UBS: China exportiert keine Inflation in die Welt

The price of goods leaving Chinese factories rose 7.8% in the year to February. This acceleration of producer prices has raised fears among some investors that China could meaningfully add to global inflation pressures. This is not likely, in our view.

22.03.2017 | 10:59 Uhr

The price of something made in China and the price of that same article sold to a consumer are not the same thing. It is other factors that are driving inflation rates higher.

The idea that the prices of Chinese exports drive inflation in developed economies is one of the most pervasive myths of modern economics. It is an understandable error. An American indulging in the national pastime of visiting the shopping mall will return home laden with electronics, clothes, and other goods labeled "made in China." This naturally fosters the belief that what happens in China will matter to the price of those goods. However, a brief glance at the economic data tells a very different story.

The United States publishes data on prices of Chinese imports, covering those goods where China has a significant market share. These prices reflect Chinese export prices plus international transport costs (shipping or air freight). As such, the prices are already one step removed from the prices of goods leaving a Chinese factory. This data allows a detailed comparison of the prices of imports from China with the prices of goods sold to US consumers.

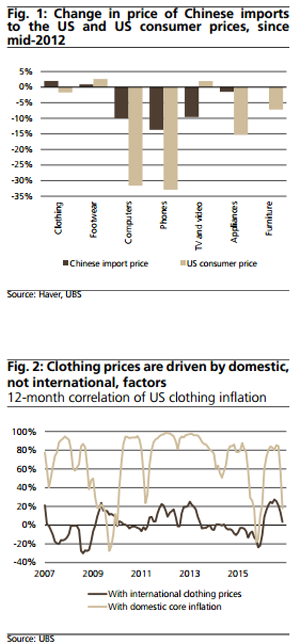

There is no obvious relationship between Chinese import price inflation and US consumer price inflation. Since mid-2012, US imports of clothing from China rose 2% in price; overall US consumer prices of clothing fell 1.7%. Imports of computers from China fell 10% in price; overall US consumer prices of computers fell 32%. Imports of Chinese televisions fell 9.6% in price; overall US consumer prices of televisions rose 2%.

This report has been prepared by UBS AG. Please see important disclaimers and disclosures at the end of the document. Imports of clothing from China remain important – in 2016, the US imported over USD 30bn of Chinese-made clothing. China produces over one-third of US clothing imports. If Chinese prices were important to global clothing inflation rates, there should be a common global trend to clothing prices. That common global trend would be easy to spot; US clothing prices should be correlated with other countries' clothing prices. That would tell economists that there could be a common factor (China) determining the inflation rate. In fact, there is no relationship between clothing prices elsewhere in the world and clothing prices in the US. If international prices do not explain the price of clothing in the US, what does? There is a strong correlation between US clothing price inflation and US core consumer price inflation. The price of US clothing appears to have something in common with the price of other products sold in the US.

In other words, the best explanation of US clothing price inflation is domestic inflation pressures rather than international inflation pressures (like China). Inflation remains a local phenomenon. It is the same story with France, Germany, Italy, and the United Kingdom – across all these economies, domestic factors are a better explanation of the price of clothing than international factors.

Why is this? To return to the consumer, struggling under the weight of their purchases at the shopping mall – the value of physical product that they have purchased is just a fraction of the price they have paid. Much happens to an import after it arrives on the dockside. All the extra factors create the inflation divergence that is clear from the data. The product is advertised locally; the product is shipped from dock to warehouse and from warehouse to store; there is a cost to keeping the product in a warehouse; the retailer has to pay for sales assistants and other overheads, and passes those costs onto the consumer. These costs are all local, and they make up a large part of the final price of the product. These costs are also predominantly labor costs.

Instinctively, "made in China" on a product means that global inflation pressures are also "made in China." Economists, however, work with facts rather than instincts. The facts tell us that domestic pressures rather than international pressures are the most important driver of consumer price inflation. This allows for inflation divergence among the major economies. It means that investors should not worry so much about the prices of products leaving Chinese factories, and instead focus on what is happening with labor market costs in developed economies. That is where the inflation story lies.

Diesen Beitrag teilen: