Mattarella gave a full mandate to Law Professor Giuseppe Conte to form a government on Wednesday despite his lack of political experience. This week saw a substantial sell-off in Italian government bonds, fueled by the possible nomination of the Eurosceptic Paolo Savona as finance minister. Conte has to choose his team of ministers before the confidence vote on the new government could take place on Monday or Tuesday next week. It is likely that the new teams of ministers will continue to convey an anti-EU rhetoric, which forms the coalition contract between Lega and 5 Star. The European Commission deemed Italy compliant with the EU fiscal rule in 2017 and 2016 and decided not to open an Excessive Deficit Procedure but said that it will re-assess Italy’s fiscal position in May 2019.

Spain

Following the anti-establishment Podemos, the Socialist PSOE party is now ready to back a no-confidence vote against the Prime Minister Mariano Rajoy. On Thursday, several of his former aides were convicted by the High Court and sent to prison for corruption reasons. Rajoy could either call a snap election or face a no confidence vote in parliament. A new prime minister will be installed only if all the opposition parties agreed on the no-confidence vote. If the vote is passed, it is very likely that the PSOE party would take the new PM role. But as Ciudadanos is leading in the polls, this center-right party would be in favor of new elections. Against this backdrop and diverging interests among opposition parties, Rajoy played down the no-confidence motion, suggesting it could jeopardize the recovery. This political stress took place after the government managed to pass on Wednesday the 2018 budget in the lower house of parliament, which targets a 2.2% fiscal deficit from 3.01% in 2017.

Robeco Euro Government Bonds

This week the overweight position in Spanish bonds has been slightly reduced versus Italy. Our overall peripheral exposure remained roughly unchanged, after having reduced our overweight exposure in Italy and Portugal earlier this month already. Currently the fund is 45.5% invested in peripheral bonds, slightly above index level. Year-to-date the fund’s absolute return is 0.23%*.

Diesen Beitrag teilen: