Morgan Stanley IM: Emerging India in a Multipolar World

In India, there has been a recent change from the Gandhian principles of small is beautiful to actively incentivizing large scale manufacturing. Coupled with a healthy banking sector and high demand for housing, the stage is set for Delhi to move forward with an opportunity to shine.

03.08.2022 | 09:09 Uhr

When the 15-nation UN security council hastily called for a vote in February to condemn Vladimir Putin’s invasion of Ukraine, India joined China and Qatar to abstain. It was a difficult balancing act. Delhi didn’t want to alienate Russia, an important historical friend, which supplies 46% of its military equipment,1 without also antagonizing the U.S., its largest trading partner.2 India also depends on Russia’s diplomatic support at the UN for its claims over Kashmir. Afterall, the Soviet Union has used its veto six times at the Security Council on India’s behalf.

For Delhi, though the abstention vote was an embarrassment, the clear and present dangers come from a prickly Pakistan and a muscular China. India is forging its own geopolitical path in this multipolar world and focusing on its strategic interests. That means siding both with Russia and joining Western alliances, such as the Quadrilateral Security Dialogue, alongside the United States, Australia, and Japan. From Brussels to Tokyo to Washington, governments are determined to lower their dependence on Beijing. At a time of when investability in China is being questioned, shifting geopolitical realities offer India an opportunity to shine.

Coupled with its geopolitical stance, India’s economic condition is looking favorable for the rest of this decade. India has not been able to realize the kind of industrial transformation that turned countries like China and South Korea into miracle economies by building their manufacturing capabilities. Instead, India’s economic growth was led by services unlike the Asian tigers. Recently there has been a change in the mindset from the Gandhian principles of small is beautiful, to actively incentivizing large scale manufacturing capacities through production linked incentive (PLI) schemes.

These schemes have attracted interest across 14 sectors including automobiles, solar panels, and advanced batteries. Buoyed by the government's PLI scheme, India now is an exporter of mobile phones. Delhi is also focusing on import substitution in manufacturing to enhance domestic capacity and reduce external dependence. As firms everywhere reconfigure supply chains to lessen their reliance on China, India has an opportunity to increase its manufacturing, helped by a $26 billion subsidy scheme.3

Emerging sectors such as aerospace, semiconductors, and renewables should help increase youth employment. The reform measures are starting to pay off. The “Make in India” initiative encourages both foreign and domestic investment in the manufacturing sector; “Smart Cities” aims to eradicate urban squalor and “Digital India” targets an overhaul of government services with electronic identity, digital payments, and bank accounts. Additionally, the government has launched its Open Network for Digital Commerce (ONDC) in an attempt to deepen e-commerce penetration and foster innovation by start-ups with a special focus on small merchants and rural consumers. Each of these are enhancements in efforts to improve the country’s infrastructure. India has backed the “tech stack” and direct welfare and persevered with the painful task of shrinking the informal economy. Financial reforms have made it easier to float young firms and bankrupt bad ones.

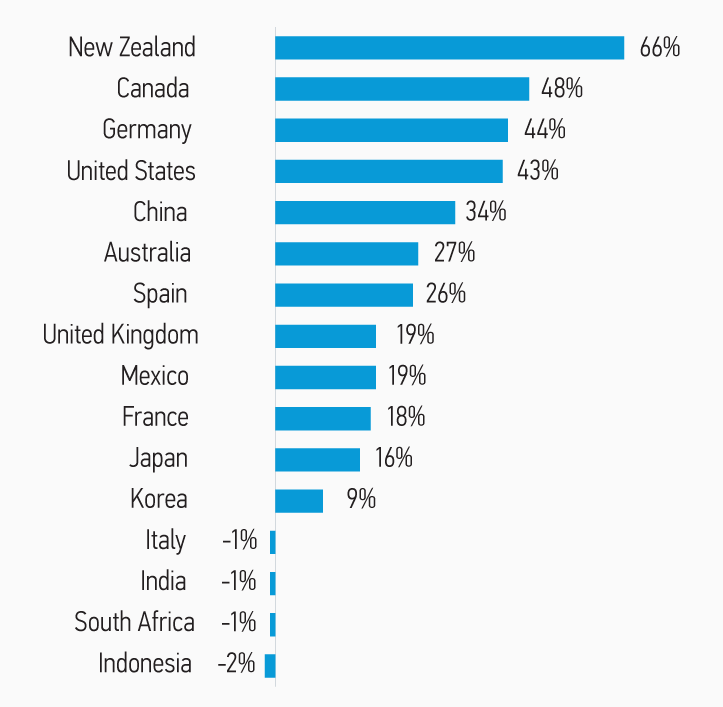

Display 1

India Missed the Global Real Estate Party

Real House Price Appreciation: 2015 – 3Q21

In contrast, China continues to focus on transitioning its economy away from investment to consumption. China’s economy is slowing down, faced with a shrinking workforce, industrial overcapacity, a floundering property market, a mountain of debt and renewed COVID lockdowns. A serious downturn in the property market, a key engine of GDP growth, has eroded confidence in the economy. Real estate lies at the heart of an investment cycle. While investment to GDP ratio in India hovers at 30%, China’s has peaked at 45% and a big share of that is real estate investment.4 The real estate sector accounts for around 29% of GDP in China, more than double the ratio in India, according to IMF economist Yuanchen Yang.5 Excessive supply is dragging down China’s heavily indebted property sector. The working-age population in China is now shrinking,6 which will further erode the demand for housing over the coming years hurting future growth.

The reverse holds in India. After being in doldrums for the past 3 years, India’s real estate sector is set to recover. As more of India’s population heads to the cities, demand for housing increases. India’s young work force stands to benefit from affordability at almost unprecedented levels in terms of mortgage payments relative to income growth, that has declined to 28% in Q1 2022 from 53% in 2012.7 House prices are 3.2 times average income in India compared to 6.7 times in China.8 In fact, the five biggest cities in the world, with the lowest rental yields, are all in China, making it one of the most expensive cities in the world.

Diesen Beitrag teilen: