BNP Paribas AM: Local currency emerging market debt deserving of a closer look

At a time when many bond investors vacillate between concerns over rising interest rates and the belief that the multi-decade bull market in fixed income is not over yet, local currency emerging market debt deserves to be given more attention than it often gets these days. Or so argue Bryan Carter and JC Sambor, Head and Deputy Head of Emerging Market Fixed Income, respectively.

23.05.2018 | 12:08 Uhr

Under-appreciated, so under-owned?

In part, the cold shoulder for local currency debt reflects an underappreciation of the size of the asset class and the opportunities it offers. It has become one of the largest fixed-income universes over the past eight years, with local currency debt issued by emerging market governments rising to USD 8 trillion by January 2018 and corporate debt in local currencies exceeding USD 7.6 trillion.

The asset class has become deeper, with market liquidity improving, and broader, with more countries now issuing debt as well as more EM corporates. This has expanded the range of investment opportunities, also in high-quality, investment-grade debt.

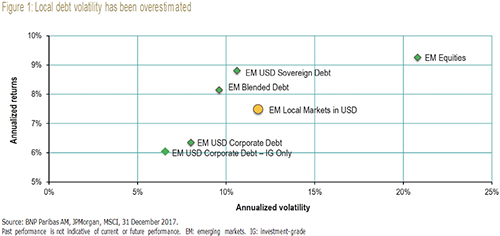

The bad rap can also be attributed to the perception among certain investors that local currency bonds tend to be very volatile. This is indeed a perception. The reality is that historically, the volatility has been well below that of emerging market equities. Over the last 15 years, the volatility of local currency debt has averaged around 12%, which is well short of the level of over 20% for emerging market equities.

This realisation should contribute to an improving debt profile. Equally, the understanding that default risk is typically overestimated, especially in local currency debt, and that the risk/reward trade-off is clearly positive should lift the prospects of greater ownership of local currency debt.

Index inclusion is one source of demand...

Apart from a reassessment of these attractions of emerging local currency debt, there is also room for giving these bonds a bigger place in portfolios. Looking back over the past 10 years, allocations to emerging debt in global portfolios, and local currency debt in particular, are below average.

We can see a number of triggers for a pick-up in demand. Chinese bonds are due to become part of most major global emerging market debt indices and inclusion of the world’s third-largest fixed income market should automatically create demand as index-focused investors adjust their portfolios. Foreign ownership of the Chinese onshore bond market is currently at only roughly 4%. India can be expected to follow suit in the next three to five years.

...as is investment from foreign investors lagging that of domestic buyers

Another factor for upside potential is the still reasonable foreign participation in this market. The 2017 rally in local emerging debt was driven mostly by local buyers. The share of foreign ownership has not risen materially in most markets or has even fallen in large markets such as Malaysia. There is room for catch-up there.

It is worth noting that these local investors inject a note of stability into these markets and have become more diversified over time, ranging from pension funds and insurance companies to banks and even asset managers. They are adding these bonds to their portfolios in the knowledge and with the full understanding of the local, often idiosyncratic, drivers of this market. This growing domestic investor base has proven an efficient cushion during recent bouts of volatility.

Regarding foreign involvement, the fact that “real money” – from long-term investors such as insurance companies and pension funds – is increasingly involved rather than short-term speculative money should also mean that these investments are not a fad or part of a bubble, but genuine and return-driven, which should help curb market volatility.

Click here to read the full report .

Diesen Beitrag teilen: