Schroders: Economic growth - a mirage for emerging market investors

The link between emerging market companies' earnings and GDP growth is tenuous. We explain why investors are better off focusing on fundamental analysis of individual companies.

11.10.2017 | 13:47 Uhr

Investors love growth. Indeed, it was to capture the benefits of the fastest-growing economies that so many jumped aboard the emerging markets (EM) bandwagon at the beginning of the century. Sadder but wiser, following years of underperformance (at least until recently), many will have concluded that any connection there once was has now broken.

As emerging markets take off again, we argue that EM investors should not be dazzled by the economic prospects. In fact, there is only a tenuous link between companies’ earnings and emerging markets’ gross domestic product (GDP).

A watered-down growth cocktail

Moreover, any growth that does filter down to earnings will come with a lag, given the dilutive effect of initial public offerings (IPOs) and other share issuance.

There is a well-established belief that relatively fast GDP growth in EM countries will automatically lead to fast growth in the profits of firms listed there. We argue that the reality is that investors are unknowingly consuming a watered-down cocktail of economic growth when they invest in EM equities.

Over the last 10-years, real GDP growth has been noticeably faster in emerging markets than in developed markets (DM), with annual growth of 4.2% nearly four times the 1.1% recorded in the developed world. Yet real earnings per share (EPS) growth has been very similar (-0.6% vs -1.0%).

So, while there is clearly a gap between economic growth and profits growth in both markets, it is yawning when it comes to the emerging world. Why?

Mind the gap

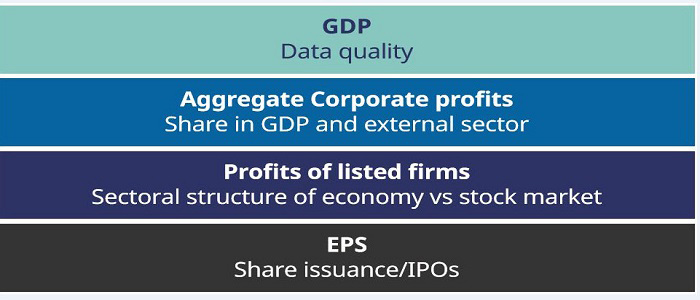

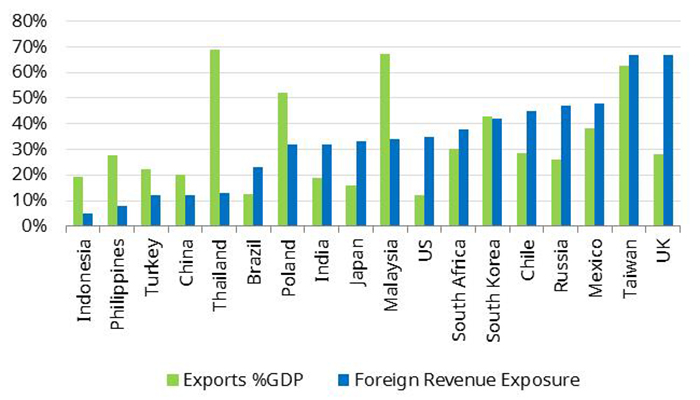

Figure 1 below is an illustration on how a unit of GDP flows through to a unit of EPS. There are possible distortions at every stage of this process. At the level of the economy itself, the reported GDP figure may suffer from measurement issues, while the share of corporate profits in an economy can change over time. More importantly for investors, however, the foreign exposure of economies and stockmarkets can vary hugely, as shown in Figure 2.

Figure 1: Flow from GDP to EPS

(Source: Schroders)

Countries on the left hand side of Figure 2, such as China and Brazil, are more domestically oriented, whereas countries on the right hand side derive a large share of revenues from overseas. Take Taiwan, for instance: 67% of the revenues of listed Taiwanese companies come from abroad. This means that Taiwanese companies are much more sensitive to what is happening in the rest of the world than in the Taiwanese economy.

Figure 2: Exports and foreign revenue exposure

(Source: Schroders, MSCI, HSBC, National Sources. Exports as of December 2016, foreign revenue exposure as of July 2014.)

Industrial make-up

Another important distortion comes from differences between the industrial make-up of the stockmarket and the economy. Within the EM universe, these differences can be very large.

For instance, some sectors may be under-represented in the stockmarket – as is the case with Russia’s consumer sector – or missing altogether, such as is the case with Mexico’s car manufacturing industry. In fact, despite Mexico being the 4th largest car exporter in the world, investors must turn to US, German or Japanese stocks to benefit from the growth of the industry.

Such factors can explain why the connection between GDP and EPS growth is shaky at best, but does little to account for the large structural gap between GDP and earnings growth. The key here is the dilutive effect of IPOs.

Pre-float growth

Academic research1 has shown that this is because the early growth in earnings of new companies happens before they float on the stockmarket. Such growth is picked up in GDP figures, but not by the stockmarket. We found that this dilution has been considerably larger in emerging than in developed markets (3.8% vs 0.5%).

This seems to be the missing link between GDP and EPS growth. To put it simply – the faster the growth, the greater the volume of IPOs and hence the larger the dilution.

The dilution issue is particularly prominent in China, which isn’t surprising as China has seen the fastest GDP growth of any emerging market. It has been common practice for large Chinese state-owned enterprises to be listed on the stockmarket at a relatively mature stage of their business life cycles. Given that, it should come as no surprise that real EPS growth has been just 2% annualised in China over the last 10 years.

Such large dilution may at least partially explain why investors who hoped to cash in on fast Chinese GDP growth have been disappointed.

Focus on fundamentals

What can we learn from all this? Investors who are truly trying to capture the fast growth in emerging markets have to be prepared to do the necessary groundwork. This means conducting thorough fundamental analysis of individual companies, rather than relying on broad-brush assumptions that aggregate growth will automatically translate into stockmarket success.

Die hierin geäußerten Ansichten und Meinungen stellen nicht notwendigerweise die in anderen Mitteilungen, Strategien oder Fonds von Schroders oder anderen Marktteilnehmern ausgedrückten oder aufgeführten Ansichten dar.

Der Beitrag wurde am 09.10.17 auch auf schroders.com veröffentlicht.

Diesen Beitrag teilen: