Janus Henderson: China A-share inclusion encouraging Asia’s decoupling from emerging markets

The inclusion of China A-shares into MSCI equity indices is an important recognition of China’s economic weight. This should provide a long-deserved boost to both China shares and Asian equities as a distinct asset class.

19.06.2018 | 09:22 Uhr

MSCI’s decision to include China A-shares (Shanghai and Shenzhen-listed stocks) in its indices is an important recognition of China’s economic weight. This follows the successful implementation of the Stock Connect scheme, which facilitates mutual market access between mainland China and Hong Kong. Together, these events should continue to encourage increased foreign participation into China’s equity markets.

A significant first step

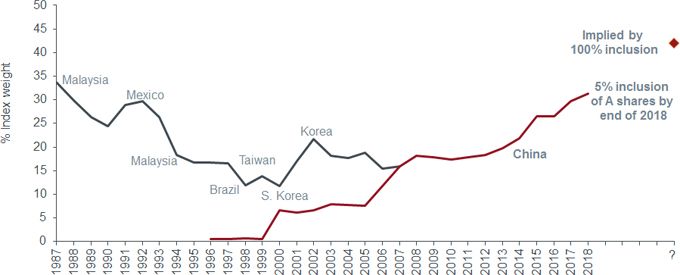

The initial impact is not significant since less than 1% of the MSCI Emerging Markets (EM) and Asia ex Japan indices will be affected with only 234 China A-shares included. Additionally, there is only a small inclusion factor of 2.5% of a stock’s market capitalisation now, increasing to 5% later in the year. For example, a stock worth $100bn now will initially be considered a $2.5bn market cap company in the indices, then in September $5bn assuming the $100bn market cap remains unchanged. These measures are needed to help avoid a dramatic change in index weightings given China A-shares would comprise around 15% to 20% of the MSCI EM Index based on current market capitalisations. This is in addition to the significant China weights already in these benchmarks from Hong Kong and New York-listed China shares.

China's increasing weight within the MSCI Emerging Markets Index

Source: MSCI indices data, as at 24 May 2018.

Note: Largest country weights at calendar year end. China weights include A-Shares, US-listed American Depositary Receipts (ADRs) and Hong Kong-listed H-shares.

Asia could be seen as distinct from EM

In the past two decades, we have seen Asia’s weighting in the MSCI Emerging Markets Index rise to more than 70%. This is partly explained by the emergence of China, particularly its new consumer-driven economy and internet sectors, and China’s disproportionate number of new listings and equity issues versus other emerging countries. This looks set to continue given the MSCI inclusion event, and we believe it may spur investors to increasingly consider Asia ex Japan as a dedicated asset class in its own right rather than a subset of emerging markets.Similarly, the lines are blurred as to what constitutes an emerging market, as we have seen previously with MSCI’s decision not to upgrade Taiwan and South Korea to developed market status despite meeting many of the characteristics of a developed market.

Reassessing allocations to Asian equities

It is expected to take more than five years for China A-shares to gain full economic weight in the MSCI benchmarks. But this, in our view, provides attractive opportunities for global investors to assess their Asia and China exposure given the region’s robust economic growth. Naturally, robust economic growth does not always correlate with equity market returns but it is a strong tailwind for companies operating in Asia, together with the region’s attractive demographics and rising consumption.

While investors will rightly retain some scepticism for China stocks given differing levels of corporate governance and shareholder structures, the sheer size and depth of the market offers some attractive opportunities for us as active managers. We have existing A-share investments in the technology, consumer discretionary and industrials sectors within the Asian Growth Strategy and expect to increase these over time.

Andrew Gillan, Head of Asia ex Japan Equities and Co-Manager of the Asian Growth Strategy at Janus Henderson.

Diesen Beitrag teilen: