Morgan Stanley IM: Stars Align for EM Debt in 2023, Following a Stellar 4Q22

Boston - Emerging markets (EM) debt rebounded sharply in the fourth quarter of 2022, capping a challenging year on a positive note.

27.01.2023 | 06:50 Uhr

The surge was driven by improvements in the macro backdrop including expectations that the U.S. Federal Reserve is nearing the end of its tightening cycle and encouraging developments in China, which dramatically reversed its zero-COVID policy. Attractive valuations in the sector also drew investors.

The fourth quarter's large gains still left all three EM debt segments — local currency, sovereign hard currency and corporate — with double-digit losses for 2022. All were hit hard by rising interest rates, with sovereign hard currency having the greatest exposure to U.S. dollar duration. Widening corporate spreads added another negative factor to corporate debt.

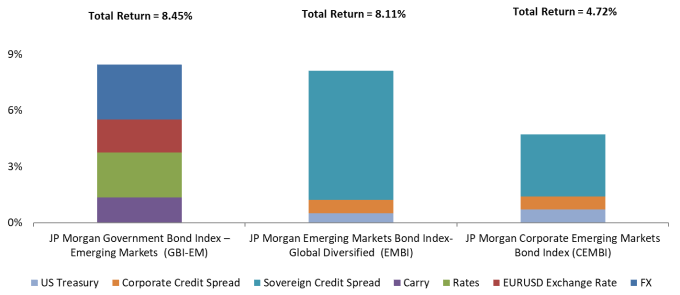

All three segments in the EM sector showed substantial improvement in the fourth quarter:

- EM local-currency debt had the strongest performance, at 8.45%, with all four factors — FX, EUR/USD exchange rate, rates and carry — additive to returns.

- Dollar-denominated, hard-currency debt returned 8.11%, with tighter sovereign credit spreads adding the bulk of the gains.

- Corporate EM debt gained 4.72%, also due to largely tighter sovereign credit spreads. However, its exposure to that factor is smaller than for hard-currency debt, and its return was proportionally smaller.

Every Risk Factor Powered Strong EM Debt Returns in 4Q22

Sources: JP Morgan, Morgan Stanley Investment Management, 12/31/22. The vertical axis reflects the amount contributed by each factor to total return-adding the bars above 0% and below 0% (negative numbers) results in the total return in the headline. FX is the gain or loss in the GBI-EM from currency changes relative to the U.S. dollar. EURUSD reflects the portion of currency movement in the GBI-EM that is explained by the change of the euro versus the U.S. dollar. Rates refers to the contribution of change in local-currency interest rates in the GBI-EM. Carry refers to the risk-free returns in each GBI-EM country that cannot be attributed to FX, EURUSD or rates. Sovereign credit spread refers to the spread above U.S. Treasurys in the EMBI paid by a country. Corporate credit spread is the spread above the sovereign spread paid by an EM corporate issuer. U.S. Treasury refers to the contribution to return in the EMBI and CEMBI (both dollar-denominated indexes) due to interest-rate changes on the U.S. Treasury. The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment. Past performance is no guarantee of future results.

2023 Outlook

The EM debt team feels the stars may very well align for the sector in 2023, as the positive trends that emerged at the end of last year are likely to continue.

The challenging macro environment that marked most of 2022 appears to be abating. Recent data suggests that the U.S. is past both peak inflation and Fed hawkishness. China looks to reopen, after reversing its long-standing zero-COVID policy and moving significantly to support the ailing property sector. And while the Russia/Ukraine war continues, the range of potential outcomes seems to have narrowed.

Several other factors add to the bullish case for EM debt:

- Growth differentials between EM and developed-market (DM) countries continue to be revised upward-meaning the outperformance of EM economies relative to DM is expected to be larger than previously anticipated. Growth is improving and inflation appears to be peaking in many EM countries, and a number of EM central banks are at or near the end of their tightening cycles.

- Commodity prices are off their recent highs, which potentially helps lower inflation, yet they are still high relative to the past decade and should also continue to support commodity exporting

- Despite the notable EM debt rally during the final two months of 2022, valuations remain quite compelling across the sector and appear to offer attractive compensation for investors.

The attractiveness of the EM debt landscape is reflected in our portfolio positioning: Rarely are we simultaneously overweight in all four risk factors of currency, local interest rates, sovereign and corporate credit.

For example, we have upgraded currency to a moderate overweight, as currencies are likely to be the beneficiaries of the improving macro backdrop we have noted earlier. Real interest-rate differentials with DM remain near their widest levels of the past two decades. That should be a tail wind for local interest rates, which we upgraded to a full overweight position.

We upgraded sovereign credit to moderate overweight, as spreads remain wide, with notable bifurcation in the market, which creates opportunities for the team. We have maintained a moderate overweight for corporate credit given the combination of attractive valuations and underlying fundamental strength of issuers.

Bottom line: EM debt opportunities for 2023 can be seen from two perspectives: from the macro-level tailwind that has the potential to help the entire sector and from the wide dispersion in value represented by different countries and credits. We believe the sector is well positioned to continue its rebound.

Risk Considerations: The value of investments may increase or decrease in response to economic and financial events (whether real or perceived) in the U.S. and global markets. Investments in foreign instruments or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, currency exchange rates or other conditions. In emerging or frontier countries, these risks may be more significant. Investments in debt instruments may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non-payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer's ability to make principal and interest payments. Exposure to derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other investments. As interest rates rise, the value of certain income investments is likely to decline. The value of commodities investments will generally be affected by overall market movements and factors specific to a particular industry or commodity, including weather, embargoes, tariffs, or health, political, international and regulatory developments.

For the complete content and important disclosures, refer to the link.

© 2022 Morgan Stanley. All rights reserved.

Diesen Beitrag teilen: