NN IP: Weak EM growth but improving outlook

More dovish DM central banks and Chinese policy stimulus remain positives for EM equities.

21.02.2019 | 14:11 Uhr

While the outlook for emerging market (EM) growth has clearly improved, thanks to the Fed’s quick change in policy bias and the increasing evidence of Chinese economic policy easing, investors remain nervous about the weak EM growth momentum.

It is not easy to fully understand why emerging equity markets have underperformed in the past two weeks, but it is probably the combination of the continuously weak economic growth data and ongoing skepticism about the effectiveness of Chinese monetary policy stimulus. What also may have played a role is that investors might have discounted a positive outcome of the US-Chinese trade negotiations by now and that the balance of risks regarding the trade conflict is now skewed to the downside.

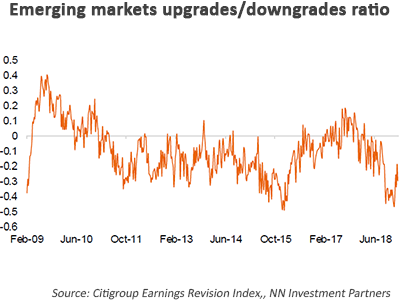

We continue to believe that the current environment is good for EM equities. We appreciate that economic growth data have remained weak (our own EM growth momentum indicator is still close to its multi-year trough), but we also see that EM earnings momentum has started to recover (see graph).

This indicator offers the first signs of an improving growth outlook on the back of the sharp easing of financial conditions almost everywhere in the emerging world following the changed policy bias of the Fed and the resulting improvement in EM capital flows. So while the macro and earnings data are still weak, the latter at least is tentatively showing the beginning of a recovery.

Chinese outperformance should help EM overall

We know from earlier cycles that when the Chinese authorities embark on a major economic stimulus programme, Chinese equities tend to outperform the broad EM universe and emerging markets tend to outperform developed markets (DM).

Since the summer, the Chinese economic policies have clearly been eased, first by means of public infrastructure investment and tax cuts for households and private companies, and more recently through numerous initiatives to stimulate bank lending. However, in the aggregate Chinese credit data, we still see little evidence of accelerating credit growth. In January, total year-on-year credit growth was 7.9%, slightly above the December level of 7.6%.

The breakdown of the data gives us more information. Credit to local governments and private companies has started to pick up and credit through shadow-banking channels continues to slow. This is consistent with what the authorities have been saying recently: they want to reduce excessive risk-taking in the financial system and at the same time give more room for local governments to finance themselves in the market and help private companies, particularly in the small and medium-sized enterprise segment, to secure more bank financing.

The increasing evidence of Chinese stimulus makes us confident enough to believe that Chinese domestic demand growth will pick up starting in Q2. The improving growth outlook for China, particularly in comparison with the developed world and large parts of the emerging world, is reflected in the steady outperformance of Chinese equities since the beginning of the year. In times when Chinese equities benefit from an improving Chinese growth outlook, the broader EM universe tends to outperform DM. This dynamic should hold, particularly now, as investors remain nervous about the US and European growth outlook.

Markets have gradually priced a positive outcome of the US-Chinese trade negotiations. Looking at key global-trade-sensitive indicators, such as the relative performance of Korean exporters vis-à-vis the broad Korean market, we can at least say that expectations of a negative outcome have declined considerably in the past four months. This means that there is more room for a disappointment if no deal is reached in the coming months. At the same time, we think the two sides are slowly moving closer to some kind of understanding.

Hard information remains scarce, but it looks like the Chinese are willing to buy more US goods and to open up their market more to US companies. Perhaps commitments like this might be enough for President Trump to accept little change in the field of intellectual property protection and technology transfers and still strike a deal. In any case, our base-case scenario has moved to an extension of the negotiations by at least a month.

Diesen Beitrag teilen: