Morgan Stanley IM: Untangling Supply Chain Linkages

After the pandemic and Russia’s invasion of Ukraine, supply chain security became the new manufacturing mantra. Companies implemented, or at least discussed, strategies to reduce exposure to supply hiccups that brought about shortages ranging from semiconductors and car parts to food and medicine.

24.03.2023 | 09:03 Uhr

Here you can find the complete article

The “China Plus One” theme has gained traction for several global brands looking for alternative production hubs. Increasing labor costs in China, geopolitical tensions and human rights issues have encouraged other companies to rely less on Beijing as the world’s factory. Others are shifting from a “just in time” to a “just in case” cycle. These developments will create winners and losers as companies shift factories to different countries impacting economies, trade routes and payments globally.

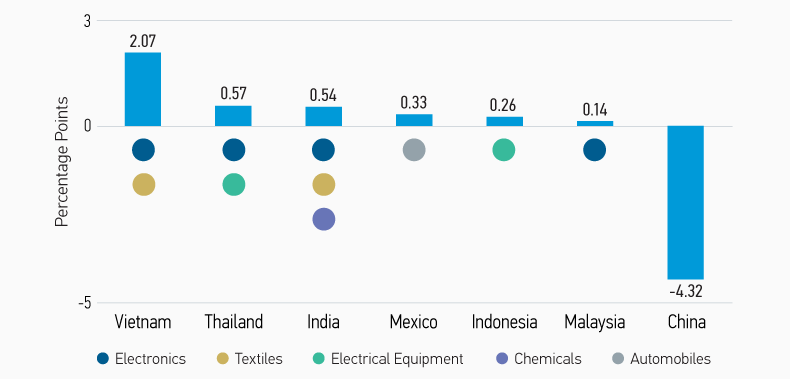

Since 2018, the decoupling of the two economic superpowers has gathered pace. The U.S. has employed tactics, such as tariffs on certain goods and sanctions on China, to gain digital sovereignty and punish companies for human rights violations. The disentangling of the two economies has led to critical manufacturing coming home (onshoring) and a shift in imports from China to the Association of Southeast Asian Nations (ASEAN), India and Mexico, countries that provide more competitive labor costs and friendlier relations (Display 1)

DISPLAY 1: Beneficiaries of Reshoring and Nearshoring

Change in share of U.S. imports since 2018

Onshoring is supported by recent legislation. The U.S. is allocating vast resources to secure technological advantages and facilitate the green transition. The landmark Inflation Reduction Act (IRA) directs nearly $400 billion to boost clean energy and reduce dependence on China in critical areas such as batteries for electric vehicles (EVs). The bulk of the funding is in the form of tax credits, with an estimated $216 billion directed toward corporations to catalyze private investment in clean energy, transport and manufacturing. Another $43 billion in IRA tax credits aims to lower emissions by making EVs, rooftop solar panels, geothermal heating and home batteries more affordable.

Similarly, the U.S. CHIPS and Science Act allocates $52 billion to revitalize semiconductor manufacturing.1 The European Chips Act also promises €43 billion of investment in chip development on the continent. In the U.S., growth in manufacturing jobs has been the highest since 2010. About half of these job gains can be attributed to onshoring, according to the Reshoring Initiative, which lobbies for bringing industrial jobs back to the U.S.

However, the factors that made offshoring attractive, such as lower labor costs, are still relevant today. Production costs are much higher in the U.S. and Europe. For example, a machine operator in the U.S. makes around $26 an hour, while those in Europe earn $32. By comparison, a similar position in Mexico pays $4 an hour. A machine operator earns $7.50 in China, four times that in Vietnam.

This is why we believe onshoring will be limited to critical industries, such as fabrication of advanced microchips. Since 2020, semiconductor companies have proposed more than 40 projects in the U.S., valued at $200 billion, that would create 40,000 jobs. However, a shortage of qualified workers and a maze of regulatory roadblocks may still hamper efforts to onshore electronics manufacturing. The world’s biggest chipmaker is building a $40 billion semiconductor facility north of Phoenix, but the plant will be twice as costly as a similar plant in Taiwan.2

Although complete decoupling from China is unlikely because dependencies and interlinkages between China and the world are too strong, supply chain diversification is happening. Some corporations are spreading their bets by adopting the “China Plus One” strategy, where they keep part of their production capacity in China while adding a supplier in other parts of Asia. Beijing now accounts for 18% of total U.S. imports, declining from 23% in 2018. Over the same period, U.S. imports from ASEAN increased to 10% from 7%. Countries like India, Indonesia, Malaysia, Thailand and Vietnam are taking initiatives to promote investment in industries like textiles, electronics, chemicals, pharmaceuticals and machinery. Malaysia established fast track channels for investors and businesses to diversify supply chains; Vietnam offers preferential treatment to science and tech enterprises; India has launched Production Linked Incentive (PLI) schemes and is building infrastructure to attract foreign manufacturers.

In the West, Mexico, with its low cost of production, also stands to benefit from its proximity to the biggest consumer market in the world. Mexico, Latin America’s leading exporter of manufactured goods, already accounts for 14% of U.S. imports, second only to China. The country needs to improve electric grid capacity and infrastructure to capitalize further on this nearshoring trend.

Global trade patterns are shifting. Regional trade agreements have increased substantially, with 42 goods notifications submitted in 2021 to the World Trade Organization, compared with only 7 a year earlier.3 Despite its declining share of U.S. imports since 2018, China’s slice of global exports has in fact risen by two percentage points to 20% since 2019.4 In the late 1990s, 70% of Asian exports went to the West, whereas today, 60% stay in Asia.5 Last year, China and 14 regional economies created the Regional Comprehensive Economic Partnership (RCEP), the world’s largest free trade agreement. Trade between the bloc’s 15 economies, estimated at $2.3 trillion in 2019, could rise by nearly $42 billion, because of the agreement on tariff concessions. Beijing has also increased shipments to Europe and other developing countries, notably the ASEAN region.

Extra shipments require additional infrastructure and port facilities. Singapore's PSA and Chinese state-owned rail operators entered a joint venture to build dry ports in China. Currently, a $300 million inland container depot in northern Vietnam is being funded by the World Bank. The IMF says by 2027 Indonesia, Malaysia, Singapore, the Philippines and Thailand will be the fastest growing bloc in the world by trade volumes.

European countries have seen the largest increase in regional trade agreements. Shifting manufacturing to Eastern European nations such as the Czech Republic, Poland and Hungary is an attractive option, given their existing industrial base along with a skilled and relatively low-cost labor force.

Improving supply chain resilience will not be without cost. The extra layers of security, storage and resiliency will be inflationary. The non-optimal allocation of resources, barriers to knowledge and data transfer will result in higher capital expenditure and hinder movement of a skilled workforce across borders. However, some countries and sectors will emerge as winners of this repositioning. Emerging markets like India, Vietnam, Thailand, Indonesia and Mexico are likely to benefit from reshoring, friend-shoring and nearshoring. Supply chain untangling has created an opportunity, and these countries are best poised to grab it.

Diesen Beitrag teilen: