Henderson: ECB ignoring "monetary pillar"

Euroland monetary trends continued to strengthen in March, suggesting solid economic prospects and increasing danger of a 2018-19 inflation overshoot. The ECB’s strategy seems to be to try to delay any meaningful withdrawal of monetary stimulus until after Italian parliamentary elections expected in early 2018 but policy could by then be far “behind the curve”.

02.05.2017 | 13:26 Uhr

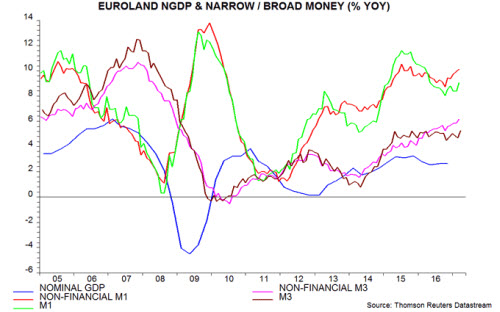

Annual growth in the headline M3 broad aggregate rose to 5.3% in March, exceeding a previous high of 5.2% reached in several months in 2015-16. Narrow money M1 growth increased to 9.1%, a 10-month high. The headline measures, however, understate monetary looseness because their growth has been depressed by a fall in money holdings of financial institutions over the past 12 months, probably related to negative rates, which has no adverse implication for economic prospects. The preferred broad and narrow money aggregates here are “non-financial” M3 and M1, comprising holdings of households and non-financial corporations. Annual growth of non-financial M3 rose to 6.1% in March, the fastest since 2008, with non-financial M1 growth at 10.1%, a 17-month high. The continued acceleration of the two aggregates suggests that annual nominal GDP growth will move up towards 4% in late 2017 / 2018 – see first chart.

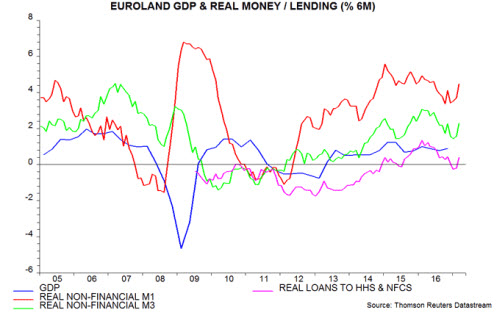

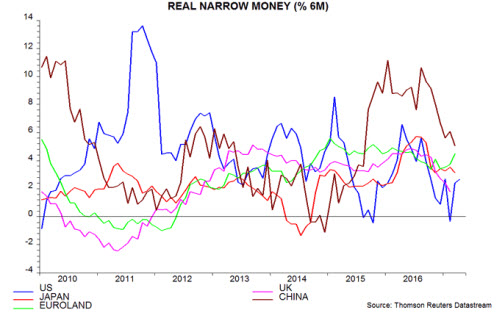

Prospects for economic activity depend on real (i.e. inflation-adjusted) rather than nominal monetary trends. Six-month growth rates of the non-financial money measures deflated by consumer prices (seasonally adjusted) rose strongly in March but are lower than a year ago and roughly in the middle of their ranges over the past three years – second chart. Real money trends, therefore, are consistent with a continuation of GDP growth at its recent pace of 1.5-2% per annum. Relative monetary strength, in other words, suggests that Euroland activity will be insulated from an expected loss of global economic momentum over the summer / autumn – third chart.

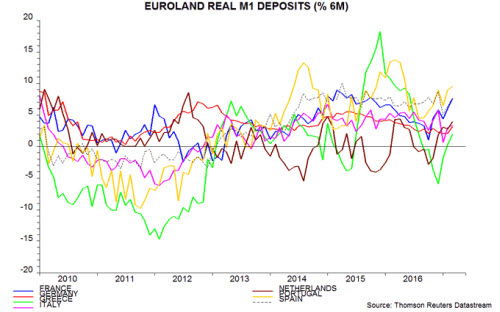

The country breakdown of narrow money (i.e. overnight) deposits shows strong real growth in Portugal, Spain and France, with Germany and Italy lagging – fourth chart. Lacklustre Italian economic prospects may help to explain ECB President Draghi’s determination to hold the hawks at bay until after elections. French monetary strength suggests the potential for a sharp rebound in GDP growth – officially estimated at 0.3% in the first quarter – as political uncertainty abates. A resumption of real money expansion in Greece, meanwhile, may herald improving economic prospects.

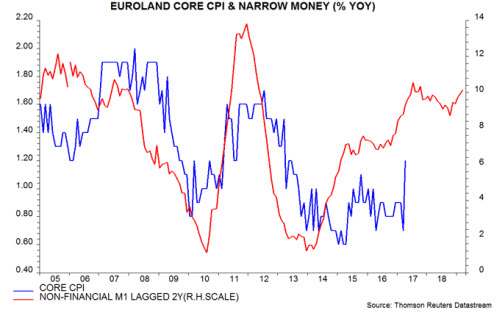

In other Euroland news today, annual “core” consumer price inflation – i.e. excluding energy, food, alcohol and tobacco – jumped from 0.7% in March to 1.2% in April, reflecting Easter timing distortions. Core inflation will probably fall back again in May but the lagged relationship with narrow money growth suggests a rising trend into 2018-19 – fifth chart.

Diesen Beitrag teilen: