NN IP: A little less political uncertainty

The wave of populism induced by Brexit and Trump might subside somewhat after the Dutch election outcome, which did not provide the big win for euro-sceptic Geert Wilders that polls had suggested until recently. This might be good news for the French elections and the reflation trade.

16.03.2017 | 16:14 Uhr

(Foto: v.l.n.r.: Valentijn van Nieuwenhuijzen, Chief Strategist & Head of Multi-Asset, Patrick Moonen, Principal Strategist Multi-Asset)

Yesterday, the European election cycle kicked off with the Dutch elections. The centre-right Party for Freedom and Democracy (VVD) of prime-minister Mark Rutte, although losing 8 of its 41 seats, were the big winners. Geert Wilders' Party for Freedom (PVV), although going from the third to the second biggest party in the Netherlands, did not gain as many seats as many polls had suggested until very recently. So, the score of the populist anti-EU vote was not as big as many had expected. This could be good news for the French elections next month, where the anti-EU candidate Marine Le Pen from the National Front has also been losing some ground in the polls recently against her centrist rival Emmanuel Macron. Therefore fears regarding the French elections may abate somewhat, providing an extra pulse to the reflation trade, especially in Euroland.

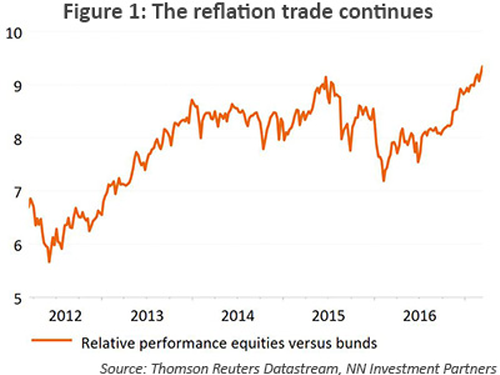

Houseview11 2017 Asset Allocation

Especially the rate-sensitive assets like government bonds, spread products and real estate posted declines in the past few days – until yesterday. Commodities were hit by a drop of almost 10% in the oil price on news that OPEC compliance is weak and crude oil inventories had risen. Equities, although they were down primarily because of adverse currency movements, resisted well. Especially the Eurozone and Japan posted relatively strong performances. In our view, this is an indication that the reflation trade is still in place. A reflation trade can be defined as the outperformance of asset classes positively correlated with rising interest rates versus negatively correlated assets. In its purest form, it is the return on equities versus the return on safe treasuries. Figure 1 illustrates investors' preference for this trade. Of course, big regional divergences exist due to differences in policy setting, political uncertainty and the point in the economic cycle. The US is much more advanced in this reflation trade, whereas in the Eurozone it is still in an early stage.

Houseview11 2017 Asset Allocation

On the data and policy front there was not too much news aside from soaring Fed rate hike expectations, which were fully discounting a 25bp rate hike yesterday. In fact, they had expected a somewhat more hawkish stance from the Fed, as in the hours after the announcement the Treasury yield declined almost 10 basis points. The ECB meeting was, by reading between the lines, a bit on the hawkish side. Macro numbers remain strong, but politics remain noisy.

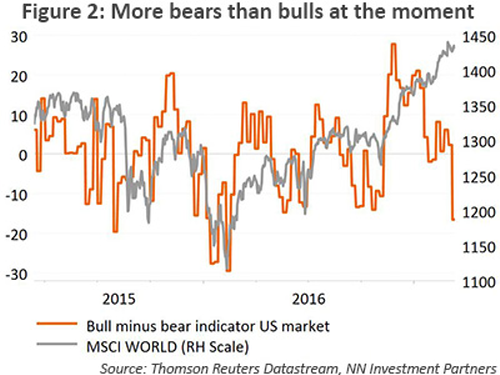

Still, there are no broad-based signs of excessive optimism visible as fears over political shocks linger. Investor cash levels remain high and investor sentiment has come down from its elevated levels at the start of the year. In the US, the bull/bear indicator of private investor sentiment has fallen to its lowest level since February 2016 (see Figure 2), when many other negatives were present. This bearish reading coincided exactly with the low of the market. We think this caution is partially linked to political uncertainty and the ebb and tide of this will determine the short term direction of the market.

This week we made no changes in our TAA-stance. We maintain a small underweight in treasuries. Equities and spread products are a small overweight, real estate and commodities are a medium overweight.

Diesen Beitrag teilen: