Henderson: Evolution and Opportunities for Emerging Market Corporate Credit

Emerging market corporate credit grew out of the sovereign bond market over a decade ago and has since grown significantly to reflect a greater diversity of countries, sectors and issuers. Outstanding volumes of hard currency EM corporate debt now surpass those issued by EM sovereigns.

13.03.2017 | 14:40 Uhr

1. How has the Emerging Market Credit asset class evolved in recent years?

Emerging market (EM) corporate credit grew out of the sovereign bond market and has expanded significantly in the past decade. Indeed, the outstanding notional value of EM corporate debt now surpasses sovereign debt in hard currency terms.

The growth of EM corporate credit has been propelled by privatisation, structural growth, and international M&A activity. In addition, the breadth of issuers across countries and sectors, and across the credit curve has provided investors with more opportunities in EM corporates than in sovereign hard currency bonds. With EM economies growing stronger, credit ratings have improved and investor sentiment has turned more positive around this fast growing asset class.

2. Is EM credit more investor-friendly as a result?

Since the early 2000s, the EM corporate bond market has been evolving into an asset class that is more similar to that of developed market corporate bonds. At a time of persistently low yields in the developed markets, investors are increasingly reaching for yield elsewhere. For income investors, EM corporates provide good yield for an investment grade asset class. As the asset class has matured, issuance is now robust, creating a happy medium for issuers and investors in terms of increased supply and demand.

But the real benefit to investors has come from a convergence towards developed markets standards. EM corporate bond structures are now nearly identical to developed market bonds, with indentures that will be easily recognisable and understood by all investors.

From a reporting perspective, more than 70% of issuers adhere to either International Financial Reporting Standards (IFRS) or US GAAP, making financial statement analysis much easier for developed market investors. In addition, a number of countries (eg, Mexico, Brazil, China) have accounting rules that are very similar to the IFRS/US GAAP, accounting for close to 15% of additional NAV. Finally, more than 85% of EM corporate issuers are publicly listed, which adds a layer of transparency and corporate governance.

3. What types of companies does an EM allocation now provide exposure to?

While in the past, emerging markets were associated exclusively with issuers reliant on natural resources such as oil, iron ore or agricultural products, the picture has changed significantly. EM economies have grown in strength and now represent over 57% of global gross domestic product, on a purchasing power parity basis (IMF’s October 2016 World Economic Outlook). As countries grew, industries have also strengthened, leading to a wider and deeper issuer base. This, as noted above, has naturally coincided with the steady growth in EM bond markets, resulting in a diverse set of participants and issuers across sectors from financials and utilities to transport and industrials.

The list of example companies ranges from systemically important state owned enterprises such as Petrobras in Brazil or China State Grid to multi-nationals such as JBS, a Brazilian meat processor (and the largest in the world) or Hyundai Motor, the Korean auto manufacturer. There are companies whose business is focused almost entirely on export, such as Brazil’s Fibria (pulp and paper); while others have a domestic focus, such as Alibaba, the Chinese e-commerce company. Issuance can also range from companies with foreign currency exposure, to those without; some companies can even hedge their currency risk.

4. What are the arguments for a strategic rather than a tactical allocation?

The EM debt asset class is growing, not shrinking. Long-term fundamental improvements in EM economies have improved the credit quality of the asset class. In 2016, 64% of the corporate debt stock was investment grade compared with less than 40% back in 2000.

Today, there are many developed market companies that have more underlying exposure to emerging markets than some EM companies; often, when you buy corporate bonds from emerging markets, you are buying the debt of very solid companies — they are just based in the wrong zip/postal code. Many of these companies are also assuming a more significant role in global corporate consolidation, often acquiring developed market competitors.

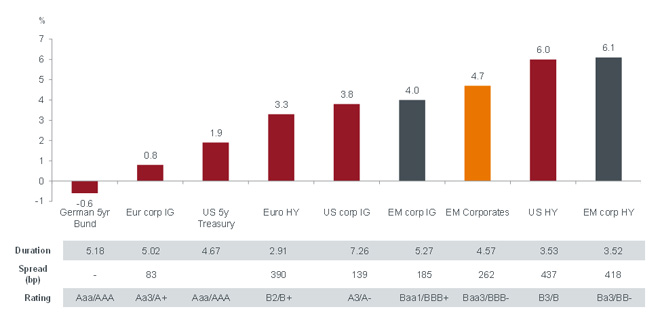

EM bonds form an investment grade asset class that offers lower volatility and higher yields than comparable developed market bonds, but with additional diversification benefits not readily available in the developed world. EM corporate bonds have traditionally offered relatively high returns, but have low correlation to certain other bond markets such as developed market government bonds. Finally, as the chart shows, the yield on EM corporate bonds continues to be among the highest currently available in fixed income markets.

Yield to maturity on fixed income asset classes

5. What is the best way to approach EM from an investment point of view?

We believe the best investment approach is a holistic one, with consideration of macro and micro factors.The EM market is not static and can be driven by technical factors, macroeconomic concerns, geopolitical developments, company fundamentals and/or valuations at any given time.

6. How is the Henderson strategy different to competitors?

With the EM corporate asset class borne out of a sovereign strategy, many peers still rely primarily on country views to anchor their investment decisions. Our strategy is different – we invest in companies, rather than countries. While the country view helps shape our view of the company, we believe it is integral to have a solid fundamental view on the company, in addition to understanding the technicals driving price action, being comfortable with geopolitical risks, and being adequately compensated for the risk. In short, we believe that country risk alone is inadequate in assessing EM corporates.

7. Which areas of the market currently have the strongest potential?

We especially like the Philippines and Argentina – both are good diversifiers for our portfolio, providing opportunities to deliver positive performance through alpha generation (active risk-adjusted returns), while the yields available in these markets provide good carry.

Corporates in the Philippines tend to be in sectors that are systemically important to the country, such as utilities, and are therefore fairly high quality despite the lack of rating in most names. The macroeconomic picture in the country is very positive with strong growth and consistently robust remittance levels. Furthermore, bond technicals are very supportive, given an active local investor base. Finally, asset prices tend to have low volatility with strong carry.

Argentina is back in the capital markets now that a new administration is in place and lawsuits are more or less out of the way. We like the country’s growth prospects, favourable demand-supply dynamics and strong commitment to re engaging with the international investor community. We’ve seen a handful of Argentinian issuers recently and believe that this country could provide many more investment opportunities as issuance grows.

8. Which areas are best avoided?

In the near term, we are still constructive on overall valuations, but given how far the market has come in terms of lower yields and spreads in the EM hard currency debt universe we are currently cautious and not as overweight as we have been over the last year. We believe the market could be susceptible to broader macro risks outside of EM.

Politics in EM have acted as positive catalysts in 2015-16, particularly in Brazil where we view President Dilma Rousseff's impeachment as positive but President Temer still has the same deteriorating macro fundamentals to contend with.

Nevertheless, we think there are some compelling investment opportunities available; we especially like companies in sectors were growth is strong and the switching costs are high, such as transport infrastructure.

9. What do you think the EM corporate credit market will look like in 10 years’ time?

The steady and rapid expansion seen in this asset class in the last decade looks set to continue. The asset class has already overtaken the US high yield market in size and we believe that in 10 years' time it will be even more diverse. Opportunities in EM corporate credit will arise from its expansion as a standalone asset class but also as part of broader blended strategies encompassing sovereigns and local market debt.

With governments continuing to privatise quasi sovereign entities, we believe the percentage of state owned enterprises will fall. In addition, we potentially see a separate market for Chinese corporates, given the size and scale of the country and the levels of untapped opportunity. Finally, we think there could be issues from entirely new entities, as EM countries’ economies mature and evolve; Argentinian corporates are a good example of this.

Bitte beachten Sie, dass es sich hierbei um Archivinformationen handelt. Sie sind nicht als aktuelle Ansichten oder Einschätzungen, sondern nur als historische Angaben zu verstehen.

Diesen Beitrag teilen: