Morgan Stanley IM: Emerging Markets – Stepping Into the Spotlight

After lagging the developed economies for more than a decade, emerging markets are in a much stronger position to outperform developed countries in the decade ahead. Jitania Kandhari, Deputy CIO, Solutions & Multi Asset Group, explains.

22.12.2022 | 06:07 Uhr

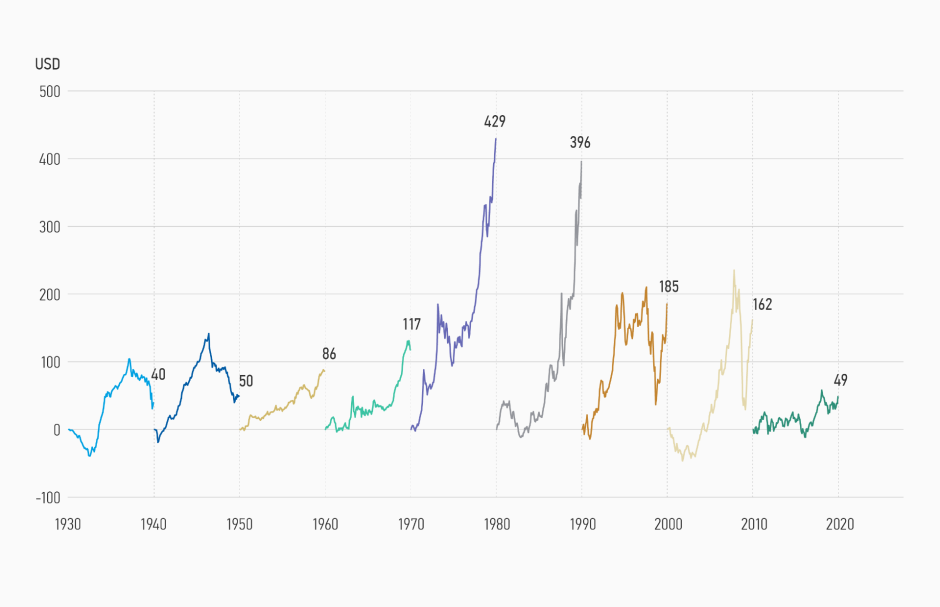

In the 2010s, emerging market (EM) equities suffered their worst performance as an asset class since the 1930s (Display 1).1 They returned a mere +49%, compared to an average of +203% in the previous seven decades.2 Emerging market countries ran high twin deficits, which led to currency depreciation and forced a cleanup of excesses from their precarious balance sheets, a legacy of loose fiscal and monetary policies. An important factor inhibiting EM equity performance in the last decade was the deterioration in the growth differential between emerging economies and the developed world, the key driver historically of relative returns of the asset class. After lagging the developed economies (DM), especially U.S. equities, for more than a decade, emerging markets are in a much stronger position to outperform developed countries this decade.

Display 1

2010s: Worst Decadal Returns for EM Since the 1930s

Emerging Markets Cumulative Total Returns Each Decade

Despite global crises like the COVID pandemic and Russia’s invasion of Ukraine, as well as monetary policy tightening by the Fed and the continued strength of the U.S. dollar (USD), several emerging markets have thrived. Brazil, Mexico, India, Indonesia and the GCC (Gulf Cooperation Council) have not only outperformed the MSCI EM index but even the U.S. so far in 2022.3 In fact 9 of the 10 top performing markets this year are emerging countries. The headwinds of the past are becoming tailwinds in several markets, with the exception of China, that we believe should provide support for many years to come. Various factors contributing to this outperformance should continue to serve as catalysts for a broader EM rally:

Diesen Beitrag teilen: